Participants take on the role of equity analysts, evaluating companies, forecasting performance, and pitching stock recommendations. They build valuation models, craft investment theses, and communicate insights under real-world time pressure.

Financial Statement Analysis: Interpreting income statements, balance sheets, and cash flows

Forecasting: Projecting revenue, margins, and capital expenditure

Valuation Techniques: DCF, trading comparables, and target price setting

Investment Thesis Building: Identifying key drivers and risks

Market Sentiment Analysis: Reacting to real-time news, earnings calls, and sector trends

Research Communication: Writing research notes and presenting buy/sell/hold recommendations

Ethical Considerations: Transparency, compliance, and conflicts of interest

Review company profiles and sector outlooks

Analyze financial performance and KPIs

Build and adjust a financial model

Apply valuation methods to derive a stock price target

Write a professional-grade research memo

Present recommendations in a live (or recorded) committee format

Defend their thesis under questioning from peers or simulated stakeholders

By the end, participants will be more confident in:

Analyzing company performance using real data

Building credible financial forecasts and valuations

Communicating investment ideas with clarity and confidence

Navigating uncertainty and conflicting data

Making decisions under pressure and defending them

Writing professional research notes for real-world audiences

Differentiating between story-driven and data-driven analysis

Responding to real-time market developments with agility

Understanding the buy-side vs sell-side research perspectives

Practicing presentation skills in high-stakes financial environments

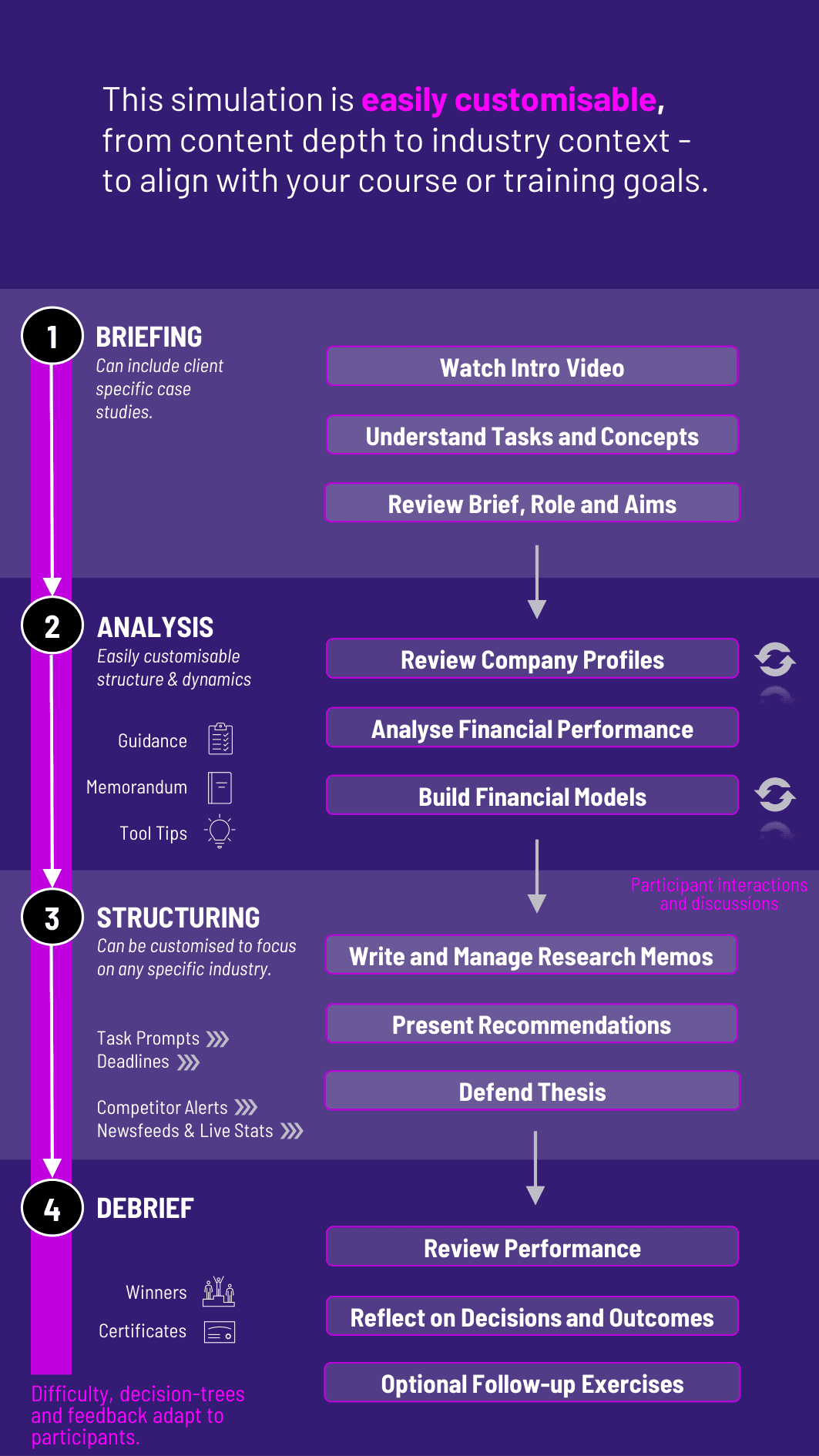

The simulation is highly flexible and can be scaled for entry-level students or advanced learners preparing for finance roles.

1. Receive a Scenario or Brief Each round begins with a new company case, market update, or event (e.g., earnings release). Participants receive a research task - such as a valuation update, downgrade memo, or new coverage report.

2. Analyse the Situation Participants evaluate available data: company financials, analyst estimates, macro headlines, peer performance, etc. They interpret key drivers and risks.

3. Build a Model and Make Decisions Using simulation tools or guided templates, participants forecast financials and apply valuation logic to form a view on fair value and investment direction.

