In this Divestitures Simulation, participants act as corporate finance professionals assessing which business units to divest, how to structure the deal, and how to align stakeholders behind the transaction.

Business Unit Portfolio Evaluation

Strategic Fit vs. Core Business Focus

Valuation of Divested Assets

Deal Structuring (asset vs. equity sales, tax implications)

Buyer Profiling and Negotiation

Stakeholder Communication (Boards, Employees, Investors)

Spin-Off vs. Sale vs. Wind-down Decision-Making

Regulatory and Reputational Considerations

Use of Proceeds

Post-Divestiture Operating Strategy

Review a company’s full business unit portfolio

Identify units that are underperforming, non-core, or strategically misaligned

Analyze financials, synergies, and market positioning of each division

Value the business units using various methods (DCF, multiples, precedent transactions)

Select appropriate deal structures (sale, spin-off, partial exit)

Choose target buyers and shape negotiation strategies

Communicate rationale to stakeholders including boards and employees

Respond to resistance from internal or external parties

Monitor the market’s response to announcements and adjust plans accordingly

Reinvest or reallocate proceeds post-divestiture

By the end of the simulation, participants will:

Understand how to evaluate a company’s portfolio through strategic and financial lenses.

Learn how to identify strong candidates for divestiture.

Apply valuation techniques to non-core or carve-out business units.

Choose appropriate deal structures based on tax, control, and operational implications.

Develop negotiation tactics tailored to different buyer profiles.

Manage internal resistance and stakeholder concerns.

Communicate complex divestiture strategies with clarity and confidence.

Integrate market reactions and adjust messaging or approach accordingly.

Understand the impact of divestitures on long-term value creation.

Improve cross-functional thinking by balancing legal, financial, and strategic trade-offs.

