Participants take on the role of financial analysts, building econometric models, analyzing market data, and forecasting trends to drive data-informed decisions under real-world pressures with our financial econometrics course simulator.

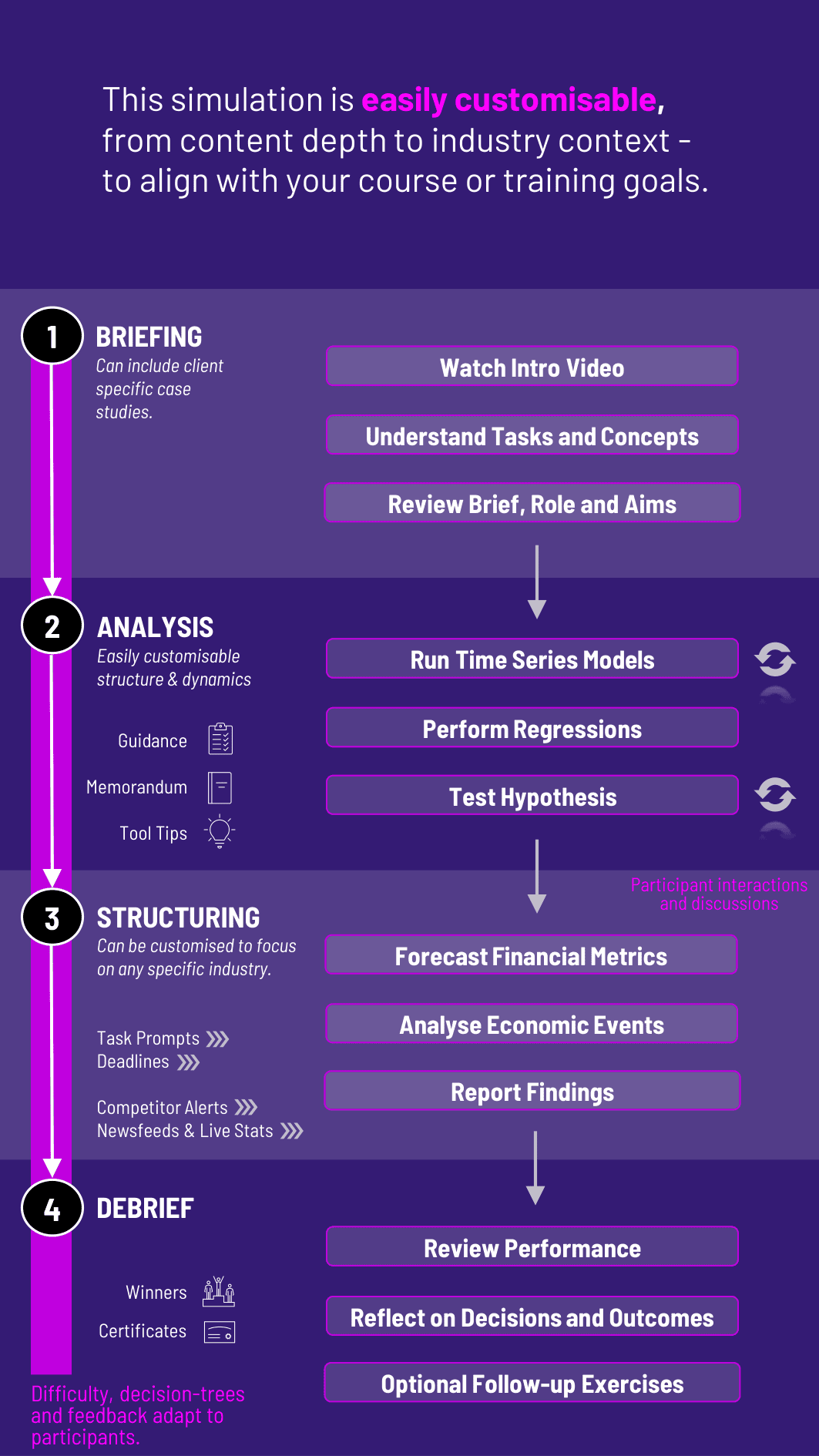

The Financial Econometrics Course gives participants an applied, hands-on experience with the statistical tools and models that drive modern financial analysis. Participants take on the role of financial analysts and researchers, using econometric techniques to interpret data, test hypotheses, forecast market trends, and build predictive financial models.

The financial econometrics course replicates the real-world environment of data-driven finance, challenging participants to extract actionable insights from complex datasets.

This financial econometrics course prepares participants to not only understand econometric theory but to apply it in fast-paced professional contexts. It’s ideal for participants learning concepts in quantitative finance, economic research, investment analytics, or financial modeling roles.

By integrating statistical thinking with financial decision-making, the financial econometrics course prepares participants for high-demand careers in data-driven finance. It reinforces technical mastery while encouraging critical thinking and clear communication, ensuring participants graduate with skills they can apply immediately in both academic and industry settings.

Who is this course designed for? It's ideal for participants and professionals pursuing careers in quantitative finance, research, and investment analytics.

Do I need programming experience? While familiarity with statistical tools (e.g., R, Python) helps, the financial econometrics course is accessible to users with basic econometrics knowledge.

How long does the course take? The full experience runs 4-6 hours, but instructors can break it into smaller sessions or modules.

Is the course math-heavy? It focuses on application over derivation, making it accessible to those with a working knowledge of statistics.

Can I apply this to real-world finance jobs? Yes - skills developed here are directly applicable in risk, investment, treasury, and research roles.

What datasets are used? The financial econometrics course uses a mix of historical financial data and simulated time series for realism and relevance.

Is there instructor support? Yes, instructors receive guides, customization options, and help integrating the financial econometrics course into their course.

Can teams collaborate in the course? Yes, it supports both individual and group work, ideal for in-class or remote settings.

Are participants assessed? Participants are evaluated on model accuracy, interpretation, and presentation of findings.

What software is required? The financial econometrics course is web-based and compatible with most modern browsers - no downloads necessary.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the financial econometrics course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the financial econometrics course can benefit you.