This simulation places you in the role of an ESG Analyst at a leading asset management firm, tasked with evaluating companies and building a portfolio that aligns with both financial and sustainability goals.

ESG Integration

Materiality Assessment

ESG Data and Ratings

Stakeholder Capitalism

Climate Risk and Opportunity

Proxy Voting and Engagement

Impact Measurement

Greenwashing vs. Authentic Transition

Portfolio Construction

In the simulation, participants will:

Analyze company reports, sustainability disclosures, NGO criticisms, and news flow.

Compare the ESG performance of multiple firms within the same industry.

Develop a weighted scoring model based on material E, S, and G factors.

Create a "Buy," "Sell," or "Hold" recommendation supported by both financial and ESG rationale.

Allocate capital across a universe of securities to achieve a target risk/return and ESG profile.

Defend your portfolio choices and ESG methodology in a final presentation, simulating a real-world pitch.

Analyze a company's holistic performance using a structured ESG framework.

Differentiate between robust ESG practices and corporate "greenwashing."

Synthesize complex and often conflicting ESG data into a clear, concise investment thesis.

Construct a portfolio that aligns with specific ESG mandates (Low-Carbon, Socially Responsible, Best-in-Class).

Articulate the financial materiality of ESG factors to stakeholders and clients.

Evaluate the impact of ESG performance on company valuation and risk.

