In this simulation, participants act as finance professionals facing dilemmas - balancing profitability, compliance, and integrity while navigating stakeholder pressures, regulatory requirements, and reputational risks under real-world constraints.

Insider trading and market abuse

Conflicts of interest in finance

Mis-selling and client protection

ESG, sustainability, and ethical investment choices

Pressure from earnings targets and performance incentives

Whistleblowing and reporting protocols

Reputational risk and media scrutiny

Ethical frameworks for decision-making

Cultural and global perspectives on finance ethics

Long-term trust vs short-term profit trade-offs

Review case scenarios with competing interests

Debate trade-offs between compliance, profitability, and integrity

Decide on actions under time pressure and uncertainty

Communicate choices to boards, clients, or regulators

Respond to whistleblowers, media coverage, or regulatory audits

Reflect on how their decisions shape trust and credibility

By the end of the simulation, participants will be able to:

Recognize common ethical dilemmas in finance

Apply ethical frameworks to complex decisions

Balance profitability with integrity and compliance

Communicate transparently with stakeholders under pressure

Reflect on the reputational consequences of decisions

Anticipate long-term risks of unethical practices

Manage conflicts of interest responsibly

Foster cultures of transparency and accountability

Understand global perspectives on finance ethics

Strengthen judgment and self-awareness in leadership roles

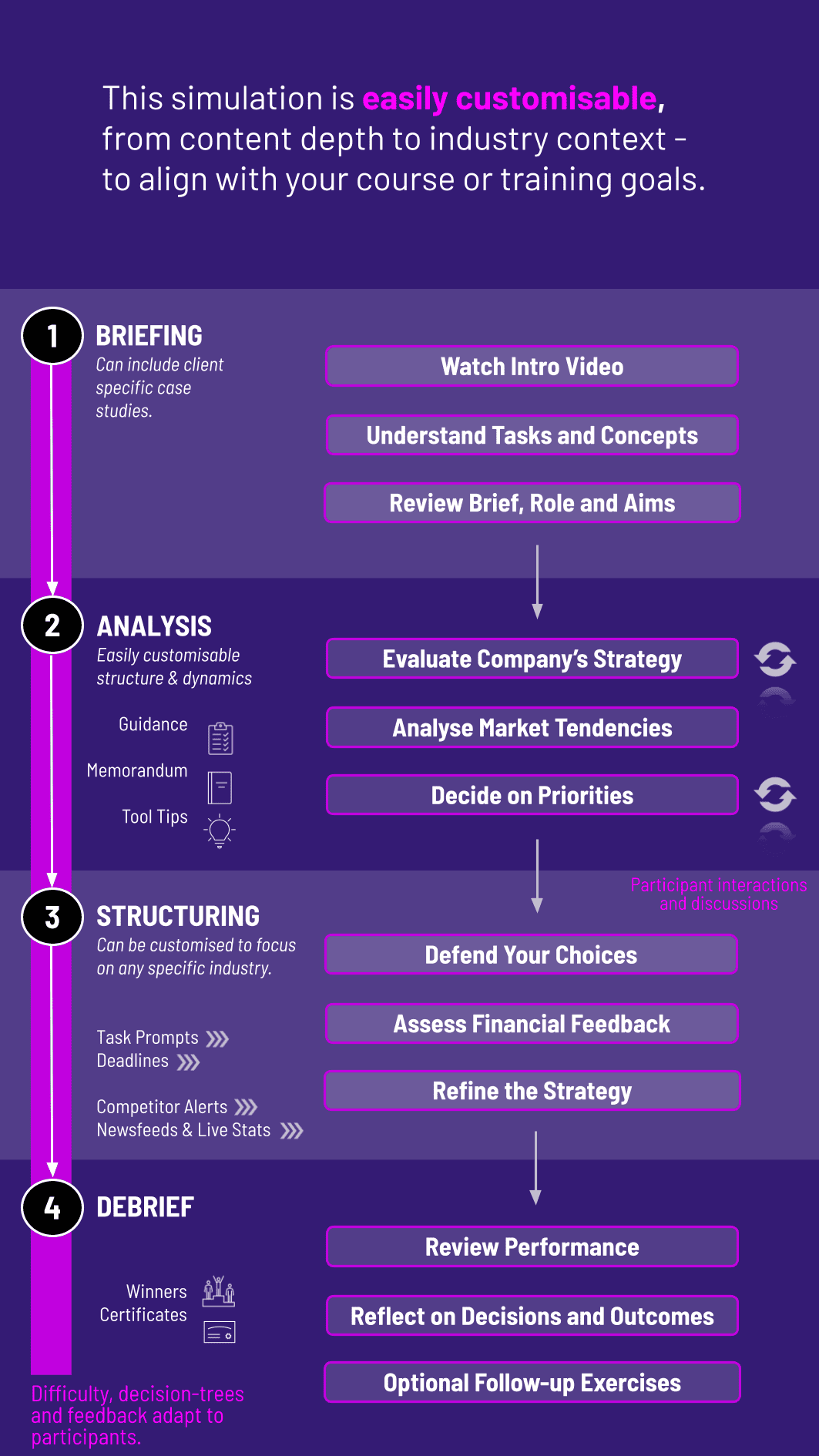

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

The simulation can be run individually or in teams, across classrooms or professional programs. Each cycle represents a decision-making round.

1. Receive a Scenario or Brief: Participants are presented with an ethical challenge shaped by financial, regulatory, and reputational factors.

2. Analyse the Situation: They review key details, stakeholder positions, and trade-offs.

3. Make Strategic Decisions: Participants decide whether to prioritize profit, compliance, or ethical considerations.

4. Collaborate Across Roles: Teams role-play as executives, regulators, or clients debating outcomes.

5. Communicate Outcomes: Participants justify choices through board memos, press statements, or client updates.

6. Review and Reflect: Feedback highlights financial impact, reputational outcomes, and stakeholder trust. Participants refine strategies across rounds.

Do participants need finance experience? No. Ethical dilemmas are designed to be relatable for varied audiences.

What roles are included? Bankers, regulators, executives, investors, and clients.

Is this simulation only about compliance? No. It explores ethics beyond compliance, including culture, trust, and responsibility.

Can scenarios be tailored? Yes. They can reflect banking, asset management, fintech, or corporate finance.

How long does it run? It can be delivered in short sessions or extended programs.

Is teamwork part of it? Yes. Group play allows participants to debate ethical trade-offs.

Does it include global perspectives? Yes. Scenarios can explore cultural differences in finance ethics.

Can it be used in executive training? Absolutely. It is highly relevant for leaders balancing profit and integrity.

How is performance measured? By judgment, reasoning, and communication rather than “right answers.”

Can it run online? Yes. It supports hybrid, online, and in-person delivery.

Consistency in applying ethical frameworks

Balance between financial and ethical outcomes

Clarity in communicating rationale

Responsiveness to new information or scrutiny

Collaboration and peer/self-assessment in dilemmas

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.