In this hands-on simulation, participants act as senior finance professionals navigating earnings targets, accounting judgment calls, and ethical boundaries - exploring how financial decisions impact credibility, compliance, and stakeholder trust.

Earnings Smoothing and Revenue Timing

Discretionary Accruals and Provisions

Accounting Policy Choices and Justifications

Internal Controls and Governance Constraints

Auditor and Regulator Response

Market Reactions and Investor Calls

Ethical Dilemmas in Reporting

Consequences of Overreach or Manipulation

Long-term vs. Short-term Shareholder Strategy

Review quarterly financials and upcoming earnings calls

Make judgment-based decisions about accounting treatments

Weigh the impact of choices on KPIs, analyst expectations, and audit flags

Respond to market events, competitor earnings, and board pressure

Draft internal memos explaining or justifying accounting decisions

Navigate interactions with the CFO, CEO, board, and external auditors

By the end of the simulation, participants will:

Understand the techniques and motivations behind earnings management

Identify red flags and risk factors in earnings manipulation

Develop confidence navigating accounting choices under pressure

Reflect on ethical boundaries in corporate reporting

Experience the trade-offs between transparency, ambition, and compliance

Communicate accounting rationale to internal and external stakeholders

Gain insight into auditor dynamics and regulatory scrutiny

Strengthen their ability to defend or challenge earnings decisions

Build storytelling skills around financial results

Recognize how reputation, investor trust, and long-term value intersect

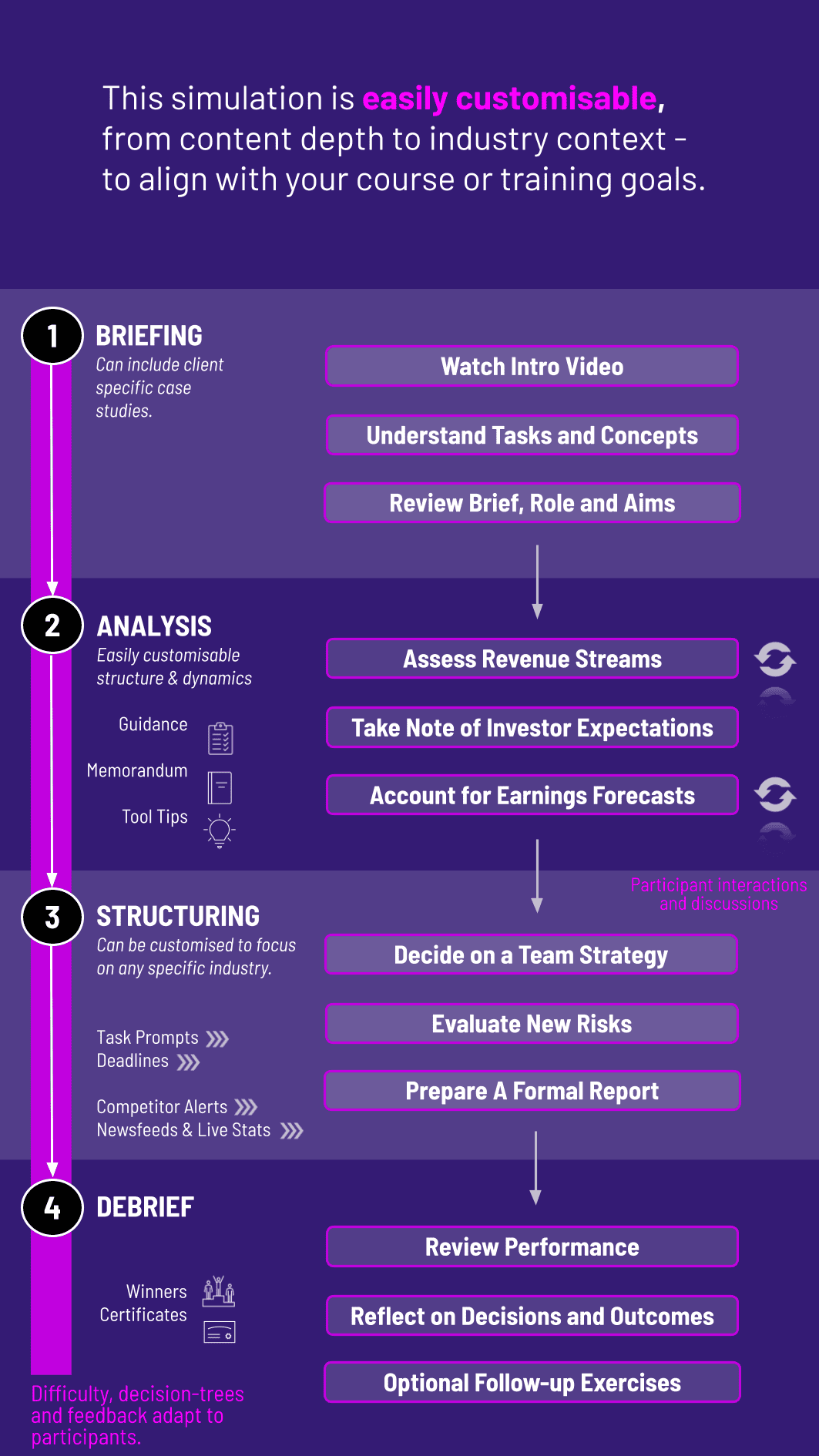

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

This simulation is adaptable to individual or team formats and is suitable for academic, onboarding, or professional development settings. Each round simulates a financial quarter, with escalating pressure and complexity.

1. Receive a Scenario or Brief: Each round opens with a quarterly business update, financial target, and internal pressure point. Participants review context, past earnings, and market expectations.

2. Analyse the Situation: Participants examine financials, earnings forecasts, and accounting options. They assess legal, reputational, and financial consequences of possible reporting decisions.

3. Make Decisions in the Simulation Interface: Participants choose how to treat revenues, costs, provisions, and disclosures. These choices impact reported EPS, audit risk, and long-term trust metrics.

4. Individual or Team Interactions: In team setups, roles may include CFO, Controller, Investor Relations, or Audit Liaison. Participants must agree on an approach and defend it internally.

