Replicating the complete workflow of a buy-side equity analyst we challenge participants to research companies and make compelling investment recommendations to a portfolio manager.

Financial Statement Analysis

Financial Modeling

Valuation Methodologies (DCF, Comps)

Investment Thesis Development

Industry and Competitive Analysis

Cost of Capital (WACC)

Terminal Value Calculation

Stock Pitching and Communication

In the simulation, participants will:

Conduct fundamental research on an assigned public company and its industry.

Analyze historical financial data and identify key performance drivers.

Build a from-scratch, integrated financial model in Excel to forecast financial statements.

Perform a DCF valuation, a Comparable Company analysis, and a Precedent Transaction analysis.

Synthesize findings to arrive at a target price and a final investment recommendation (Buy/Hold/Sell).

Draft a professional-grade equity research report.

Prepare and deliver a compelling 5-minute stock pitch to a "Portfolio Manager" (instructor or peers).

Defend their thesis under questioning and challenge the theses of their peers.

Execute the end-to-end workflow of a professional equity analyst.

Construct a robust, three-statement integrated financial model from scratch.

Apply core valuation techniques (DCF, Comps, Precedents) to determine a target share price.

Develop a logically sound and evidence-backed investment thesis.

Critique financial models and investment theses for strengths and weaknesses.

Communicate an investment recommendation effectively, both in writing and orally, under pressure.

Interpret the impact of macroeconomic and industry-specific factors on a company's valuation.

1. Company Assignment and Briefing Participants are assigned a fictional publicly-traded company and given access to its financial data, annual reports, and equity research database summaries.

2. Research and Financial Modeling Phase Using provided data and templates, participants conduct their analysis and build their financial models in a controlled platform. The simulation dashboard provides key industry data and competitor information.

3. Valuation and Decision Phase Participants run their valuation models, reconcile the different valuation outputs, and determine their final investment recommendation and target price.

4. Reporting Phase Participants compile their analysis into a standardized equity research report template.

5. Stock Pitch and Defense Participants present their stock pitch in a live session. They are challenged by the instructor (acting as Portfolio Manager) and peers, simulating a real investment committee meeting.

6. Debrief and Feedback Instructors provide personalized feedback on the financial model, research report, and pitch performance, highlighting areas of excellence and improvement.

What is the main goal of the Equity Analyst Simulation? The main goal is to provide a realistic, end-to-end experience of an equity analyst's role, from financial modeling and valuation to crafting and defending a compelling investment thesis, thereby bridging the gap between academic finance and a career in asset management.

Who is the ideal participant for this simulation? This simulation is ideal for MBA students, advanced undergraduate finance majors, career-changers, and finance professionals looking to transition into roles in equity research, asset management, or hedge funds.

What kind of companies will we be analyzing? The simulation typically uses well-known, non-financial public companies (from technology, consumer goods, or industrial sectors) with sufficient public data and a clear narrative, making them ideal for fundamental analysis.

How long does the simulation typically last? The simulation can be run as an intensive 2-3 day workshop or extended over a 5-to-8-week academic module, depending on the depth of analysis and the time allocated for each phase.

Is this simulation more focused on modeling or soft skills? It is a 50/50 balance. Technical financial modeling and valuation skills form the core of the analysis, but the ability to synthesize that analysis into a clear, persuasive story during the stock pitch is equally critical for success.

How does this simulation help with investment banking interviews? It is extremely beneficial. Technical questions on DCF modeling, valuation, and financial statement analysis are core to both equity research and investment banking interviews. The experience of building a model and pitching a stock provides powerful "talk-through" examples for behavioral questions.

