In this immersive Fairness Opinion Simulation, participants act as investment bankers delivering valuation assessments in M&A scenarios. They analyze deals, apply valuation methods, and draft fairness opinions under board-level scrutiny.

Valuation Methodologies: DCF, precedent transactions, trading comparables

Deal Terms Assessment: Consideration structure (cash vs stock), premiums, synergies

Fairness Opinion Drafting: Legal language, disclaimers, scope of review

Conflict Management: Independence, disclosure, regulatory expectations

Stakeholder Sensitivity: Board interests, fiduciary duties, minority shareholders

Strategic Alternatives: Evaluating the deal vs other paths (IPO, internal growth, etc.)

Regulatory and Legal Frameworks: Role of fairness opinions in M&A governance

Review the terms of an M&A deal from both buyer and seller perspectives

Conduct valuation analysis using different methods and stress test assumptions

Draft sections of the fairness opinion document

Identify and articulate any limitations, assumptions, or risks

Present the opinion to a simulated board or internal review panel

Defend the opinion under questioning from stakeholders

Adjust the analysis as new deal terms or market dynamics emerge

By the end of the simulation, participants will be more confident in:

Applying valuation methods to real-world M&A transactions

Understanding the legal and financial function of a fairness opinion

Communicating technical findings clearly and persuasively

Structuring a fairness opinion document that withstands legal and reputational scrutiny

Balancing analytical integrity with commercial judgment

Navigating competing stakeholder interests and ethical considerations

Responding to time pressure, changing information, and strategic pushback

Collaborating in high-stakes, professional decision-making environments

This simulation develops financial judgment and professional credibility - essential for aspiring bankers, strategy consultants, and in-house corporate finance professionals.

