Master the Human Dynamics of High-Stakes Finance. While technical prowess in financial modeling, valuation, and market analysis is the foundation of a finance career, it is often Emotional Intelligence that separates top performers from the rest.

Emotional Intelligence Framework

Stakeholder Management

Negotiation Psychology

Influence and Persuasion

Managing Stress and Pressure

Giving and Receiving Difficult Feedback

Conflict Resolution

Non-Verbal Communication

In the simulation, participants will:

Assume roles such as Investment Banker, Hedge Fund Manager, CEO, or Venture Capitalist, each with distinct emotional drivers and pressures.

Progress through a dynamic narrative, such as a deal negotiation, where each interaction impacts the next.

Interpret in-simulation feedback on their counterpart's emotional state and their own behavioral impact.

Choose how to respond to provocations, setbacks, and opportunities, weighing both the financial and relational consequences.

Work within teams and across the table to build trust and alignment.

Identify their own emotional triggers and default behaviors under stress.

Apply a structured EQ framework to analyze and manage complex interpersonal dynamics.

Demonstrate enhanced empathy by accurately assessing the motivations and concerns of clients and counterparts.

Execute negotiation and persuasion strategies that leverage emotional intelligence for better financial terms.

Develop strategies for building stronger, more trusting client and team relationships.

Articulate the direct link between emotional intelligence and key financial outcomes like deal success, client retention, and team performance.