5. Review Results and Reflect: After each round, participants receive feedback on stock price impact, audit concerns, and stakeholder sentiment. This drives group discussion and ethical reflection.

6. Repeat the Cycle: Subsequent rounds introduce new challenges - missed sales, auditor scrutiny, whistleblower alerts, or activist investor questions - forcing evolution in strategy and ethics.

Do participants need prior accounting experience? A basic understanding of financial statements is helpful, but the simulation includes enough guidance to support learners from varied backgrounds.

Is this a team or individual simulation? It can be run in both formats. Team play encourages role debate and ethical reasoning; individual play focuses on personal judgment and reflection.

How do you simulate earnings management in a game? Participants face real-world accounting choices - like revenue timing or provisioning—and must decide whether to stay within the rules or push boundaries under pressure.

Does the simulation include ethical dilemmas? Yes. Learners are challenged with ambiguous scenarios where the “right” answer isn’t always clear, helping build ethical reasoning under pressure.

Is this simulation suitable for corporate training? Absolutely. It’s highly relevant for finance teams, compliance officers, and future leaders facing real pressures around earnings communication and financial reporting.

What metrics are used to evaluate performance? Performance can be evaluated on financial accuracy, consistency, stakeholder trust, ethical awareness, and the ability to justify choices clearly.

Can we customise the complexity or scenarios? Yes. The simulation is modular and can be tailored for undergraduate students, MBAs, or professionals in banking, audit, or corporate finance roles.

Does it cover regulations like GAAP/IFRS? It introduces these frameworks contextually but avoids getting bogged down in technicalities—focusing instead on the judgment areas they leave open.

How long does the simulation take to run? It can be delivered in a short 2 - 3 hour session or stretched across multiple rounds in longer programs, depending on your learning goals.

How is it different from a regular accounting exercise? Unlike static case studies, this simulation creates evolving pressures, introduces stakeholder reactions, and tracks how decision-making impacts outcomes round-by-round.

Accuracy and transparency of reporting decisions

Risk exposure created by accounting choices

Communication skills in stakeholder contexts

Ethical reasoning and boundary awareness

Peer and self-assessment reflections

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.