Participants become ETF portfolio managers, designing and rebalancing index-tracking funds while responding to market shifts, investor flows, and tracking error in our Exchange Traded Funds Course.

ETF Structures: Physical replication, synthetic replication, and sampling

Benchmark Tracking: Tracking error, index rebalancing, and drift

Portfolio Construction: Weighting methods (market cap, equal weight, thematic)

Liquidity and Market Impact: Bid-ask spreads, creation/redemption mechanisms

Investor Behaviour: Flows, demand shifts, and pricing deviations

Cost Management: Expense ratios, transaction costs, and slippage

Performance Attribution: Understanding excess return and tracking precision

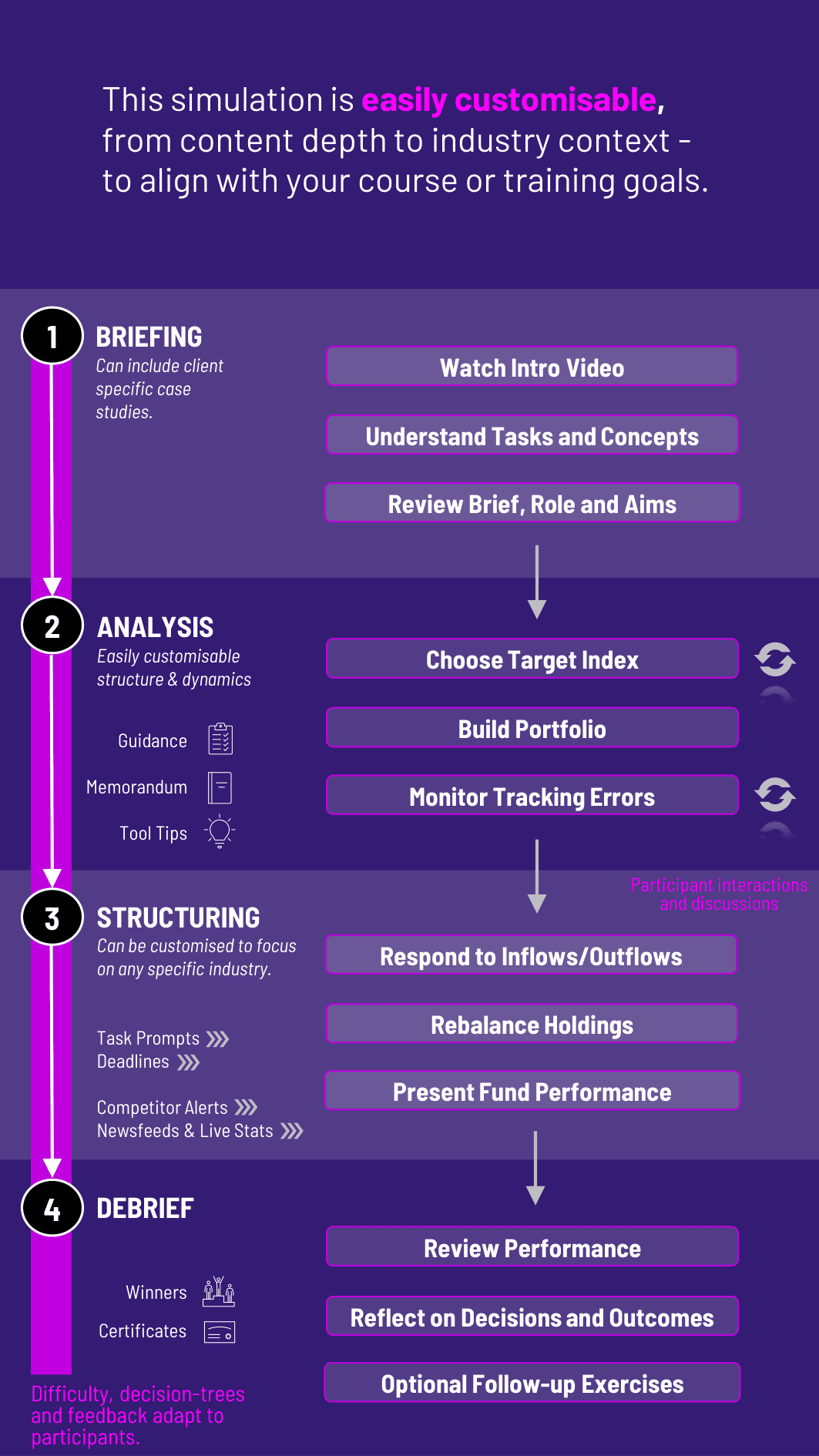

Choose a target index or strategy to replicate

Build a fund portfolio based on liquidity, costs, and exposure needs

Monitor performance against the benchmark and manage tracking error

Rebalance holdings in response to index changes and market shifts

Respond to inflows/outflows and adjust positions for liquidity

Present fund performance, tracking rationale, and lessons learned

The course gives participants direct experience managing passive investment products under real-world constraints. They will learn how to:

Construct and rebalance ETF portfolios effectively

Analyze the trade-offs between tracking accuracy and cost efficiency

Interpret flows, volatility, and benchmark changes

Recognize how market microstructure affects ETF pricing

Communicate ETF strategy clearly to investors and internal teams

Appreciate the strategic and operational complexity of "passive" investing

Do participants need prior investing or ETF knowledge? Not necessarily. The course includes onboarding content to explain ETF basics, replication methods, and benchmark tracking.

Can instructors choose different indices or sectors? Yes. Instructors can select from equity indices (e.g. S&P 500, MSCI sectors) or thematic indexes (e.g. clean energy, tech, ESG).

How long does it take? The course typically runs over 2–3 hours but can be extended to accommodate multiple rebalancing cycles and presentations.

Is it suitable for individual or group play? Both. Team formats often mirror real-world ETF management structures with separate roles (strategy, trading, reporting).

How is participants performance evaluated? Based on tracking error, cost efficiency, responsiveness to flows and rebalancing events, and clarity of strategy presentation.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.