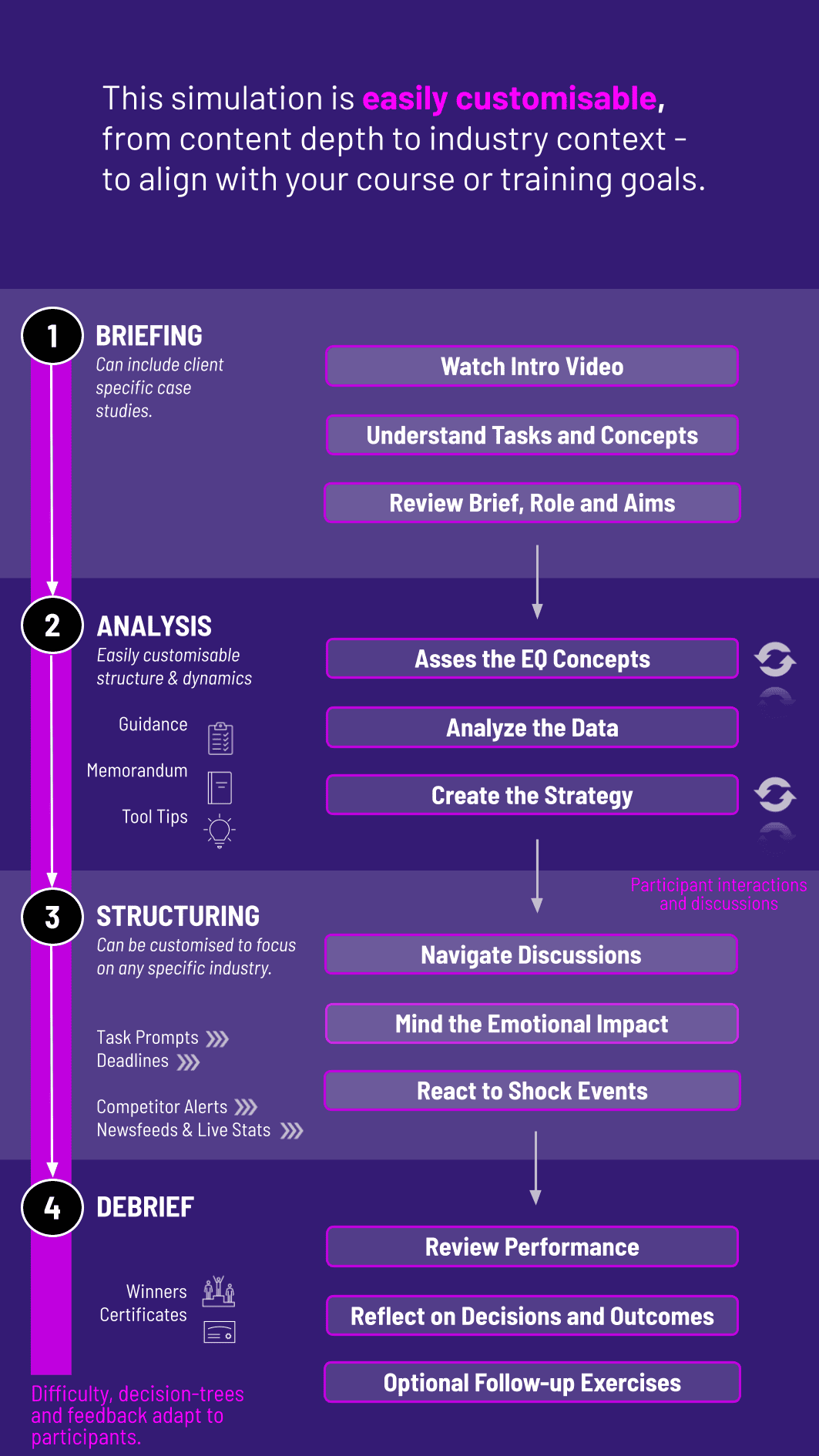

1. Introduction and Briefing Participants are introduced to the core EQ concepts and their specific role, objectives, and background for the scenario.

2. Scenario Launch The simulation begins, presenting participants with a realistic financial challenge (a contentious M&A term sheet negotiation, a distressed asset sale).

3. Interactive Rounds The simulation unfolds in a series of timed rounds. In each round, participants interact with other participants, making dialogue and strategic choices.

4. Real-Time Feedback The simulation provides feedback on the emotional impact of their choices, the trust level with their counterpart, and the progression toward their financial goals.

5. Consequence and Progression Choices have direct consequences, altering the negotiation landscape, changing the other party's willingness to deal, and impacting the final terms.

What is Emotional Intelligence and why is it important in finance? EQ is the ability to understand and manage your own emotions, and to recognize and influence the emotions of others. In finance, it's crucial for negotiating deals, managing client relationships, leading teams, and making clear-headed decisions under extreme pressure.

Is this simulation suitable for participants without a finance background? Absolutely. While the context is finance, the core skills taught are universal. The simulation is designed to be accessible, focusing on the interpersonal dynamics rather than complex financial modeling.

How is EQ measured and assessed within the simulation? Participants are assessed through their in-game choices and their outcomes. The simulation tracks metrics like trust-building, deal terms achieved, and the ability to de-escalate conflict. The primary assessment comes from the reflective debrief, not a numerical "EQ score."

What kind of scenarios are used in the simulation? We use high-stakes finance scenarios like M&A negotiations, capital raising, managing a portfolio crisis, and client retention meetings, where interpersonal dynamics are critical to success.

Can this simulation be run for teams? Yes, it is highly effective for teams. It helps teams understand their collective communication patterns, improve collaboration under stress, and develop a shared language for emotional intelligence.

How long does the simulation take to complete? A typical workshop, including the briefing, simulation rounds, and a thorough debrief, can be run as a 3-4 hour session or a full-day immersive experience, depending on learning objectives.

Do you provide materials for facilitators? Yes, we provide a comprehensive facilitator's guide, slide decks for briefing and debriefing, and all necessary technical support to ensure a seamless learning experience.

How does this simulation integrate with traditional finance training? It is the perfect complement. While traditional training teaches the "hard" technical skills (the "what"), this simulation teaches the "soft" execution skills (the "how"). Together, they create a complete and highly effective finance professional.

Achievement of stated financial and relational goals.

Consistency in building trust and rapport with counterparts.

Effectiveness in navigating conflict and overcoming impasses.

Facilitator-led discussion analyzing key decision points.

Participant self-assessment of their emotional awareness and strategic choices.

Peer feedback on collaboration and influence within team-based scenarios.

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.