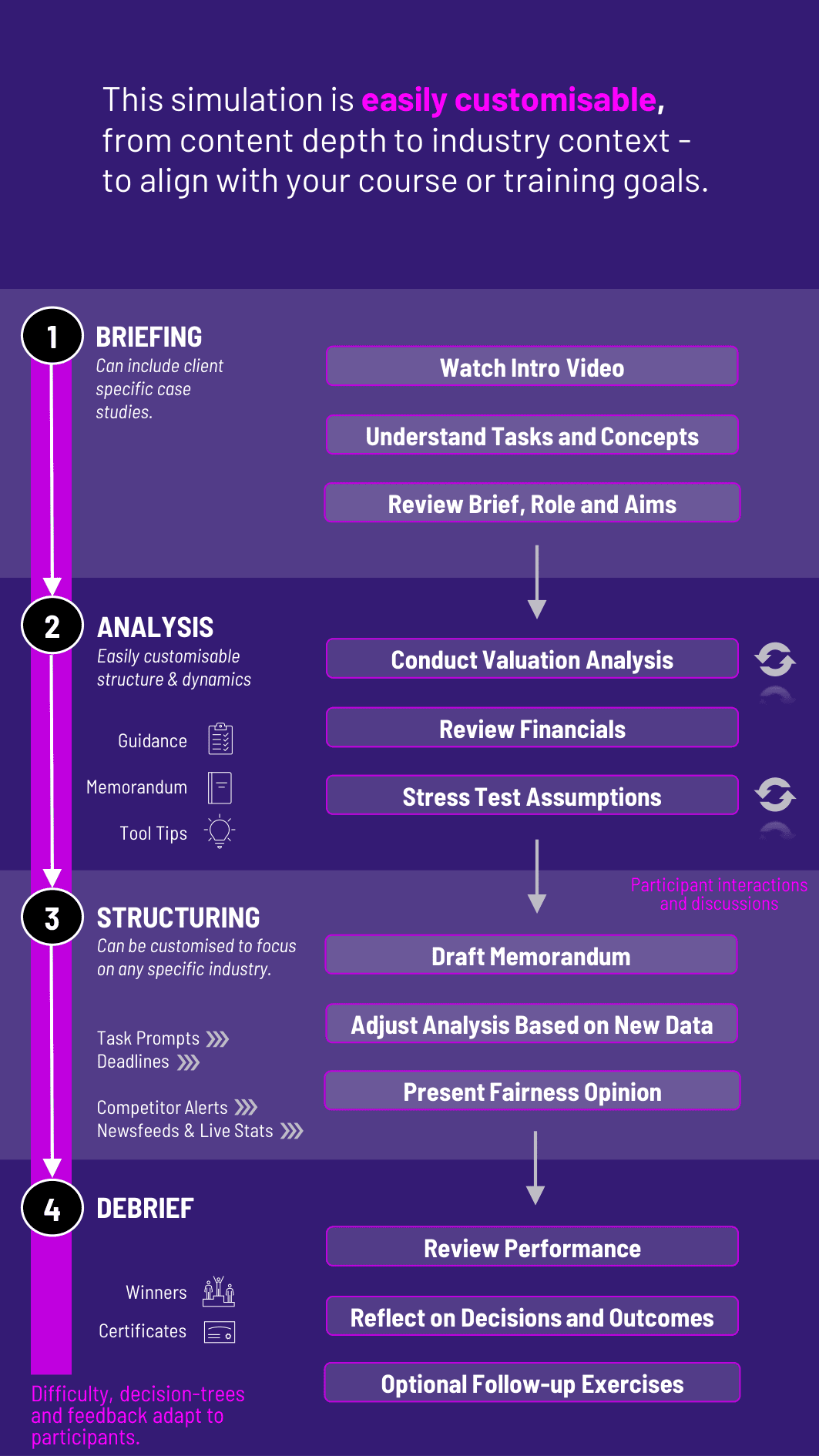

1. Receive Deal Brief Participants are given a mandate to evaluate a deal - acquisition, merger, or divestiture - along with company financials and strategic rationale.

2. Valuation and Risk Analysis Participants apply DCF, comparables, and deal metrics to determine value. They assess deal fairness from a financial standpoint and flag any red flags.

3. Drafting the Fairness Opinion Using templates or simulation tools, participants produce an opinion document outlining methodologies, assumptions, fairness conclusion, and disclaimers.

4. Stakeholder Presentation They present the fairness opinion to a simulated board, committee, or internal MDs - fielding questions, justifying decisions, and refining language under review.

5. Respond to New Information Subsequent rounds might include an improved bid, regulatory challenge, or activist investor input - requiring updates to the opinion.

6. Iterate Across Scenarios Additional engagements could include sell-side mandates, cross-border deals, or conflicted transactions, deepening the learning experience.

Do participants need M&A experience? Not necessarily. The simulation introduces core concepts with guided tools. Familiarity with finance and valuation is useful.

Is the fairness opinion a real document? Participants simulate real sections of a fairness opinion, using authentic formats and language tailored for learning.

Can teams play different roles? Yes. One can act as lead analyst, one as internal reviewer, another as presenting banker. Team-based review mirrors real advisory teams.

Are both buy-side and sell-side deals included? Yes. Scenarios include public and private deals, controlling and minority interests, and cash/stock consideration mixes.

Is the simulation more qualitative or quantitative? Both. Strong analytical work underpins the fairness opinion, but narrative clarity and stakeholder communication are equally important.

How long does it run? A single round can be completed in 3 - 4 hours. Longer programs may include multiple engagements over a full course or corporate workshop.

Can we include activist or hostile scenarios? Absolutely. Complex dynamics such as competing bids or shareholder resistance add valuable challenge and realism.

Is it suitable for MBA students? Yes. The simulation supports finance-focused learners with adaptable scenarios.

How is performance assessed? Based on analysis depth, communication, document clarity, and ability to defend a position under scrutiny.

Quality of valuation and methodology

Fairness opinion structure and language accuracy

Presentation skill and clarity under questioning

Ethical awareness and stakeholder consideration

Peer and instructor review

Iterative improvement across multiple rounds

Optional memo writing or board debriefs

You can also include debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated into by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.