Step beyond the textbook and learn by doing, as you analyze companies, build financial models, and make critical investment recommendations that drive real-world business decisions.

Financial Statement Analysis

Discounted Cash Flow Modeling

Comparable Company Analysis

Precedent Transactions Analysis

Free Cash Flow Calculation

Weighted Average Cost of Capital

Financial Forecasting and Projection Modeling

Investment Thesis Development

Financial Modeling Best Practices

Data Synthesis and Professional Reporting

In the simulation, participants will:

Conduct a thorough review of a company's past performance using ratio and trend analysis.

Create a robust, three-statement financial model to forecast future revenue, expenses, and cash flows.

Calculate the company's intrinsic value using primary valuation methodologies: DCF, Comparable Companies, and Precedent Transactions.

Synthesize your quantitative and qualitative findings into a clear and compelling Buy, Hold, or Sell recommendation.

Draft a concise investment memo, justifying your valuation and thesis with supporting data and analysis.

Defend your analysis and recommendation in a clear, professional manner, mirroring a real-world analyst presentation.

Interpret and analyze the three core financial statements.

Build a dynamic, integrated three-statement financial model from scratch.

Calculate a company's cost of capital (WACC) and unlevered free cash flows.

Construct a DCF model to determine the intrinsic value of a company.

Perform relative valuation using comparable company and precedent transaction analyses.

Formulate a data-driven investment thesis and support it with a valuation range.

Communicate complex financial analysis clearly and effectively in a written report.

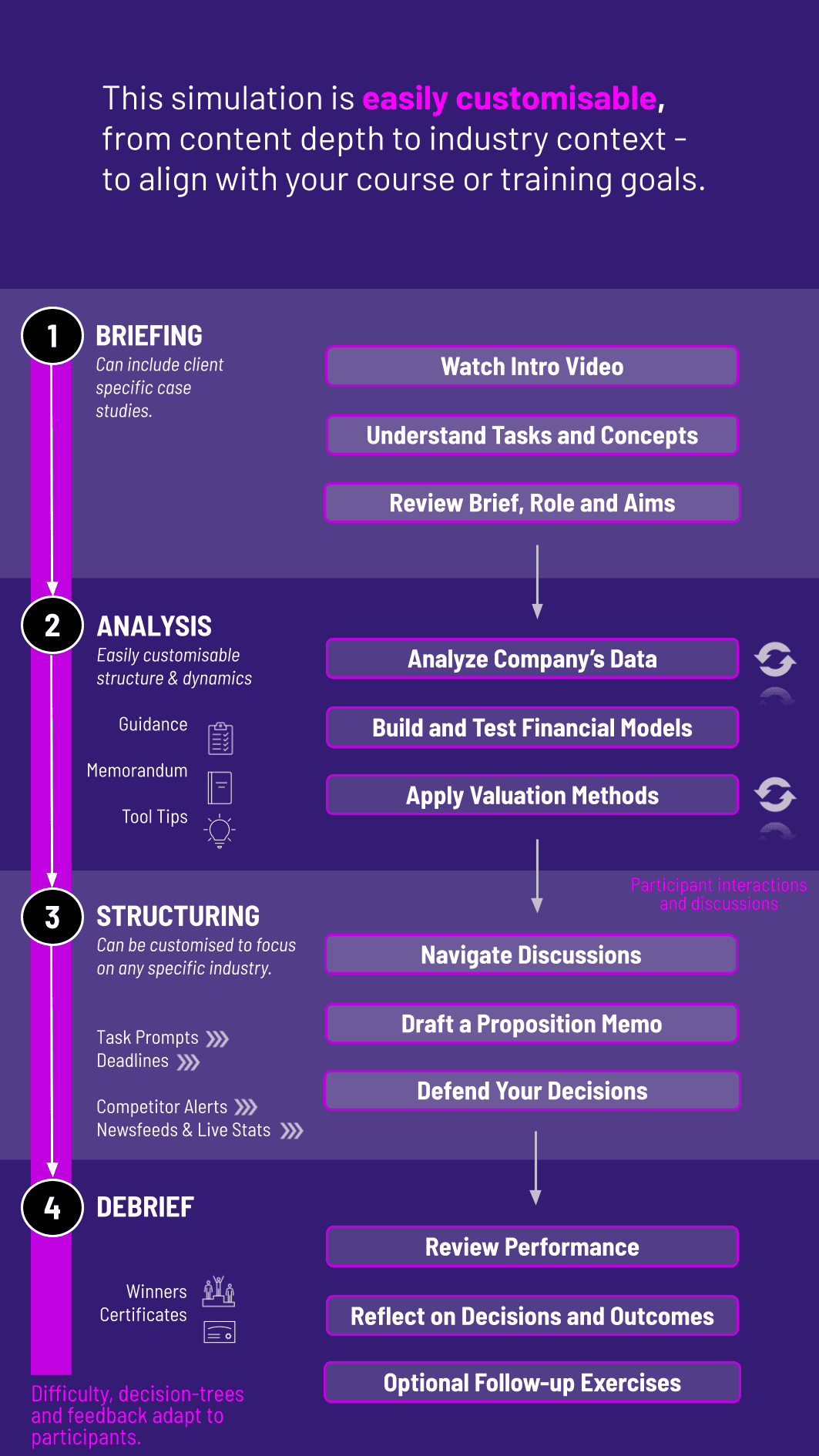

1. Introduction and Case Materials Participants are assigned the roles of financial analysts and given a comprehensive company case study, including historical financials and industry data.

2. Financial Analysis Module Participants analyze the company's profitability, liquidity, and efficiency through ratio analysis and identify key performance drivers.

3. Financial Modeling Module Participants build a projected Income Statement, Balance Sheet, and Cash Flow Statement for the next 5 years.

4. Valuation Module Participants apply DCF, Comparable Companies, and Precedent Transactions methods to arrive at a target share price and valuation range.

5. Final Recommendation Participants consolidate all your work into a final investment memo, presenting your valuation, thesis, and final recommendation.

Who is the Financial Analyst Simulation designed for? It is ideal for undergraduate and MBA students in finance, career-changers seeking to break into finance, and professionals in related fields (e.g., accounting, sales and trading) who want to build core valuation skills.

What are the technical prerequisites to participate? Participants should have a basic understanding of accounting and corporate finance principles. The simulation is cloud-based and requires only a standard web browser and an internet connection—no specialized software is needed.

Do I need prior experience with financial modeling? No. The simulation is designed to guide you through the financial modeling process step-by-step, making it suitable for beginners while still challenging for those with some prior knowledge.

How long does it take to complete the simulation? Typically between 2 to 4 hours. It can be shortened or expanded to fit class schedules or training blocks.

Can this simulation be used for corporate training? Yes. We offer customized corporate packages to train incoming analysts, associates, and other finance professionals in standardized financial modeling and valuation techniques.

What kind of support is available during the simulation? Participants have access to detailed help guides, video tutorials, and a comprehensive glossary. For academic and corporate groups, dedicated instructor/administrator support is also provided.

How does the simulation assess my performance? Your performance is assessed through an automated scoring system that evaluates the accuracy of your financial model, the logic of your assumptions, the completeness of your valuation, and the clarity of your final investment recommendation.

Mathematical integrity of participants’ financial model and the logic of your forecasting assumptions.

Final valuation range and the methodological soundness of participants’ DCF and comparable analyses are evaluated.

The strength and clarity of the written investment thesis and the justification for your recommendation are assessed.

Depth and logic of scenario analysis and sensitivity ranges

Clarity, coherence, and persuasiveness of the valuation memo and presentation.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.