In this hands-on training, participants act as financial analysts valuing companies using DCF models. They forecast cash flows, defend assumptions, and determine intrinsic value in evolving market conditions.

Time Value of Money

Forecasting Free Cash Flow to the Firm (FCFF) or Equity (FCFE)

Cost of Capital (WACC and CAPM)

Terminal Value Estimation (Gordon Growth and Exit Multiple)

Sensitivity and Scenario Analysis

Business Drivers and Operating Assumptions

Discounting Techniques

Valuation vs. Market Price Debate

DCF Model Communication

Risk Adjustment in Forecasting

Reviewing company background, financial history, and industry data

Forecasting key financial metrics including revenue, EBITDA, capital expenditures, and working capital

Estimating free cash flows and calculating terminal value

Determining the appropriate discount rate using WACC and/or CAPM

Running sensitivity analysis to test assumptions and valuation drivers

Updating valuation models over multiple rounds as conditions change

Comparing DCF outputs with market-based valuation techniques

Preparing memos or presentations justifying their valuation

Receiving feedback from virtual investment committees or CFOs

Defending and adapting their work across training cycles

By the end of the training, participants will:

Understand the components of a robust DCF model and when to apply it.

Learn to forecast free cash flows from operational and financial assumptions.

Accurately calculate discount rates using WACC and CAPM frameworks.

Determine and justify terminal value using appropriate techniques.

Apply scenario and sensitivity analysis to refine assumptions.

Distinguish between intrinsic value and market sentiment.

Communicate valuation findings clearly and persuasively.

Evaluate the strengths and limitations of DCF valuation in various contexts.

Understand how macroeconomic and firm-specific events affect valuation.

Build confidence in presenting, defending, and adjusting complex financial models.

