The Financial Planning Simulation is an immersive, experiential learning tool designed for finance students, aspiring financial planners, and professionals.

Client Profiling and Goal Setting

Cash Flow and Budget Analysis

Investment Planning and Asset Allocation

Risk Management and Insurance

Retirement Planning

Tax-Efficient Planning

Estate Planning Fundamentals

Behavioral Finance

In the simulation, participants will:

Conduct initial client consultations to gather data and define goals.

Analyze complete financial pictures, including balance sheets and cash flow statements.

Develop tailored financial plans with specific recommendations.

Implement investment strategies by selecting from various asset classes.

Monitor plans and rebalance portfolios in response to simulated economic updates.

Present plan rationale and adjustments to "clients" (instructors or peers).

Navigate ethical dilemmas and regulatory compliance scenarios.

Review plan performance and write client review summaries.

Synthesize financial planning concepts into coherent, client-focused strategies.

Apply technical skills in budgeting, investment analysis, and retirement modeling.

Develop client communication and advisory skills.

Evaluate and mitigate financial risks through appropriate product and strategy selection.

Demonstrate adaptive decision-making in response to changing market and life conditions.

Understand the fiduciary responsibility and ethical standards of the profession.

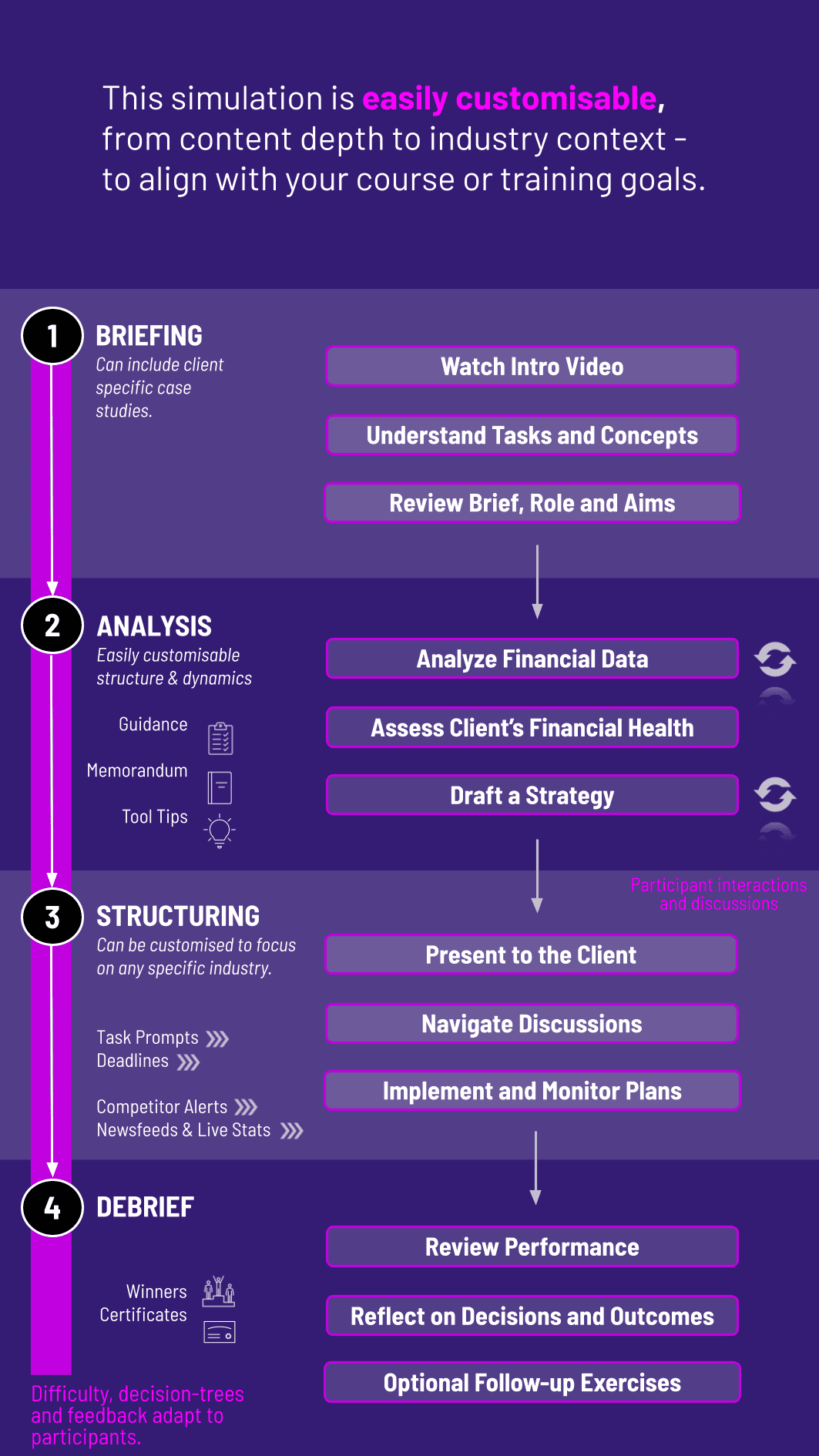

1. Setup and Analysis Phase Participants are assigned one or more client cases with detailed profiles. Using provided dashboards and tools, participants diagnose the client's financial health.

2. Planning Phase Participants create a written plan with specific, actionable recommendations.

3. Implementation and Monitoring Participants input decisions (investment allocations, insurance purchases) into the simulation platform.

4. Scenario Rounds The simulation advances through quarterly or annual rounds, introducing market events, interest rate changes, or client life events.

5. Adjustment Participants re-evaluate and adjust the financial plan, documenting their rationale.

6. Review and Debrief Final plans and performance metrics are assessed. An instructor-led debrief connects simulation experiences to theoretical knowledge.

Who is the target audience for this simulation? It is ideal for undergraduate and graduate finance programs, business schools, certification courses, and corporate training for banks and wealth management firms.

What technical prerequisites are needed to run the simulation? No special software is required. The simulation is cloud-based and runs on any modern web browser. A stable internet connection is recommended.

How long does a typical simulation session last? Sessions can be tailored from a compact 4-hour workshop to a multi-week course module, depending on the depth of client cases and number of decision rounds.

Does the simulation align with CFP Board requirements? Yes, the simulation’s structure and covered domains are designed to align with key CFP Board Principal Topics, providing practical application of certification concepts.

Can the simulation accommodate different skill levels? Absolutely. Instructors can choose from beginner to advanced client cases and adjust the complexity of the injected economic scenarios.

Is this simulation suitable for corporate training? Yes. It is highly effective for training new hires in private banking, wealth management, and retail banking, focusing on practical client-facing skills and product knowledge.

Scores based on the health of the client's financial plan, progress toward goals, and efficient use of capital.

Financial plans are evaluated for completeness, accuracy, and professionalism.

Participants present and critique each other’s plans, fostering collaborative learning.

Instructors lead discussions on key decision points, linking simulation outcomes to core financial planning theories.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.