Divestiture in Finance Simulation is an immersive and practical training experience where participants step into the role of corporate decision-makers managing the sale or spin-off of a business unit or assets.

Definition and strategic rationale of divestitures

Standalone financial statement preparation for divested units

Pro forma financial modeling and valuation impact analysis

Accretion/dilution effects on key financial metrics

Deal structuring and transaction execution

Accounting for deconsolidation and reporting changes

Regulatory, compliance, and market considerations

Stakeholder communication and investor relations

Impact of divestitures on corporate focus and financial health

In the simulation, participants will:

Analyze financial data and segment business units

Prepare standalone financial statements for divested entities

Construct detailed pro forma financial models

Evaluate potential buyers and transaction structures

Simulate negotiation and deal closing processes

Assess post-divestiture impacts on parent company valuation and operations

Prepare investor updates and internal reports

Manage regulatory and compliance requirements

Apply strategic decision-making under uncertainty and market dynamics

Understand the strategic and financial implications of divestitures

Build and interpret standalone and pro forma financial models

Assess valuation accretion or dilution from divestiture transactions

Navigate deal structuring, negotiation, and execution processes

Communicate effectively with stakeholders and investors

Manage compliance and regulatory challenges during divestitures

Appreciate the role of divestitures in corporate portfolio management and value creation

Develop critical thinking and decision-making skills under transaction uncertainty

