The global energy sector is undergoing a seismic shift, driven by the dual forces of climate imperatives and technological disruption. For finance professionals, this presents a complex and high-stakes landscape of opportunities and risks.

Project Finance Fundamentals

Financial Modeling and Valuation

Energy-Specific Metrics

Risk Analysis and Mitigation

Capital Raising

The Energy Transition

Due Diligence

Portfolio Management

In the simulation, participants will:

Conduct due diligence on a variety of project proposals, from utility-scale solar to natural gas peaker plants.

Construct and stress-test project finance models in Excel or a simulation interface, calculating key metrics like IRR and NPV.

Negotiate and structure the optimal mix of senior debt, mezzanine financing, and equity to fund projects.

React to randomized market events, including policy shifts, technology cost breakthroughs, and commodity price shocks.

Defend investment decisions and funding proposals based on rigorous financial and strategic analysis.

Track the performance of the funded projects, making strategic decisions on asset optimization or divestment.

Analyze the financial viability of diverse energy projects using industry-standard metrics.

Construct a robust project finance model to evaluate capital structure and returns.

Evaluate the major risks inherent in energy investments and propose mitigation strategies.

Differentiate the financial drivers and risk profiles of renewable vs. conventional energy assets.

Synthesize market data, policy trends, and financial analysis to make strategic capital allocation decisions.

Communicate investment recommendations persuasively to stakeholders and senior management.

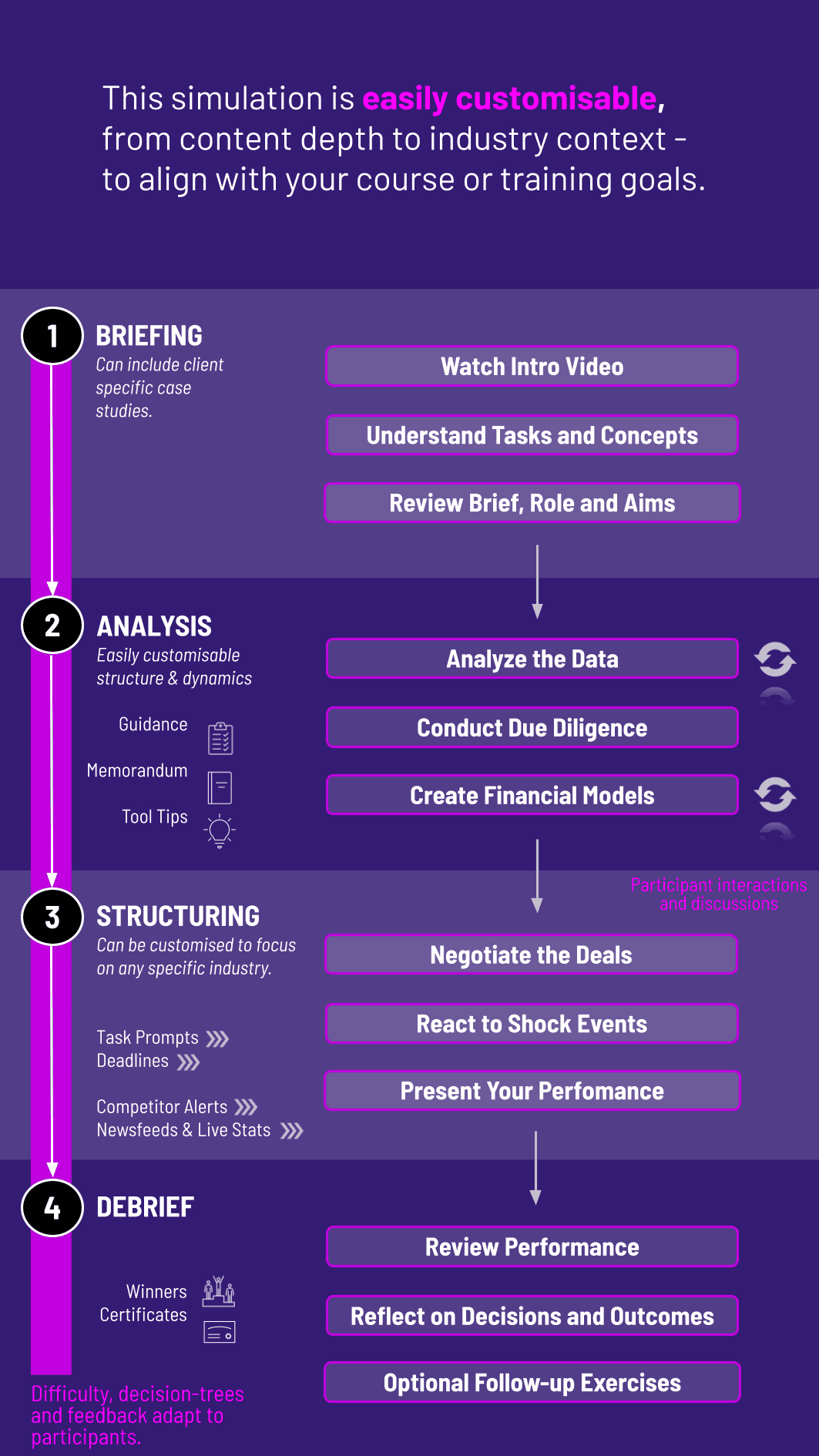

1. Introduction and Training Participants are introduced to the simulation platform and the core principles of energy project finance through guided tutorials

2. Deal Sourcing and Analysis Each round, teams are presented with a new set of investment opportunities. They must analyze project dossiers, market data, and build financial models to assess each deal's risk/return profile.

3. Capital Raising and Deal Structuring Teams decide which projects to bid on and must then structure the financing. This involves negotiating with "banks" for debt and allocating their own "equity" capital efficiently.

4. Market Events and Portfolio Management After funding, each round is advanced in time. Random market events are triggered, impacting project cash flows. Teams must manage their growing portfolio, deciding whether to hold, refinance, or sell assets.

5. Reporting and Debrief Teams report on their portfolio performance. A comprehensive debrief session led by the instructor connects the simulation experience to real-world energy finance concepts, highlighting best practices and common pitfalls.

What are the technical requirements? The simulation is 100% web-based and runs on any modern browser (Chrome, Safari, Firefox) with an internet connection. No special software is required.

Do I need prior experience in finance? No prior experience is necessary. The simulation includes foundational learning modules and is designed to build competency from the ground up.

How long does the simulation take to complete? The core simulation can be completed in 2-4 hours, but additional optional deals and advanced modules can extend the experience.

Is this simulation focused only on renewable energy? No. A key learning objective is to understand the entire energy landscape. Participants will evaluate both conventional (oil, gas) and renewable (wind, solar, storage) projects, forcing them to make strategic trade-offs.

Can this simulation be customized for our corporate training program? Absolutely. We can tailor project examples, market parameters, and learning objectives to align with your company's specific focus areas, such as renewables development, oil and gas investment, or utility finance.

Profitability Score

Risk Management Index

Compliance and Accuracy Score

Portfolio Performance

Financial Model Accuracy and Rigor

Investment Committee Presentation

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.