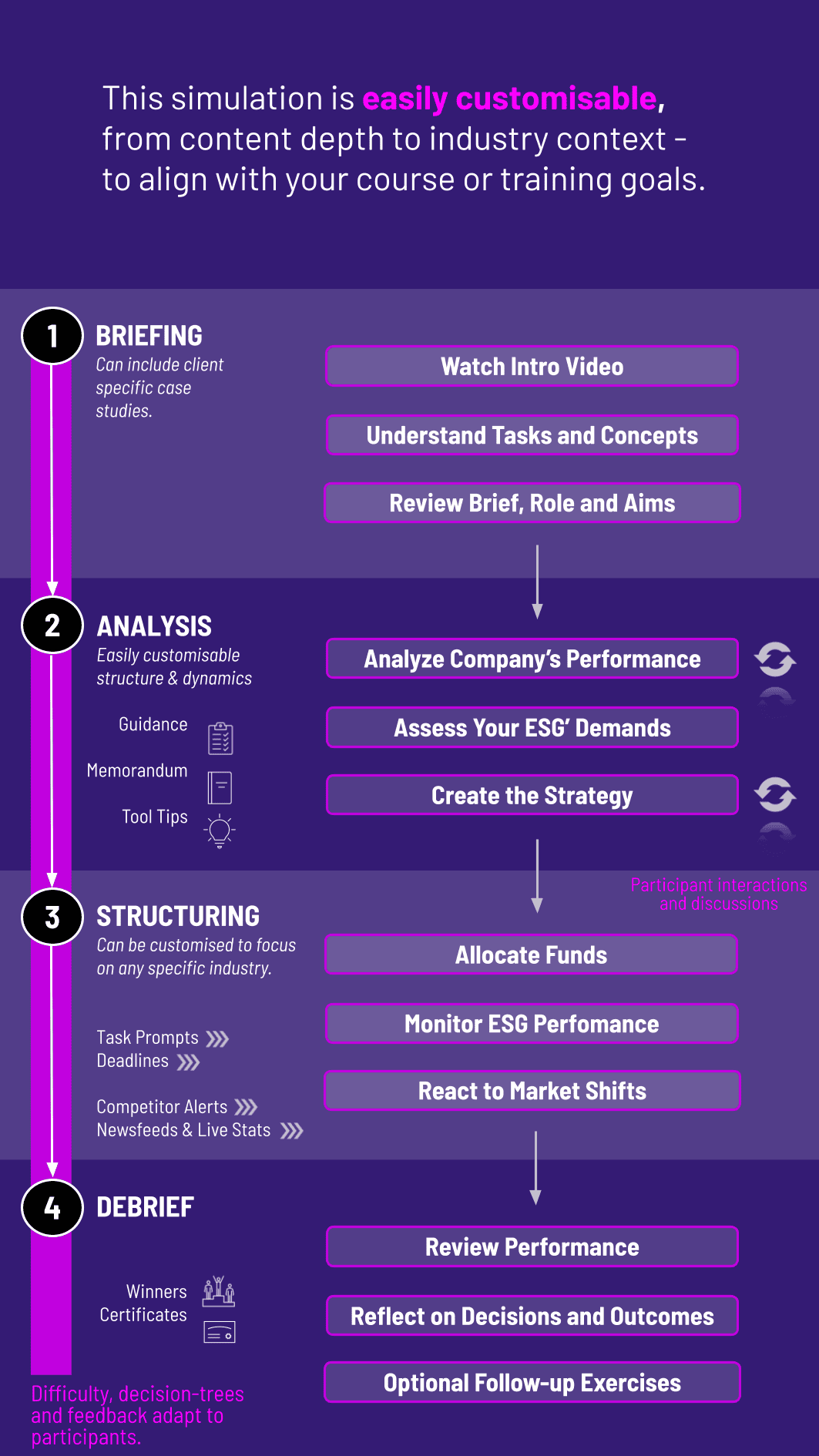

1. Introduction and Mandate Your team is hired by an asset manager with a specific ESG mandate ("Fossil Fuel Free," "Gender Lens Investing").

2. Company and Data Analysis You are given access to a simulated platform with financial and ESG data on 50+ companies across various sectors. You use research tools to dig deeper.

3. Scoring and Due Diligence You apply your custom ESG scorecard to rate each company, identifying leaders and laggards.

4. Portfolio Construction and Trading You allocate a virtual $100 million portfolio, making trades based on your analysis. The simulation platform tracks your financial and ESG performance in real-time.

5. Debrief and Ranking The simulation concludes with a debriefing session. Teams are ranked based on a combined score of their portfolio's financial return, ESG performance, and the quality of their final report.

Is this simulation suitable for someone without a finance background? Absolutely. While a basic understanding of business is helpful, the simulation is designed to be accessible. It includes foundational materials on investment concepts, and the focus is on learning the unique language and frameworks of ESG analysis.

What kind of ESG data is provided in the simulation? The simulation features realistic, proprietary data sets mimicking major providers. This includes quantitative metrics (e.g., carbon emissions, board diversity %) and qualitative flags (involvement in controversies, UN SDG alignment) across all three pillars.

How long does the simulation typically take to complete? The core simulation can be run as an intensive 1-day workshop or extended over a 4-6 week module within a course, requiring 3-5 hours of team work per week.

Do we learn about different ESG frameworks like SASB, TCFD, and GRI? Yes. A key part of the learning is understanding how these major frameworks (SASB for industry-specific materiality, TCFD for climate, GRI for broader reporting) are used in practice to gather and assess corporate data.

Can the simulation be customized for an Executive Education audience? Certainly. For executives, we can incorporate more complex scenarios, such as analyzing private companies, conducting ESG due diligence for M&A, or managing stakeholder activism.

How is the performance of participants measured and graded? Performance is multi-faceted. It is based on the risk-adjusted financial return of the final portfolio, the achievement of the stated ESG mandate, the analytical depth of the research report, and the persuasiveness of the final presentation.

What are the technical requirements to participate? Participants only need a standard modern web browser (Chrome, Firefox, Safari) and a stable internet connection. No special software downloads are required.

How does this simulation prepare me for real-world ESG careers? This simulation provides the foundational, hands-on experience demanded by employers in asset management, equity research, and corporate sustainability. You will finish with a tangible project for your resume and the practical confidence to discuss ESG analysis in interviews.

The depth of analysis, clarity of the investment thesis, correct application of ESG frameworks, and professional presentation.

Portfolio's financial return and its success in meeting the assigned ESG constraints and targets.

Clarity, persuasiveness, and professionalism of the final pitch, including the ability to defend decisions under questioning.

Contributions to the team's effort as rated by fellow team members and observed engagement throughout the simulation.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.