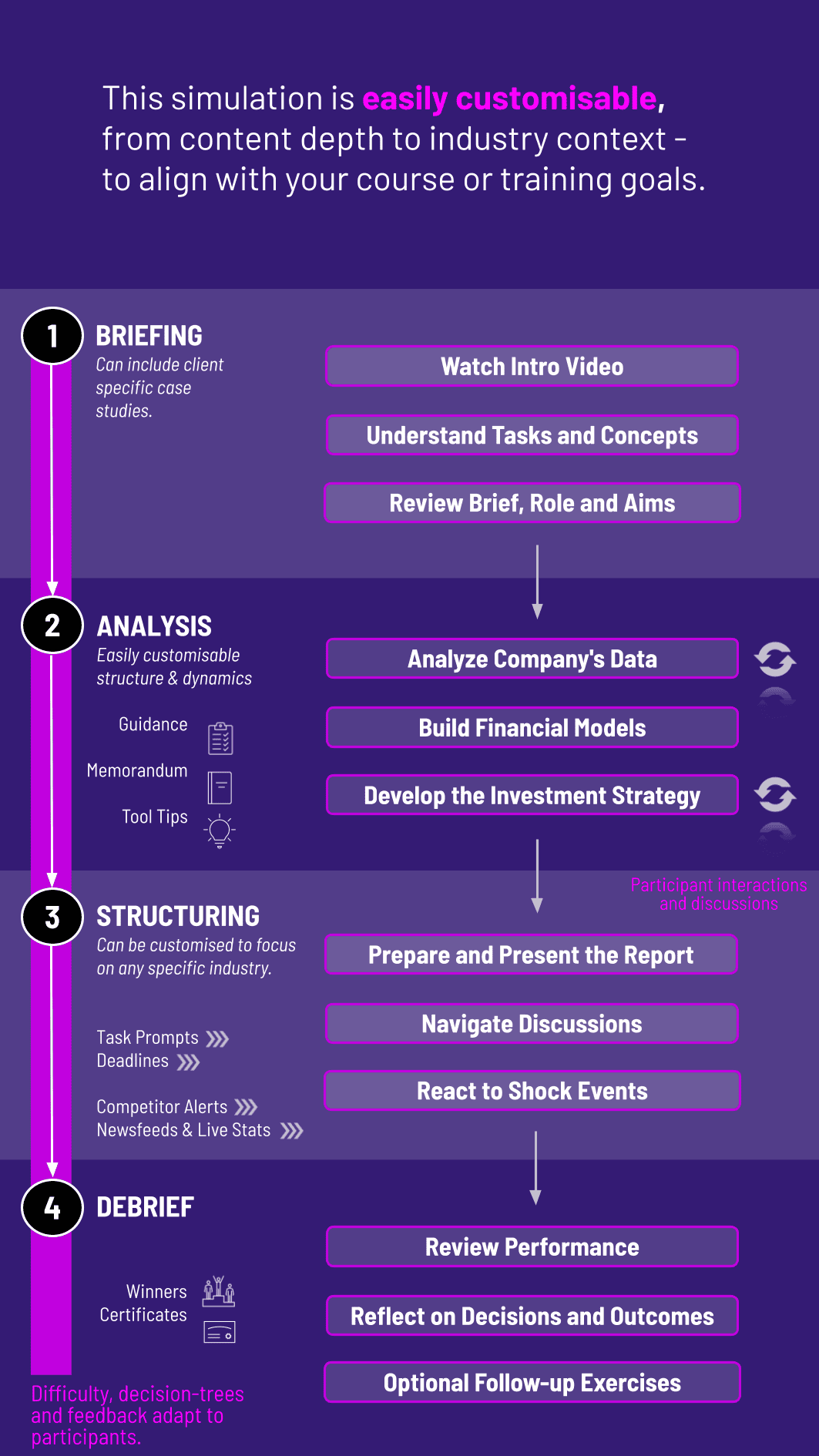

Can this simulation be customized for a corporate training program? Absolutely. We can customize the simulation to focus on specific sectors (TMT, Healthcare), tailor the companies analyzed to be relevant to your firm's coverage, or adjust the complexity to suit the experience level of the participants.

Accuracy and integrity of the three-statement model.

Logical and defensible forecasting assumptions.

Correct implementation of DCF and other valuation methodologies.

Clarity, structure, and executive summary.

Strength of the investment thesis and supporting evidence.

Professional presentation and clarity of writing.

Persuasiveness, confidence, and clarity of the oral presentation.

Ability to handle challenging questions and defend the thesis.

Time management and professional demeanor.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.