This immersive simulation places participants in the role of a Private Equity firm analyzing a portfolio company to execute a dividend recapitalization. Master the Art of Leveraging Portfolio Companies for Shareholder Returns.

Dividend Recapitalization Mechanics

Leveraged Finance and Debt Structuring

Capital Structure Optimization

Leveraged Buyout Model Refresher

Debt Covenants and Credit Agreements

Credit Ratios

Free Cash Flow Analysis

Private Equity Portfolio Strategy

Risk-Return Trade-off

Financial Distress and Solvency Analysis

In the simulation, participants will:

Analyze the historical and projected financials of your portfolio company.

Structure a new debt package, choosing between senior loans, high-yield bonds, and unitranche facilities.

Model the pro-forma impact of the recapitalization on the company's balance sheet and income statement.

Calculate and stress-test key credit ratios and debt covenants post-transaction.

Assess the return profile for the private equity fund and the impact on the holding's IRR.

Evaluate the risks of increased leverage, including sensitivity to economic downturns and interest rate hikes.

Prepare and present a final investment memorandum to the "Investment Committee" (instructors or peers) justifying the decision to proceed or abstain.

Explain the strategic rationale and potential pitfalls of a dividend recapitalization from both the private equity and portfolio company perspectives.

Structure a dividend recap transaction, selecting appropriate debt instruments and sizing the dividend.

Build a dynamic financial model to project the pro-forma impact of a recap on a company's financial health.

Interpret debt covenants and analyze a company's ability to comply with them under various scenarios.

Quantify the return impact for equity sponsors and assess the risk-return profile of the transaction.

Synthesize complex financial data into a coherent recommendation for key stakeholders.

