Navigate the trade-offs between dividends, buybacks, and reinvestment to maximize firm value and signal strength in a competitive market.

Dividend Irrelevance Theory vs. Real-World Market Imperfections

Signalling Theory and Clientele Effects

Cash Flow Analysis and Payout Sustainability

Share Repurchase Methods

Impact on Earnings Per Share and Return on Equity

Tax Considerations

Stock Valuation Models in the context of payout policy

Agency Costs of Free Cash Flow

Capital Structure Interaction

In the simulation, participants will:

Assess company cash flows, earnings stability, growth opportunities, and current leverage.

Decide on a regular dividend, special dividend, or initiate/suspend a share repurchase program.

Determine the timing and size of open market repurchases or structure a tender offer.

Craft the communication strategy for each policy change.

Respond to economic downturns, activist investor pressure, or surprise competitor actions.

Evaluate stock price reaction, shareholder yield, and relative performance against peer companies in the simulation.

Evaluate a company’s financial capacity for shareholder payouts.

Design a dividend policy aligned with corporate strategy and investor expectations.

Structure a share repurchase program and understand its mechanical and strategic effects.

Articulate the market signalling implications of different payout decisions.

Analyze the trade-offs between returning cash to shareholders and funding internal investments.

Understand how payout policy interacts with capital structure and cost of capital.

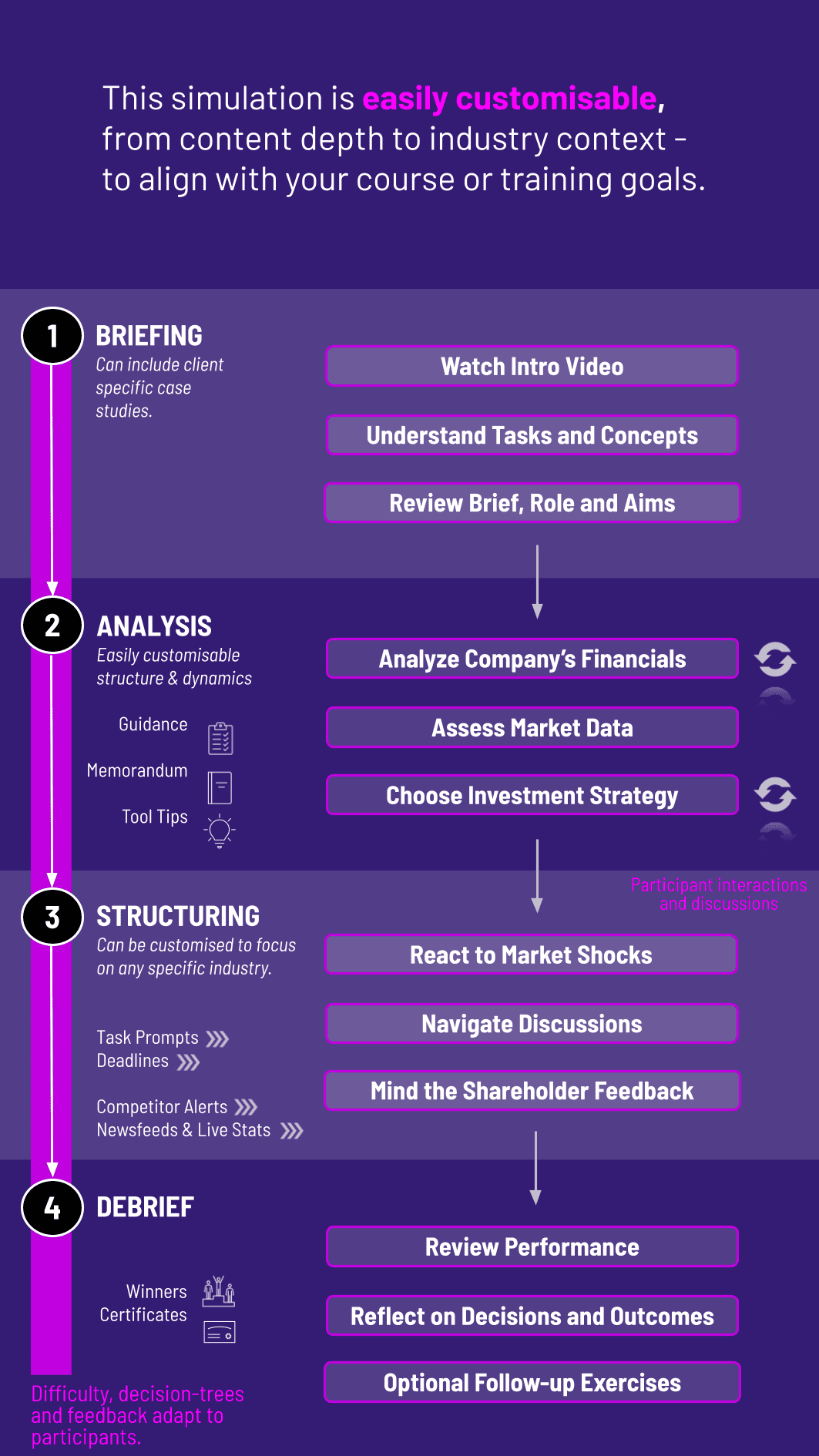

1. Analysis Phase Teams review their performance, cash position, investment pipeline, and market conditions.

2. Decision Phase Teams submit their capital allocation decisions: dividend declarations, repurchase authorizations and amounts, and any strategic communication notes.

3. Simulation Engine Processing The simulation engine calculates the financial and market impact, modeling changes to share count, financial ratios, and investor sentiment.

4. Results and Feedback Teams see their updated stock price, analyst ratings, and shareholder feedback. They review the performance of their decisions relative to peers.

5. Debrief and Learning The instructor facilitates a discussion on the outcomes, connecting team results to core financial principles and best practices.

What is the target audience for this simulation? This simulation is ideally suited for MBA programs, Executive Education courses in Corporate Finance, and training programs for finance professionals, analysts, and corporate treasurers. It is designed for learners seeking practical application of dividend and buyback strategy.

Do participants need advanced finance knowledge? A foundational understanding of corporate finance (like NPV, financial statements) is helpful. The simulation includes reference materials to bridge key concepts, making it accessible for motivated students and professionals looking to build expertise in capital allocation.

Is the simulation run remotely or in-person? Our platform is cloud-based, allowing for seamless delivery both in-person in a computer lab and for remote or hybrid classes. All you need is an internet browser.

How long does a typical simulation session last? A comprehensive experience can range from a 3-hour intensive workshop to a multi-week module integrated into a course. The timing is flexible and can be customized based on learning objectives.

What makes this simulation different from a case study? Unlike a static case, this is a dynamic, experiential learning tool. Participants see the immediate, quantified consequences of their decisions and must adapt their strategy in response to a changing market, creating a deeper, more memorable learning experience.

Can the simulation be customized for our specific curriculum? Yes. We offer customization options for company profiles, industry settings, and economic scenarios to align perfectly with your course themes, whether focused on banking, general management, or strategic finance.

How does this simulation help with career readiness? It builds critical, resume-worthy skills in financial analysis, treasury management, and strategic decision-making. Participants gain confidence in discussing complex capital allocation topics, a key advantage in finance interviews and roles.

A composite metric based on stock price appreciation, shareholder return, payout sustainability, and market stability.

Each team submits a final report defending their chosen policy over the simulation, linking their decisions to financial theory and situational analysis.

Individual input and collaboration within the team are assessed.

A brief test on core concepts reinforced by the simulation experience.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.