Master the Art of Funding and Scaling a High-Growth Venture and step into the high-stakes world of a startup founder. Make critical financial decisions to secure funding, manage burn rate, and scale the venture toward a successful exit.

Venture Capital Cycle

Financial Modeling and Valuation

Capitalization Table Management

Term Sheets and Deal Structuring

Burn Rate and Runway Management

Pitching to Investors

Convertible Notes and SAFE Agreements

Liquidation Preferences

Due Diligence

Exit Strategies

In the simulation, participants will:

Build a dynamic model projecting revenue, expenses, and cash flow.

Create and refine a compelling pitch deck to attract investors.

Engage in live negotiations with angel investors and venture capital firms, debating valuation and terms.

Allocate resources across R&D, Marketing, and Talent Acquisition to hit key performance indicators.

Evaluate and negotiate the fine print, including liquidation preferences and board control.

Manage ownership stake through multiple funding rounds.

Pitch in a competitive environment where only the most convincing teams secure capital.

Determine the optimal timing and strategy for a merger, acquisition, or public offering.

Understand the complete lifecycle of venture funding, from seed to exit.

Construct a basic financial model for a high-growth startup and calculate its valuation using accepted methodologies.

Interpret and negotiate key clauses in a venture capital term sheet.

Manage a company’s cap table and understand the impact of dilution through funding rounds.

Articulate a compelling investment thesis and business case to potential investors.

Analyze the critical trade-offs between burn rate, growth, and runway.

Evaluate different exit strategies and their financial implications for founders and investors.

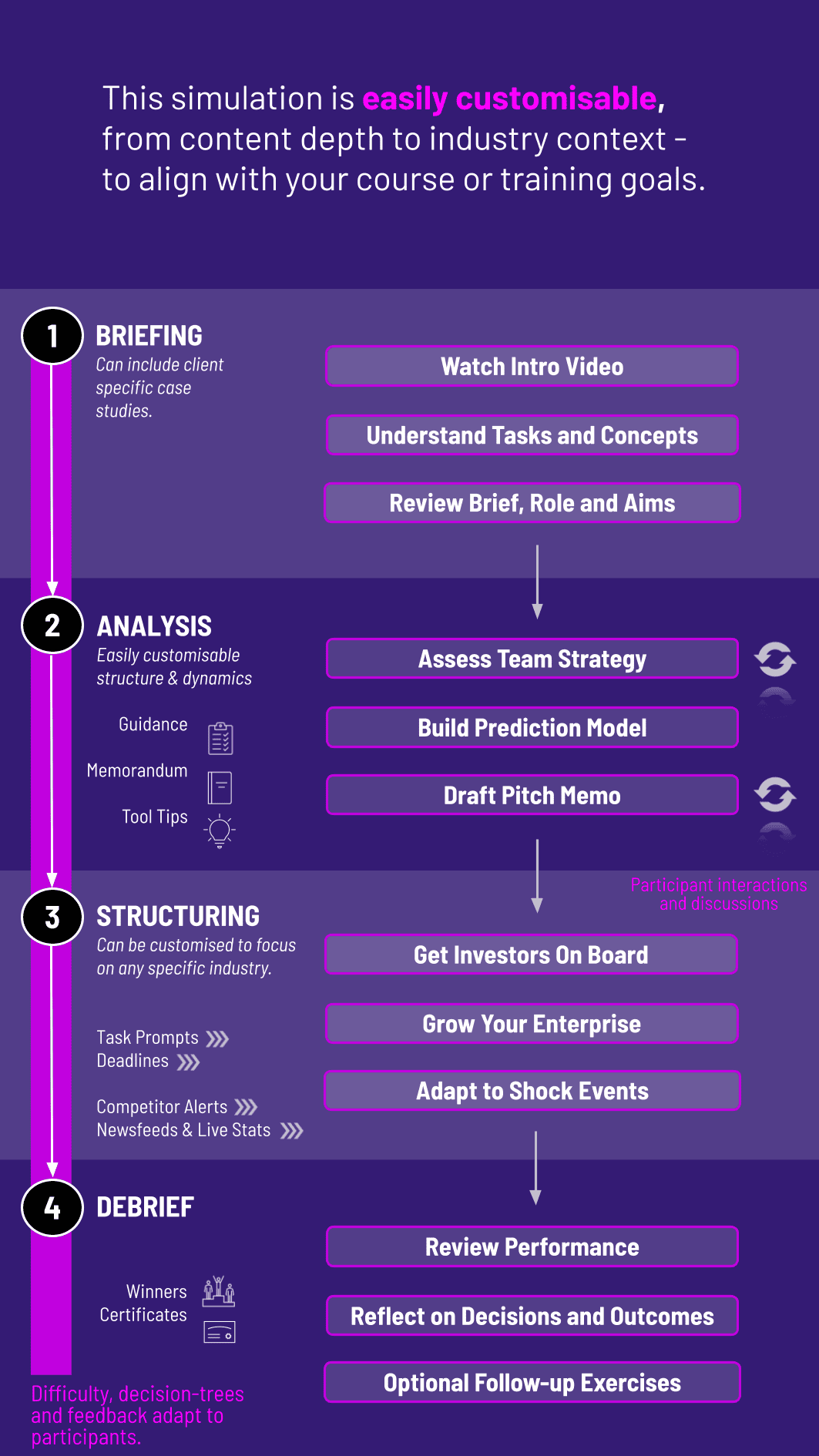

1. Team Formation and Briefing Participants are divided into startup founder teams and receive their initial company profile, including technology, market data, and seed capital.

2. Strategy Development Teams analyze their position, build their financial model, and prepare their initial pitch deck for the Seed Round.

3. Funding Teams pitch to Angel Investors (played by instructors or other participants). They receive initial funding, often via convertible notes.After operating their company for several simulated quarters—making strategic decisions that impact their KPIs and valuation—teams pitch to Venture Capitalists. Negotiations are more complex, focusing on valuation and term sheet details.

4. Operations and Decision-Making Between rounds, teams make strategic decisions on how to spend their capital to increase company value, constantly monitored by their burn rate.

5. The Exit The simulation culminates in an exit event. The company with the strongest position may go public, while others may be acquired. Final wealth is calculated based on ownership percentage and exit valuation.

Do I need a finance background to participate? While helpful, a deep finance background is not required. The simulation is designed to be accessible, teaching core concepts as you go. It provides a practical application for those with foundational business knowledge.

Is this a competition? Yes. Teams compete against each other to build the most valuable company and secure funding from a limited pool of investor capital. This competitive element mirrors the real-world environment for startups.

What is the duration of the simulation? Programs can be customized, but a typical format is a one-day intensive workshop or spread over several weekly sessions for university courses.

How is the simulation delivered? It can be run in-person with physical materials and live negotiation, or virtually through a dedicated platform with video conferencing for pitches.

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.