In the real world of finance, pristine data sets are a myth. Most of analysts and associates’ time is spent on cleaning and structuring the data into a reliable foundation for analysis. A single modelling error can lead to million-dollar mistakes.

Data Sourcing and Reliability

Data Integrity Validation

Data Cleaning Techniques

Financial ReconciliationThree-Statement Modelling

Assumption-Driven Forecasting

Error-Checking and Auditing

Data Visualization

In the simulation, participants will:

Source Raw Data by extracting financial data from a "messy" annual report PDF.

Identify and correct inconsistencies, format dates, standardize categories, and fill data gaps.

Manually ensure the integrity of the Income Statement, Balance Sheet, and the links between them.

Construct a fully integrated three-statement model from your cleaned data.

Create forward-looking projections based on clearly defined and justified operational and financial assumptions.

Test the sensitivity of your model to changes in key drivers (growth rates, margins).

Create a Final Dashboard by summarizing key findings, financial ratios, and valuation outputs in a management-ready format.

Apply a systematic framework for cleaning and validating raw financial data.

Construct a robust, integrated three-statement financial model from unstructured data.

Identify and resolve common data integrity issues that plague financial analysis.

Develop logical and defensible forecasting assumptions to drive a financial model.

Enhance the accuracy, transparency, and reliability of your financial analyses.

Boost your efficiency and confidence when handling complex data tasks in Excel.

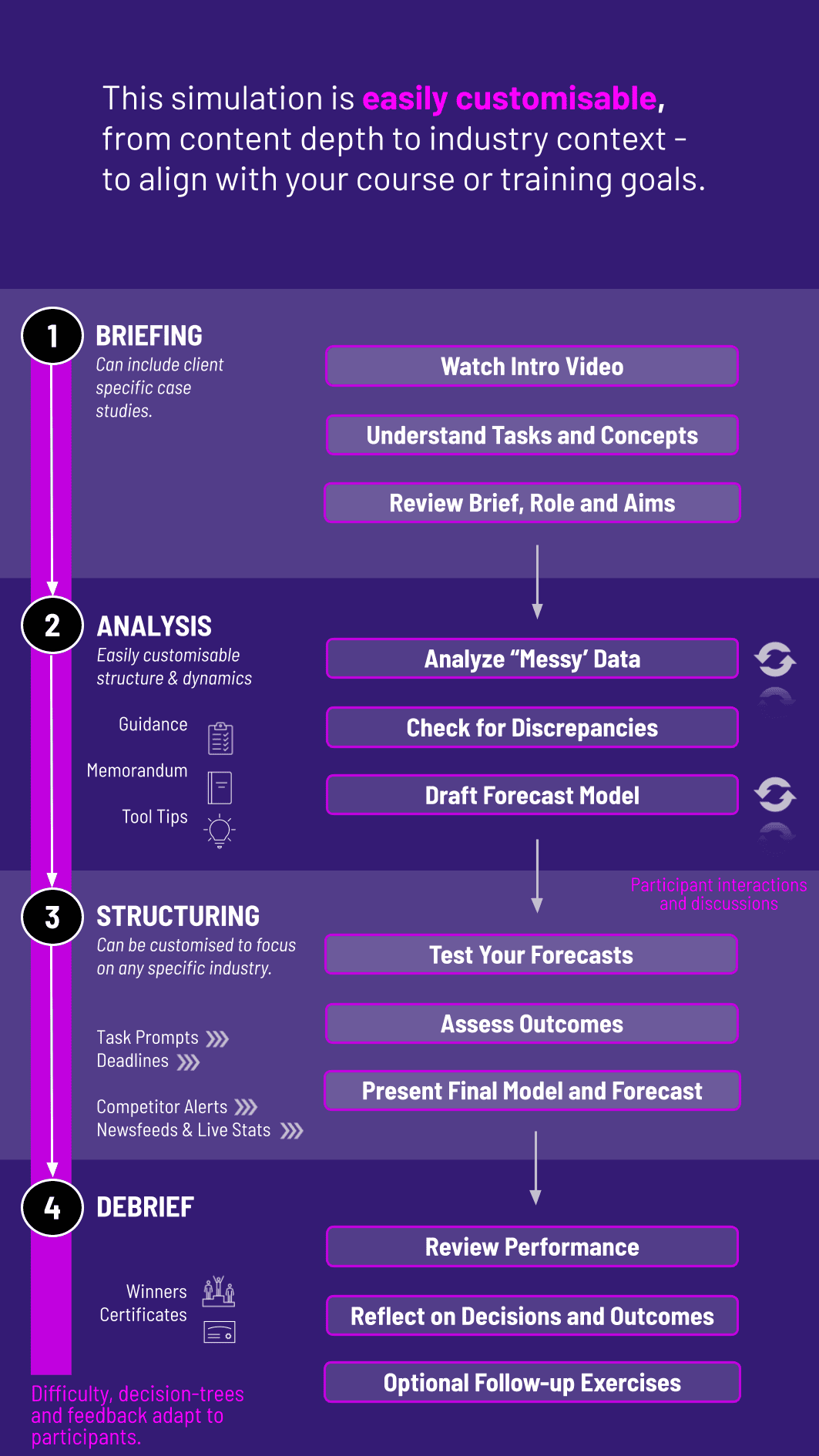

1. Assess the Data Participants will log in to our simulation platform and receive a company case study and a set of "messy" data files.

2. Source and Clean Using provided tools and guides, participants will clean the raw data, resolving inconsistencies and preparing it for modelling

3. Construction the Model Participants will follow a structured, step-by-step process to build the three-statement model with automated error-checking hints.

4. Forecast and Analyze Participants will input their financial and operational assumptions to project the company's future performance and run scenario analyses.

5. Submit the Report Participants will finalize their models and generate a summary dashboard of your key findings and valuation output.

How long does it take to complete? The simulation is designed to be completed in approximately 3-4 hours, depending on your prior experience.

Do I need to install any software? No. The simulation runs entirely within your web browser using our proprietary financial modelling interface.

Is prior experience needed? No. The simulation includes embedded instruction, tooltips, and guidance for users at various levels.

How does this simulation prepare me for a job in investment banking? Investment banking interviews and technical tests frequently involve financial modelling. This simulation goes beyond standard exercises by teaching you how to handle the real first step: building a reliable model from imperfect data. This practical, unspoken skill is what separates prepared candidates from the rest and is directly applicable to the day-to-day work of an investment banking analyst.

Who is this simulation for? Although this simulation is ideal for students and professionals pursuing careers in investment banking, equity research, corporate development, FP&A, and any finance-adjacent role where data analysis is key, it can be adapted to any need.

Accuracy of cleaned and reconciled raw data.

The technical correctness of participant’s three-statement model and its formulas.

The defensibility of participant’s forecasting assumptions and scenario analysis.

The organization, clarity, and auditability of participant’s final model

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.