Master the language of modern finance. Our Financial Data Analytics Simulation immerses participants in a competitive environment where strategic decisions are driven by data extraction, analysis, and visualization.

Data Sourcing and Mining

Financial Modeling and Scenario Analysis

Data Visualization and Dashboard Design

Statistical Analysis for Finance

Investment Thesis Development

Strategic Storytelling with Data

Capital Markets Dynamics

Risk Assessment through Data

In the simulation, participants will:

Extract and prepare financial data from simulated SEC filings, Bloomberg terminals, and economic databases.

Create three-statement models and valuation analyses based on their curated datasets.

Use integrated tools to build interactive dashboards tracking key performance and valuation metrics.

Test investment theses against various economic and company-specific scenarios.

Synthesize findings into concise, professional reports advocating a buy/sell/hold position.

Pitch their data-driven recommendation, defending their methodology and conclusions.

Identify, extract, and cleanse relevant financial data from multiple sources.

Construct a robust, data-driven financial model to forecast company performance.

Apply data visualization principles to create clear, persuasive financial dashboards.

Perform quantitative scenario and sensitivity analysis to assess risk and opportunity.

Develop and articulate a coherent investment thesis supported by empirical evidence.

Communicate complex data insights effectively to a professional audience.

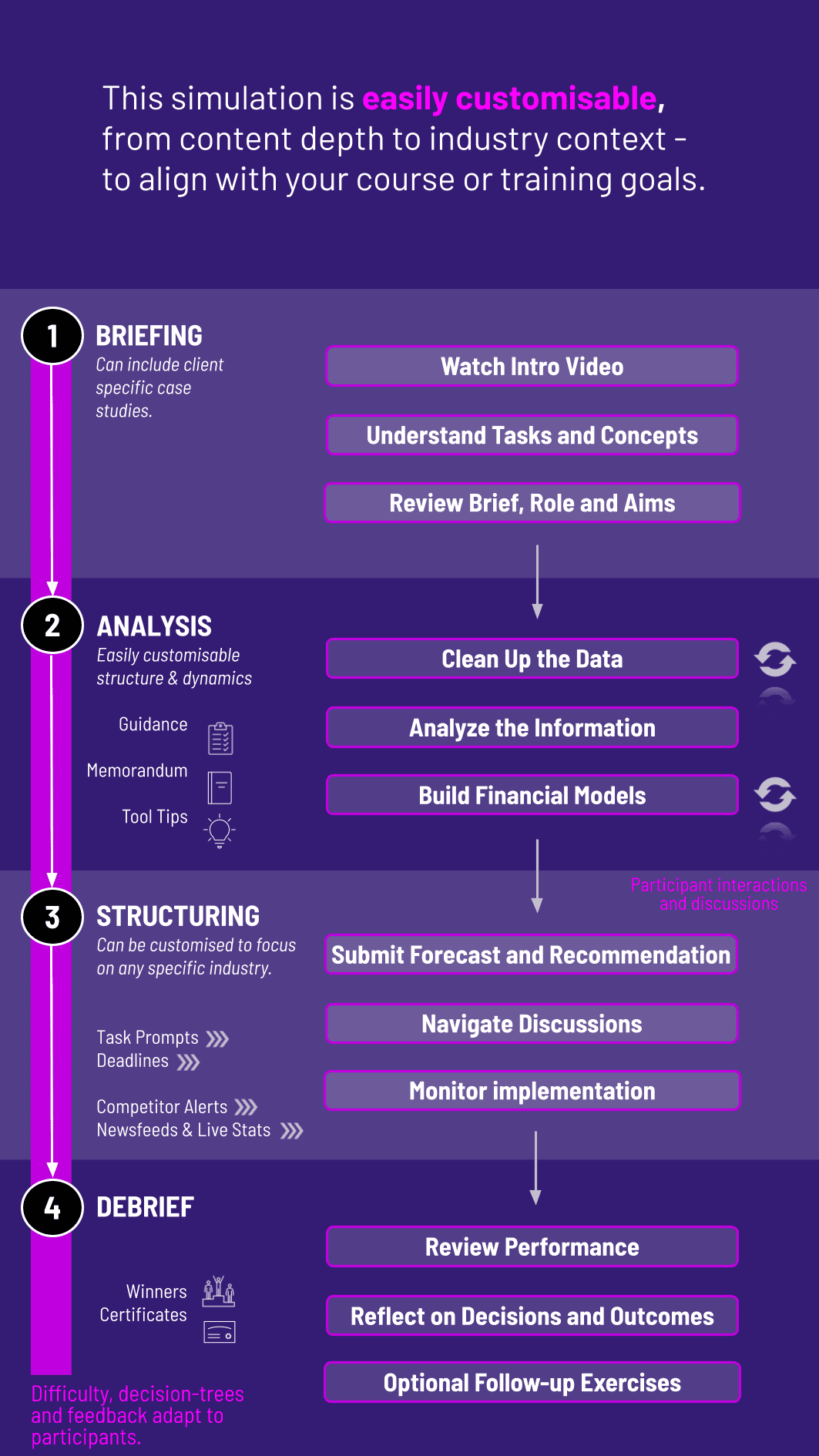

1. Data Hub Access Teams access the simulation's Data Hub, containing raw, unstructured financial data feeds, market data, and news.

2. Analysis and Modeling Phase They must clean the data, choose relevant metrics, build their financial model and dashboard, and formulate a recommendation.

3. Decision Submission Teams submit their quantified forecast, valuation, and recommended action.

4. Market Feedback and New Data The simulation engine processes all decisions, generating new market prices and quarterly results, accompanied by a new set of raw data for the next round.

5. Final Presentation The simulation culminates in a final presentation to an "Investment Committee," where teams justify their long-term analysis and performance.

What prior skills are needed for this data analytics simulation? A basic understanding of accounting, finance, and Excel is helpful. The simulation is designed to build competency, guiding participants through data cleaning, modeling, and visualization from the ground up, making it suitable for advanced undergraduates, MBAs, and early-career professionals.

How is this different from a standard financial modeling course? Unlike static courses, our simulation emphasizes the front-end of modeling: data sourcing, judgment, and cleansing. It adds critical layers of data visualization, storytelling, and decision-making under uncertainty, providing a holistic view of the analytical value chain.

Is it online-compatible? Yes. It works in digital, hybrid, and in-person formats.

Is this simulation relevant for careers in fintech and business analytics? Absolutely. The core skills of translating raw data into business insights and user-friendly dashboards are directly applicable to roles in fintech, business intelligence, equity research, and data-driven strategic finance.

How long does the typical Financial Data Analytics Simulation run? Programs can be tailored from intensive 1-2 day workshops to multi-week university courses. A typical format involves 4-6 decision rounds, allowing for deep skill development and iterative learning.

Can this simulation be used for corporate training? Yes, it is highly effective for training finance, FP&A, and analytics teams. It fosters data literacy, improves cross-departmental communication, and aligns teams on using data for strategic planning and valuation.

Accuracy and integrity of the financial model and data pipelines.

Robustness of scenario and sensitivity analysis.

Logical coherence of valuation outputs.

Clarity, design, and effectiveness of dashboards and charts.

Professionalism and structure of the written analytical report.

Ability to highlight key drivers and trends visually.

Risk-adjusted returns generated by the submitted recommendations over multiple rounds.

Consistency and adaptability of the investment strategy based on new data.

Persuasive articulation of the data-driven thesis during the final presentation.

Ability to field questions and defend analytical choices convincingly.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.