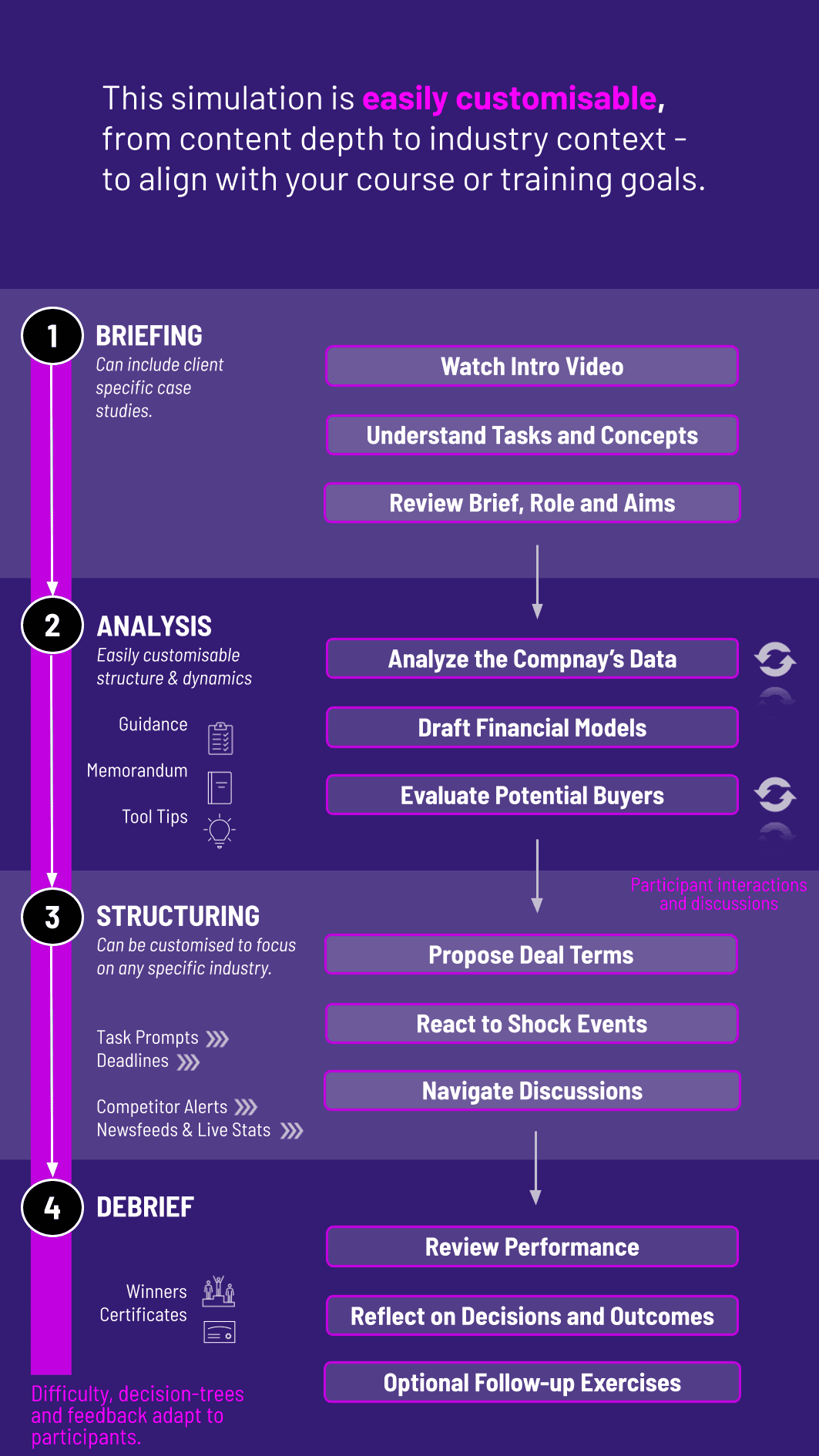

1. Receive Scenario Participants receive a brief outlining the business unit targeted for divestiture along with financial and market data.

2. Analyze the Business Examine segment financials, market positioning, and strategic fit with the parent company.

3. Prepare Financials Separate the divested unit’s revenues, costs, assets, and liabilities to create standalone financial statements.

4. Model Pro Forma Impact Build financial models to project the effects of divestiture on the parent company’s financials and market valuation.

5. Structuring and Negotiation Design deal terms, evaluate buyers, and simulate negotiation scenarios.

6. Execute and Communicate Complete the transaction simulation and prepare performance updates for investors and stakeholders.

7. Review and Reflect Assess outcomes, measure financial and strategic impacts, and refine approaches in successive rounds.

What prior knowledge do participants need? Basic understanding of corporate finance concepts such as valuation, financial modeling, and deal structuring is helpful but not mandatory. The simulation includes instructional content for all skill levels.

How long does the simulation typically run? The simulation can be conducted in 3-6 hours depending on the depth of scenarios and customization. It can be delivered as a single session or multiple modules.

Is this simulation individual or team-based? The simulation supports both formats but is designed to reflect real-world team dynamics including roles like divestiture lead, financial analyst, legal advisor, and investor relations.

Are real-world data or scenarios used? Yes, participants work with simulated data and market conditions modeled on historical and current financial markets for realism.

Can instructors customize the simulation content? Absolutely. The scenarios, industry sectors, deal complexity, and learning objectives can be tailored to match course requirements or corporate training goals.

What assessment methods are included? Participants can be evaluated on deal structuring quality, financial analysis accuracy, negotiation and communication effectiveness, and teamwork. Debrief presentations and written memos may also be part of assessment. Assessment methods are very flexible and can be adjusted to suit your specific needs.

Ability to identify and justify the divestiture target based on strategic fit and long-term corporate goals.

Proficiency in valuing assets or business units, including modeling accretion/dilution and pro forma financial statements post-divestiture.

Effectiveness in structuring the divestiture transaction, including deal terms, legal considerations, and negotiation skills.

Understanding and managing regulatory requirements and compliance issues inherent to divestitures.

Capability to plan and implement operational and financial independence of the divested entity.

Evaluation of risks involved in the divestiture and the impact on the remaining business and stakeholders.

Effectiveness in communicating divestiture rationale, progress, and outcomes to investors, executives, and other stakeholders.

Responsiveness to evolving market conditions, investor demands, and unforeseen challenges during the divestiture process.

Ability to work collaboratively in assigned roles reflecting real-world divestiture teams.

Analytical skills in reviewing divestiture outcomes versus objectives and applying lessons learned

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.