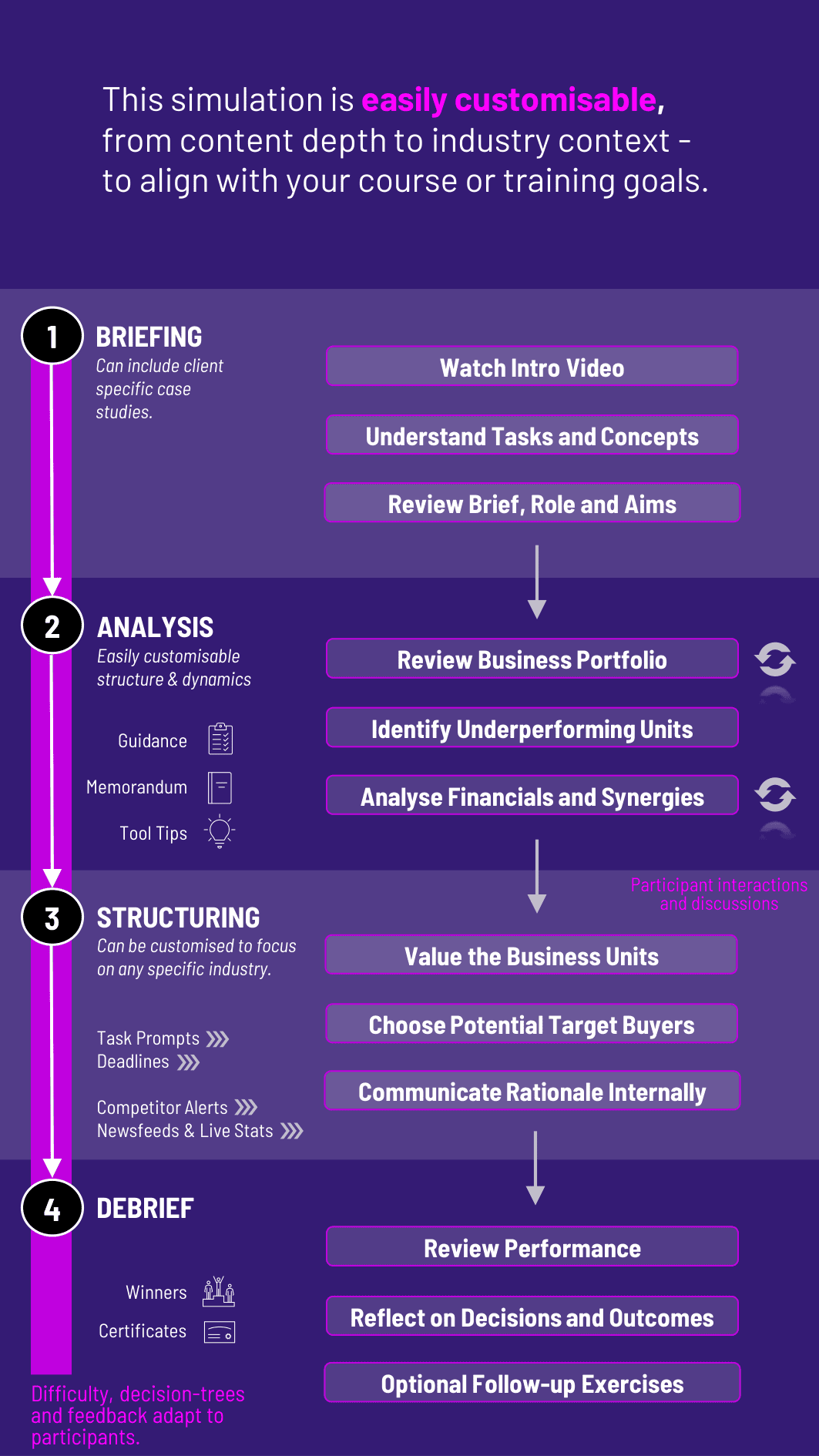

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

Participants work through multiple strategic and financial decision cycles, designed to mirror real-world divestiture planning and execution.

1. Review the Business Portfolio Participants start with an overview of the company’s divisions, recent performance, and strategic objectives. They assess which units may no longer fit the company’s direction.

2. Evaluate Divestiture Candidates Using both qualitative and quantitative criteria, participants rank business units based on strategic fit, market attractiveness, and financial contribution.

3. Determine Valuation and Deal Structure They perform valuation analyses and select whether to pursue a sale, spin-off, or wind-down. Legal and tax implications must be considered when deciding on the structure.

4. Select Buyers and Negotiate Terms Participants choose from multiple buyer profiles, each with unique interests, financing ability, and deal constraints. They prepare negotiation strategies and draft indicative terms.

5. Manage Stakeholder Expectations As plans progress, participants receive simulated feedback from internal departments, unions, investors, and the press. They must adjust messaging and decisions to address concerns.

6. Execute and Reflect on the Outcome Participants finalize the deal, evaluate the short- and long-term impact, and decide how to communicate results and reinvest proceeds for future growth.

Is the simulation focused on finance or strategy? Both - it teaches financial valuation alongside strategic decision-making and organizational impact.

Do learners need M&A experience? No. The simulation is designed to support a broad range of learners and includes guided help.

Can I adjust the complexity for MBA or executive learners? Yes. You can scale the difficulty and adjust the business context for your audience.

Is this suitable for corporate leadership development and academic courses? Absolutely. It’s a powerful training tool for senior managers, strategy teams and students as well.

Can I run the simulation online? Yes. The simulation is available in both in-person and virtual formats.

How long is the simulation? It can be completed in a 2 - 3 hour session or extended across multiple classes.

Can participants work in teams? Yes. The simulation supports both team-based and individual play formats.

Are real company scenarios included? The base scenario is fictional but realistic. Custom scenarios can be created.

Is post-divestiture strategy covered? Yes. Learners must decide how to use proceeds and adapt the business going forward.

Can I assess communication and leadership skills too? Definitely. The simulation emphasizes stakeholder messaging and team alignment.

Participants are evaluated on:

Business unit selection rationale

Valuation accuracy and deal structure appropriateness

Effectiveness in handling internal and external pushback

Communication of strategy to key stakeholders

Responsiveness to market or regulatory developments

Realism and impact of final outcome

Quality of reflection and iteration over rounds

Team collaboration and decision alignment (in group settings)

Strategic use of proceeds post-transaction

Final presentation or debrief on overall impact

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.