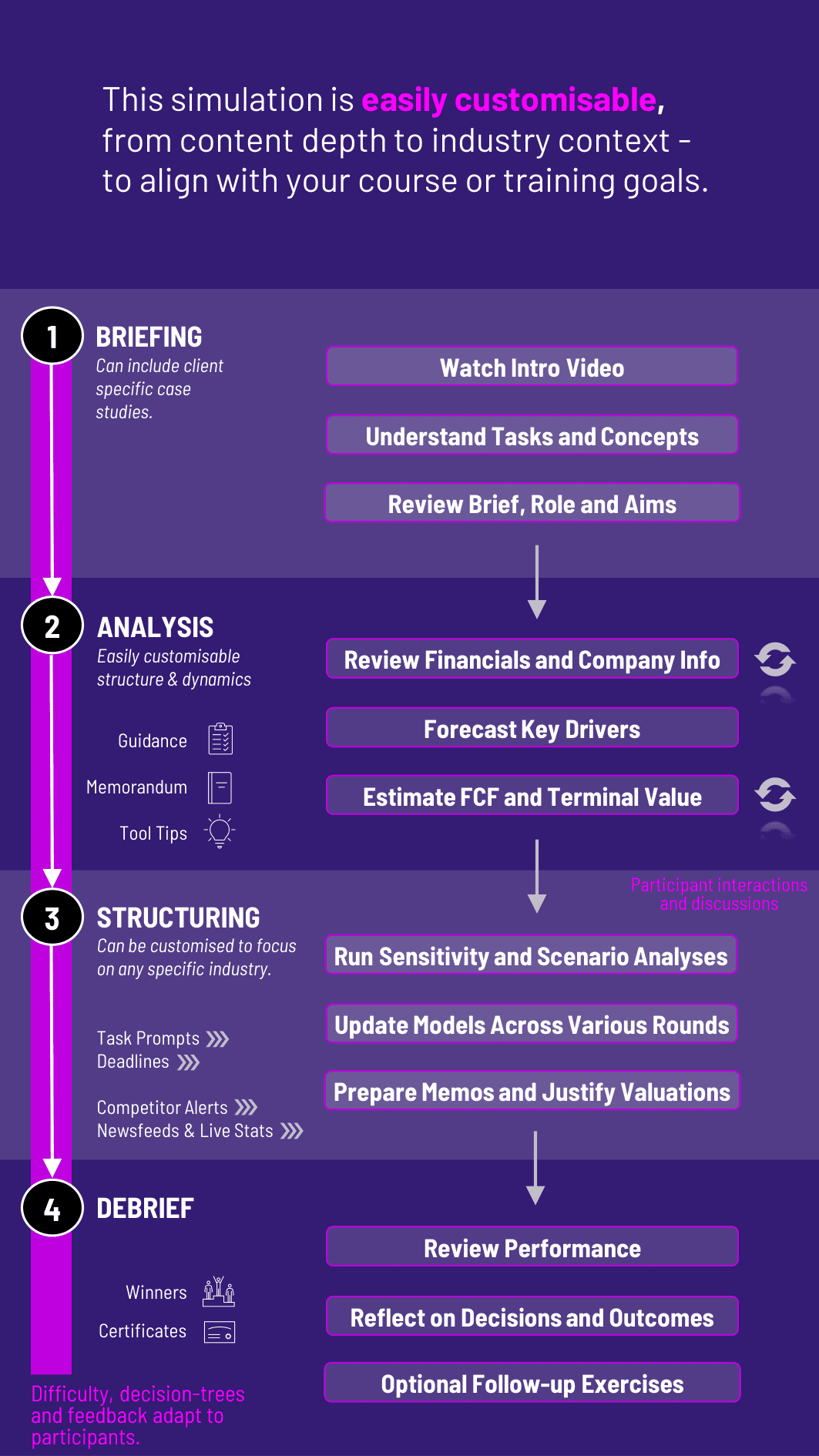

The training’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program.

Participants move through multiple rounds of decision-making, modeling, and communication - designed to mirror real-life valuation challenges in investment and corporate finance roles.

1. Receive Valuation Scenario Participants begin with a briefing on the company, industry conditions, and valuation task (e.g., IPO, M&A, strategic review). They review historical financials and strategic developments.

2. Forecast Free Cash Flows Based on assumptions about growth, margins, capex, and working capital, participants project future cash flows. The training guides them on structure but leaves room for judgment.

3. Calculate Discount Rate and Terminal Value Participants select inputs for WACC or CAPM and apply them to derive the present value of projected cash flows. They also calculate terminal value using one or both common methods.

4. Build and Submit the DCF Valuation Using the training interface, they build the model, run calculations, and determine the implied intrinsic value per share.

5. Receive Feedback and Market Signals After submission, participants get simulated stakeholder feedback, see how their valuation compares to market comps, and are challenged to defend assumptions or revise their model.

6. Iterate Across New Rounds Subsequent rounds introduce new factors - earnings surprises, inflation, regulation, leadership changes - forcing updates to forecasts and recalibration of the model.

Do participants need prior valuation experience? Not necessarily. The training scaffolds key concepts while challenging more advanced users through optional layers.

Can we use the training in both undergrad and MBA programs? Yes. It’s flexible in depth and can be adjusted for academic or executive audiences.

How long does the training run? Typically 3- 4 hours, but it can be expanded across sessions with deeper modeling.

Does it include Excel? The training uses its own interface but mirrors spreadsheet logic. Offline Excel integration is possible as a follow-up activity.

Can the training include sector-specific assumptions? Yes. Scenarios can be tailored for tech, manufacturing, services, or other industries.

Are group formats supported? Yes. Teams can divide roles - model builder, forecaster, and presenter—or play solo.

Is feedback provided automatically? Yes. The training includes auto-scoring, peer comparison, and written reflections.

Can I use this for assessments? Absolutely. Instructors can evaluate based on final valuation, clarity of assumptions, and stakeholder communication.

Does it integrate market-based valuation too? Yes. Participants are prompted to compare DCF output with trading comps or precedent transactions.

Can it be used in M&A, corporate finance, or investment courses? Perfectly. It fits into any course or training focused on valuation or financial modeling.

Participants are evaluated on:

Model completeness and structure

Accuracy and defendability of assumptions

Logical consistency in forecasts

Proper calculation of WACC and terminal value

Sensitivity analysis insights

Strategic use of valuation insights

Communication to stakeholders (memos, presentations, debriefs)

Improvement over training cycles

Peer or team collaboration (if group-based)

Reflection on what drives valuation in different scenarios

Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the training to be easily integrated by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the training.

or

Book a 15-minute Zoom demo with one of our experts to explore how the training can benefit you.