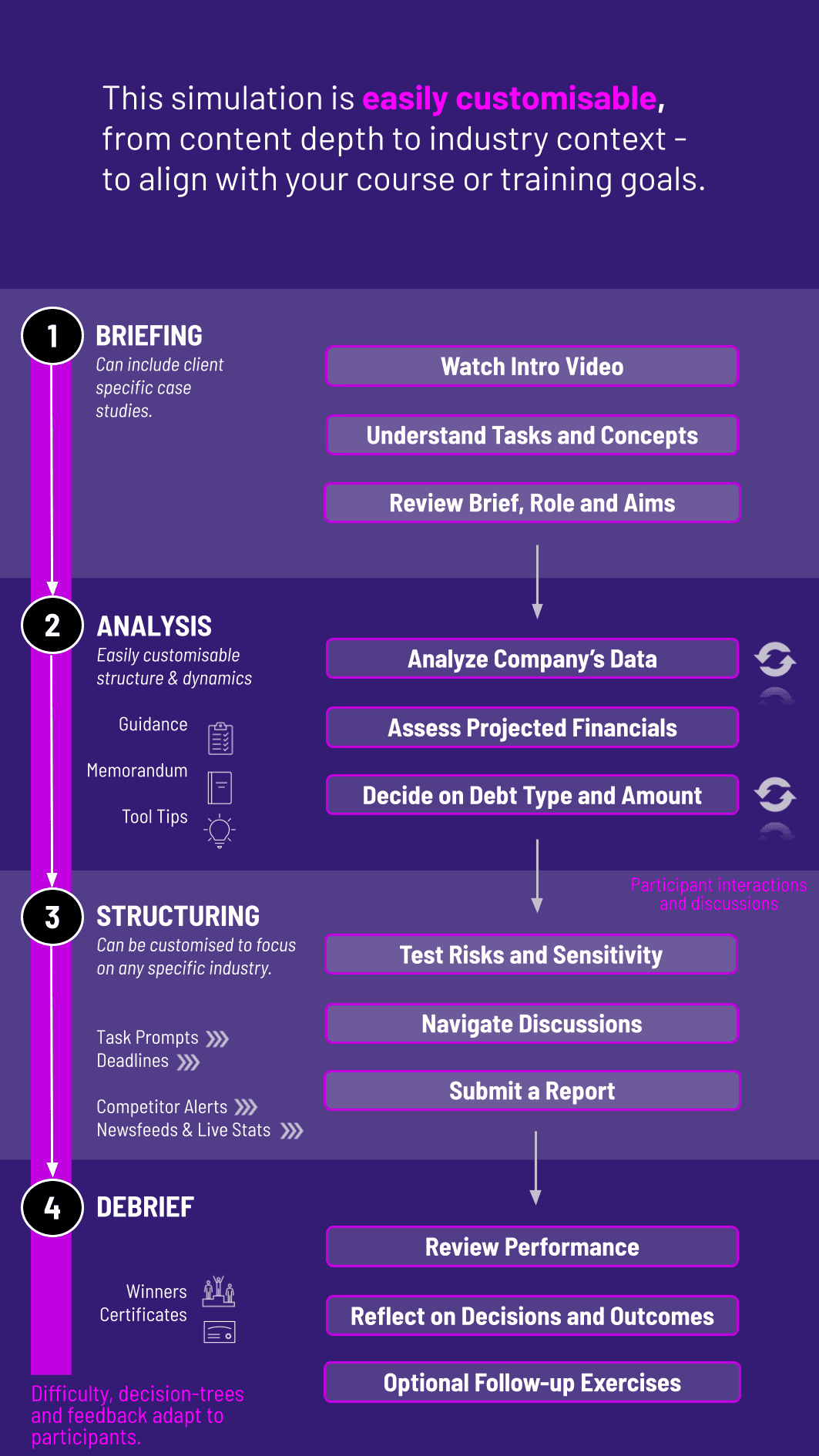

1. Introduction and Case Brief Participants receive the case study for your portfolio company, including its business model, historical financials, and the Private Equity fund's investment thesis.

2. Financial Analysis Using the provided simulation dashboard and models, participants analyze the company's current cash flow generation and debt capacity.

3. Transaction Structuring Participants choose the type and amount of debt to issue. The simulation platform provides real-time feedback on the resulting credit metrics.

4. Pro-Forma Modeling Participants run the transaction model to see the immediate and projected effects. This includes calculating the new leverage ratio, interest coverage, and the size of the dividend payout.

5. Risk and Sensitivity Analysis Participants test their proposed structure against various "what-if" scenarios, such as a 10% revenue decline or a 200-basis-point interest rate increase.

6. Final Recommendation Participants submit a detailed report or presentation outlining their analysis, proposed transaction structure, and a final "Go / No-Go" decision.

What is a dividend recapitalization in simple terms? It's a strategy where a company borrows money specifically to pay a large cash dividend to its owners (like a Private Equity firm), effectively taking cash out of the company using debt.

Who should take this Dividend Recapitalization Simulation? This simulation is ideal for finance MBA students, aspiring investment bankers (especially in leveraged finance and financial sponsors), private equity analysts, and corporate finance professionals looking to deepen their understanding of advanced capital structuring.

What prerequisites are needed for this simulation? Participants should have a foundational understanding of corporate finance, financial accounting (reading financial statements), and basic financial modeling. Familiarity with the concepts of Leveraged Buyouts (LBOs) is helpful but not mandatory.

Is this a technical, hands-on simulation? Yes. While the platform is user-friendly, the core of the simulation involves hands-on financial analysis, debt structuring, and modeling in a dynamic, case-based environment.

How does this simulation differ from a standard LBO simulation? While an LBO simulation focuses on the acquisition of a company, this simulation focuses on a mid-cycle portfolio management decision. It delves deeper into credit analysis, debt covenants, and the specific risks of increasing leverage on an already-owned asset.

What kind of debt instruments will we be working with? The simulation introduces participants to key instruments used in recaps, including Senior Secured Term Loans, High-Yield Bonds, and Unitranche Debt, each with its own cost and covenant profile.

How long does it take to complete the simulation? The core simulation can be completed in an intensive 3-4 hour session. For academic use, it is typically structured as a week-long module with preparatory readings and a final debrief.

Can this simulation be customized for our corporate training program? Absolutely. We offer extensive customization options, including tailoring the case company to your industry, adjusting the financial complexity, and integrating your firm's specific analysis frameworks.

Correct structuring of the transaction and accurate pro-forma financial projections.

Depth of analysis on leverage, coverage ratios, and covenant compliance under base and stress cases.

Clarity and strength of the argument for or against the recapitalization, linking financial data to strategic implications.

Identification and quantification of key risks associated with the increased debt load.

Professionalism, clarity, and defensibility of the final investment memorandum or presentation.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.