Participants become equity analysts and fund managers in a fast-moving stock market environment - analyzing companies, reacting to news, and making real-time buy/sell decisions in our Equity Markets Training.

Fundamental Analysis: Analyzing income statements, balance sheets, and cash flows

Valuation Techniques: DCF, multiples, and relative valuation

Portfolio Management: Diversification, beta, and position sizing

Market Reactions: Interpreting and reacting to earnings, news, and macro indicators

Risk Management: Monitoring volatility, drawdowns, and market exposure

Behavioural Finance: Understanding biases and market overreactions

Performance Metrics: Sharpe ratio, alpha, and tracking error

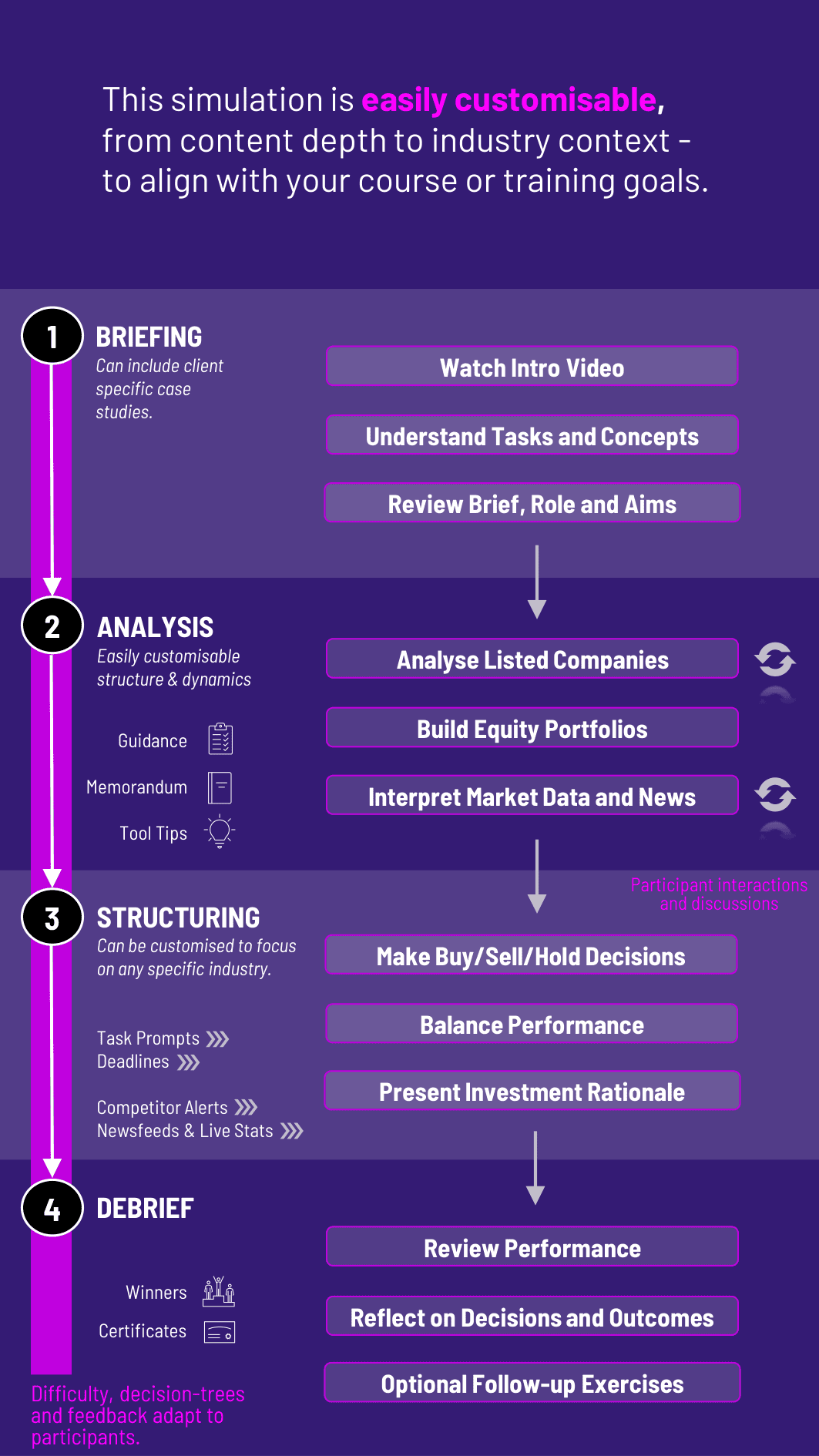

Analyzing listed companies using financial data and qualitative insights

Building and managing a virtual equity portfolio

Reacting to real-time market events, competitor updates, and earnings surprises

Making informed buy/sell/hold decisions across training rounds

Balancing short-term performance with long-term positioning

Presenting investment rationales and reviewing fund performance post-training

This training gives participants hands-on exposure to the high-pressure decision-making and analytical rigour expected in equity markets. They learn to:

Evaluate companies using real financial data and investment models

Translate economic and company-level news into stock-level decisions

Construct and manage diversified portfolios based on investment strategy

Communicate investment ideas with clarity and confidence

Reflect on how behavioural biases impact trading and performance

Track performance against benchmarks and revise strategy when needed

**Do participants need prior investing experience? No prior experience is necessary, but basic understanding of financial statements and valuation is recommended.

**Can the training be adjusted for different levels? Yes. Instructors can choose simplified or advanced metrics, and adjust company complexity based on the cohort.

**How long does the training take? A typical session runs 2–3 hours, though instructors can run multiple rounds over several classes.

**Can participants play individually or in teams? Both formats are supported. Team play encourages investment committees and collaborative strategy.

**How is participants performance assessed? Through portfolio return, risk-adjusted performance (e.g., Sharpe ratio), rationale quality, and final presentation or memo.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the training.

or

Book a 15-minute Zoom demo with one of our experts to explore how the training can benefit you.