4. Write and Present Research Participants write a short-form memo and deliver a pitch presentation (live or recorded), defending their rating and rationale to the committee.

5. Engage in Peer/Committee Review Teams or individuals receive feedback from instructors, peers, or AI-simulated investment committee members.

6. Repeat the Cycle Subsequent rounds introduce new variables (e.g., macro changes, earnings beats/misses, industry regulation), requiring revisions to analysis and narrative.

Throughout, participants are guided to reflect on their strategy, defend their assumptions, and iterate on their work.

Do participants need prior experience in equity research? No, the simulation provides guided onboarding and explanation of key concepts. Familiarity with basic financial statements is helpful.

What types of companies are used? Simulated listed companies across industries - tech, retail, industrials, etc. - with realistic financials and performance narratives.

Can valuation models be customized? Yes. The simulation allows DCF and comparables inputs to be adjusted. Pre-built or editable templates are available.

Is this simulation more quantitative or qualitative? Both. Students must build models and construct persuasive narratives to support their views.

Is it a team or individual experience? Both are supported. Individual play is ideal for deep modeling focus, while team formats mirror real research desks and investment committees.

How long does the simulation take? Anywhere from 2 hours to a full week, depending on how many rounds, presentations, and review cycles are included.

Does it include peer review or role-play? Yes. Peers can act as committee members or portfolio managers questioning the analyst’s pitch, enabling soft skill development.

How is performance evaluated? Based on the quality of analysis, accuracy of valuation, clarity of research communication, and strength of thesis defense.

Can it be integrated into a finance or business strategy course? Yes. It fits seamlessly into financial analysis, investment strategy, valuation, or communication-focused curricula.

Assessment is flexible and customizable. Participants may be evaluated on:

Forecast accuracy and valuation integrity

Structure and clarity of research notes

Presentation and persuasion skills

Strategic response to new information

Peer feedback or committee questioning

Reflection logs and memo drafts

Optional peer/self-assessment tools can also be integrated to measure collaboration, analytical depth, and improvement over time. The simulation’s format allows easy inclusion in both academic courses and professional assessment centres.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.