The Equity Financing Simulation immerses participants in the dynamic world of raising capital through equity, offering hands-on experience in structuring, negotiating, and executing equity deals.

Equity financing structures (common shares, preferred shares, convertible notes)

Valuation methods (DCF, comparables, venture capital method)

Term sheet negotiation and deal structuring

Investor relations and fundraising dynamics

Exit strategies (IPO, acquisition, secondary sale)

Impact of dilution and ownership on company control

Regulatory and compliance considerations

ESG integration in equity financing

In the simulation, participants will:

Analyze company financials and market opportunities

Develop fundraising strategies and pitch decks

Negotiate term sheets and deal terms with investors

Model financial outcomes under different funding scenarios

Manage investor expectations and reporting

Explore exit options and timing

Collaborate in teams to simulate real-world deal teams

Present investment memos and deal updates

Understand the mechanics and structures of equity financing

Apply valuation techniques to real-world scenarios

Negotiate and structure equity deals effectively

Manage investor relations and reporting requirements

Evaluate the impact of dilution and ownership changes

Develop strategic thinking for fundraising and exits

Recognize regulatory and compliance issues in equity financing

Integrate ESG considerations into financing decisions

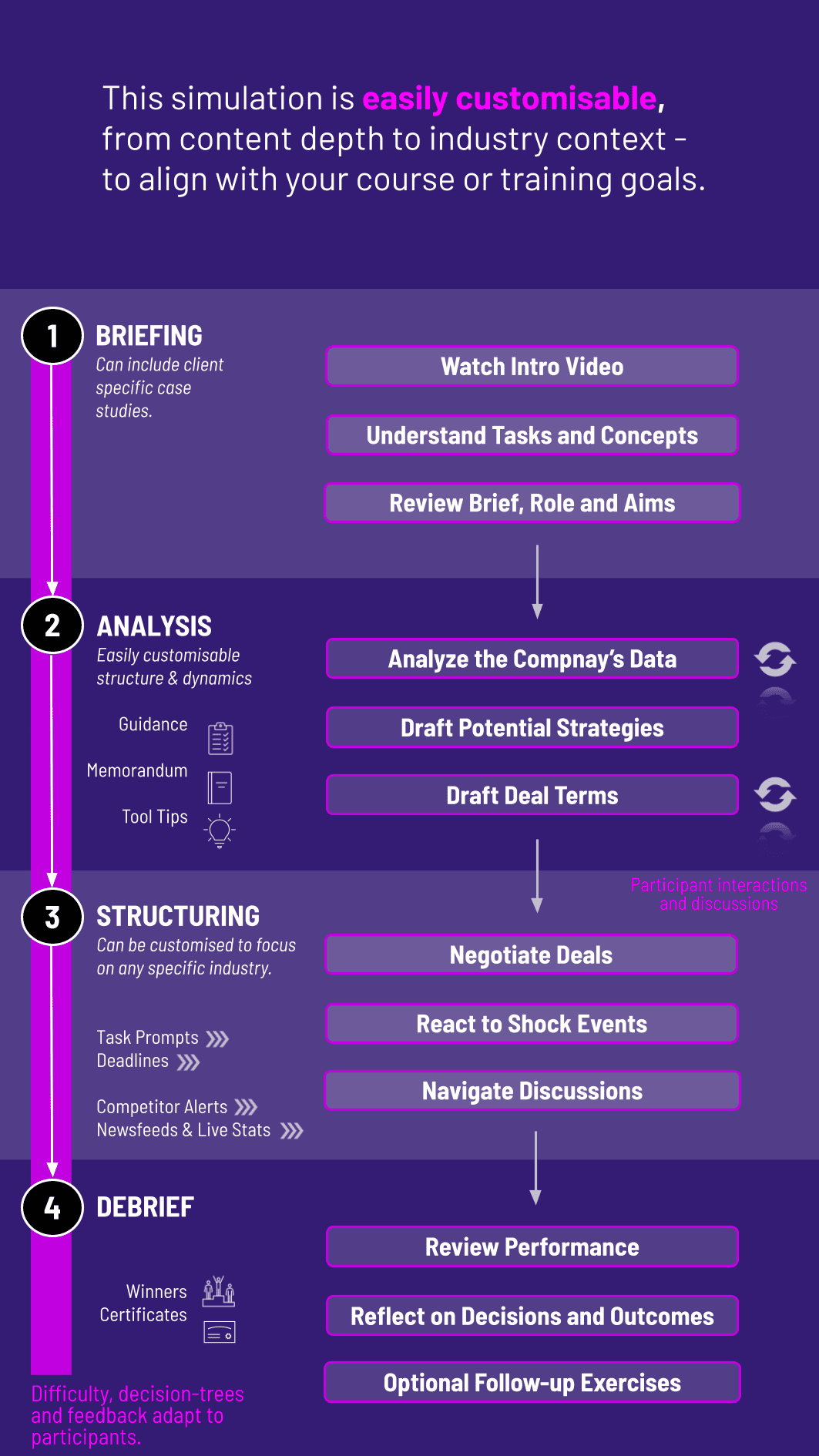

1. Receive a Scenario or Brief Participants are introduced to a company seeking equity financing, with background financials and market context.

2. Analyze the Situation Teams review financial statements, market data, and investor expectations.

3. Make Strategic Decisions Participants choose fundraising strategies, structure deals, and negotiate terms.

4. Collaborate Across Roles Teams may act as entrepreneurs, investors, or advisors, negotiating priorities and deal terms.

5. Communicate Outcomes Participants deliver investor pitches, memos, or deal presentations.

6. Review and Reflect Feedback highlights deal outcomes, negotiation effectiveness, and investor sentiment. Strategies evolve across rounds.

What skills will participants gain? By completing the simulation, participants will develop practical understanding of equity capital markets, enhance valuation and negotiation skills, understand regulatory compliance, and build confidence in making financing decisions under market uncertainty.

Do I need prior finance experience? No prior experience is required. The simulation includes instructional content for all levels.

How long does the simulation run? Typically 3-4 hours, but can be delivered in shorter modules or extended formats.

Is the simulation individual or team-based? It supports both formats and reflects real-world team dynamics.

Are real-world datasets used? Yes, participants work with simulated market data based on historical and real-time financial scenarios.

Can instructors customize the simulation? Absolutely. The focus, deal structures, and industry sectors can be tailored.

Quality of fundraising strategy and pitch

Effectiveness in deal negotiation and structuring

Accuracy of financial modeling and scenario analysis

Clarity and persuasiveness of investor communication

Collaboration and adaptability in team settings

Understanding of regulatory and compliance issues

Integration of ESG considerations

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.