In this hands-on Dividend Policy Course, participants act as corporate finance leaders responsible for adapting a company’s dividend strategy responding to pressures from investors, cash flow dynamics, and strategic opportunities.

Dividend Policy Types: Residual, stable, constant payout, hybrid

Shareholder Expectations: Institutional vs. retail investors

Signaling Effect: How dividend changes influence market perception

Cash Flow Management: Balancing liquidity with long-term investment

Alternative Payouts: Buybacks, special dividends, retained earnings

Tax and Regulatory Impact: Jurisdictional considerations and dividend taxation

Investor Relations: Framing dividend decisions to the market

Lifecycle Considerations: Growth phase vs. mature company dividend strategy

Analyze quarterly earnings and cash flows

Review capital expenditure and debt obligations

Choose between dividend options: increase, decrease, suspend, or maintain

Consider issuing share buybacks as an alternative

Evaluate the long-term financial sustainability of their policy

Monitor investor sentiment and stock price reactions

Justify decisions to the board, analysts, and shareholders

Adapt to external shocks such as recession, litigation, or windfall profits

Each round brings new data and context, pushing participants to re-evaluate and iterate their strategy.

By the end of the course, participants will:

Understand how dividend policies are formed and evolve

Evaluate the trade-offs between investor expectations and capital needs

Respond to market sentiment and communicate policy decisions effectively

Analyze financials to determine feasible and sustainable payouts

Consider tax and signaling implications of payout decisions

Explore the lifecycle of a firm and its dividend policy alignment

Justify dividend actions to multiple stakeholders with different goals

Navigate external pressure from activist investors or analysts

The course is ideal for students studying corporate finance, investor relations, or capital markets - and for early-career professionals preparing for real-world financial decision-making.

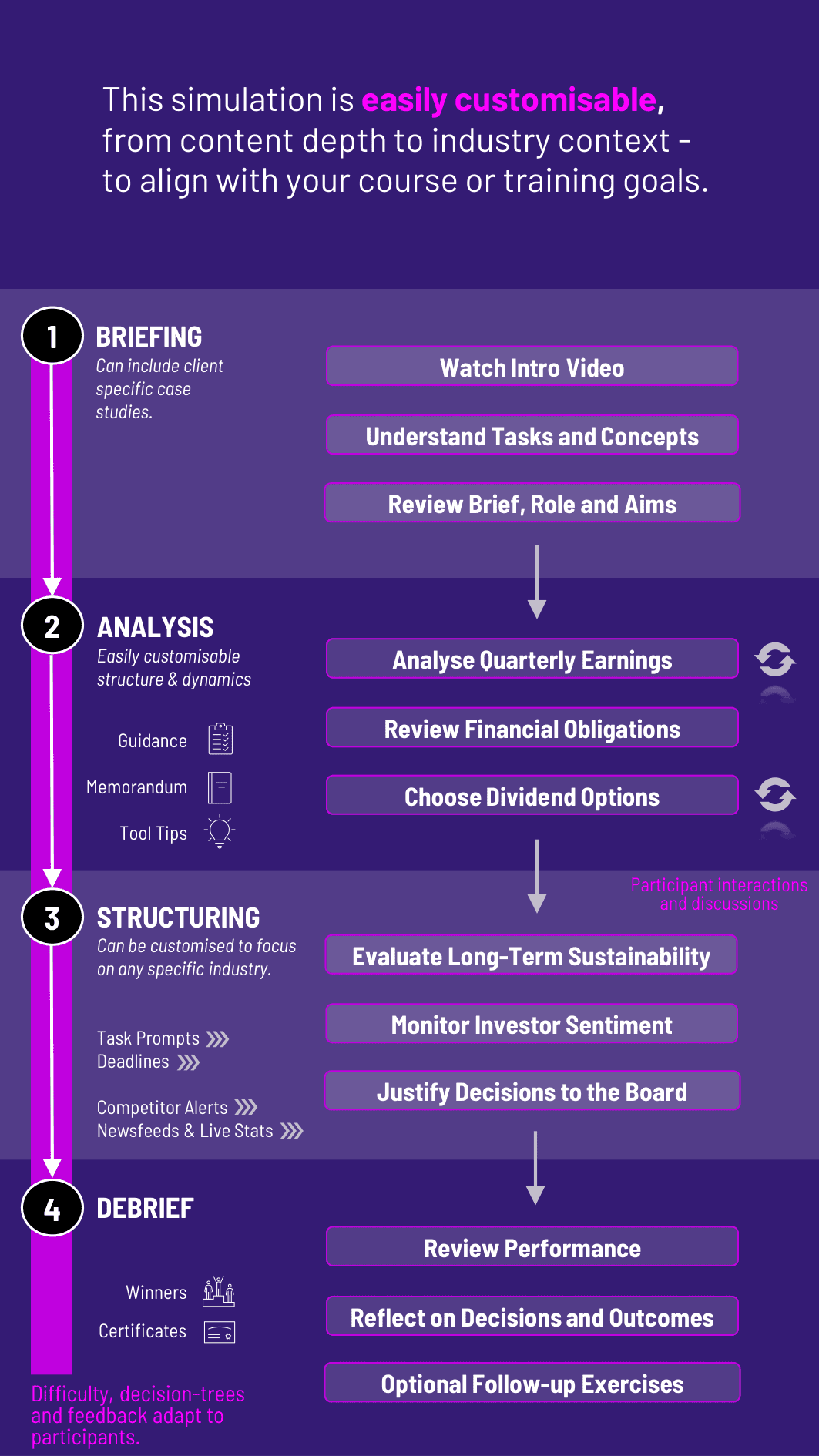

1. Review Company Performance Participants receive financial statements, strategic priorities, and capital forecasts.

2. Choose a Dividend Strategy They select a policy approach or make specific dividend payout decisions for the quarter.

3. Model Financial Implications Participants analyze cash flow impacts, debt capacity, and reinvestment trade-offs.

4. Monitor Stakeholder Reactions Market feedback, shareholder sentiment, and analyst coverage reflect the results of their actions.

5. Communicate Decisions Participants write or present a rationale for their decisions to the board, investors, or the media.

6. Adapt Over Time New events (e.g. macro shocks, profit windfalls, investment opportunities) change the game in future rounds.

Do participants need prior finance knowledge? A basic understanding of cash flow and capital structure is helpful but not mandatory.

Does the course include tax impacts? Yes. Scenarios can include dividend tax regimes and investor type differences.

Can this be run for corporate finance workshops and courses? Yes. It’s ideal for both academic and professional settings.

Does it simulate real-time market reaction? Yes. Participants see changes in investor sentiment, share price, and stakeholder commentary.

Are share buybacks included? Yes. Participants may choose to distribute capital via buybacks instead of dividends.

How long does the course last? It can be delivered as a 2 - 3 hour session or spread over several modules for deeper analysis.

Is it based on real companies? Scenarios are fictional but modeled closely on real industry situations and financial dynamics.

Is the course team-based? It can be. Teams may act as finance teams advising the CFO or presenting to the board.

Can we change sectors? Yes. The course can be tailored to sectors like energy, consumer goods, or tech.

Is communication assessed? Yes. Participants are evaluated on clarity, strategy alignment, and stakeholder handling in presentations or memos.

Strategic alignment of dividend decisions

Financial accuracy and sustainability

Adaptability to changing business contexts

Communication to internal and external stakeholders

Balancing short-term pressure with long-term goals

Team collaboration and stakeholder negotiation

Deliverables may include policy memos, board presentations, or post-training debriefs. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the course to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.