Participants take on the role of derivatives professionals, pricing instruments, managing risk, and executing trades to optimize financial outcomes under real-world pressures with our derivatives training.

The Derivatives Training gives participants the opportunity to work hands-on with the instruments that define modern financial risk management and speculative strategy. Acting as derivatives traders and risk managers, participants use options, futures, swaps, and other structured products to build hedging strategies, enhance portfolio performance, and respond to shifting market dynamics in real time.

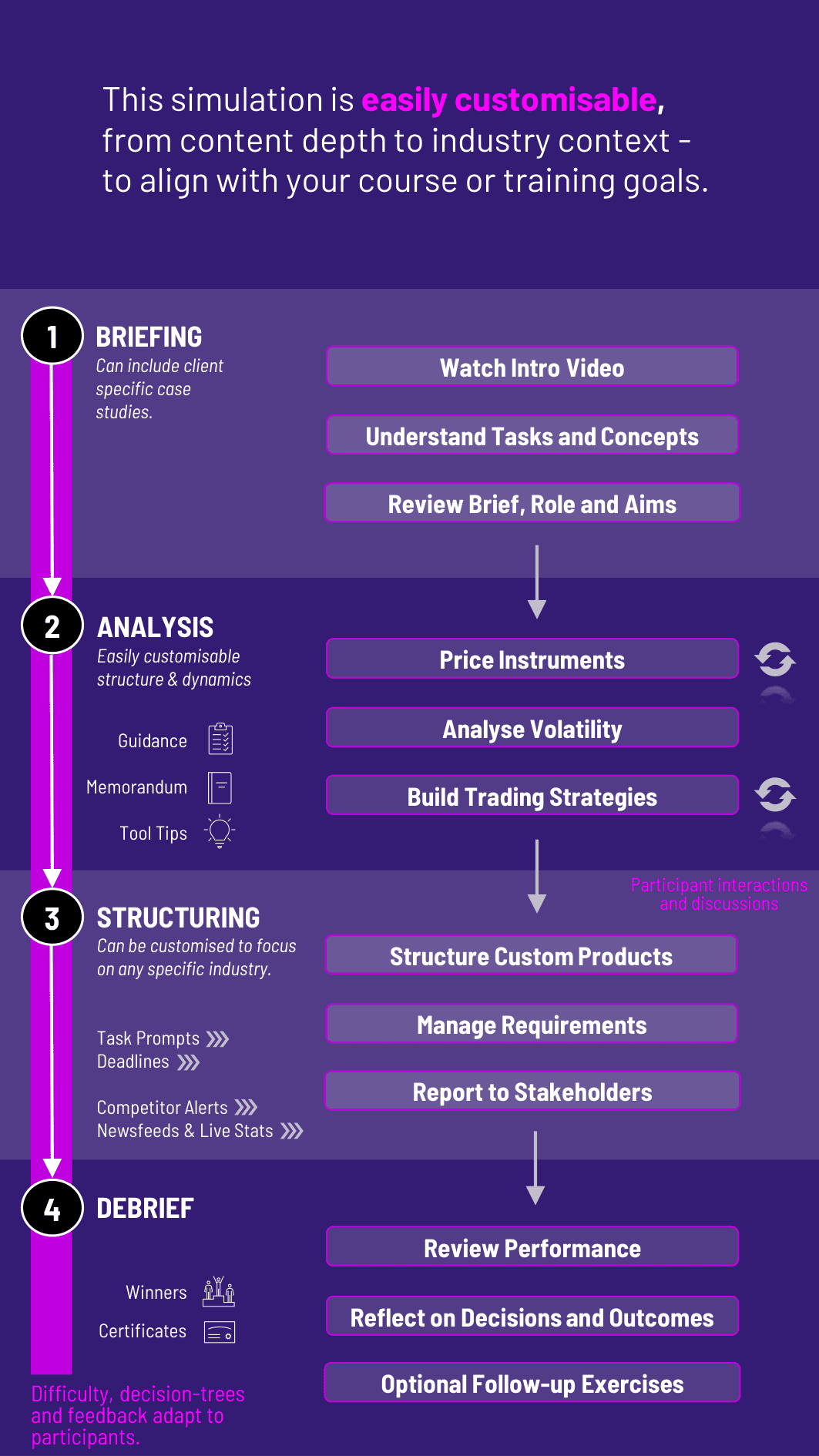

This immersive experience brings together theoretical knowledge and applied decision-making. From pricing and strategy design to trade execution and post-trade analysis, the derivatives training covers the full lifecycle of derivatives usage in institutional and corporate finance. Whether for hedging commodity risk, managing currency exposure, or structuring payoffs, participants gain fluency in using derivatives for real-world financial outcomes.

This derivatives training is especially valuable for developing both technical proficiency and strategic thinking. It empowers participants to not only understand the instruments, but also to use them with confidence in diverse financial contexts - from trading floors to corporate treasury departments. By immersing learners in realistic, time-sensitive challenges, it prepares them for the analytical demands of today’s financial careers.

Who should take this training? It’s ideal for finance, economics, or business participants preparing for roles in trading, risk, or corporate finance.

Do I need prior knowledge of derivatives? A basic understanding of financial instruments helps, but the training includes guidance for all levels.

How long does the training take? Typically 4-6 hours, but it can be adapted into shorter sessions or multi-day formats.

What software is required? The training runs entirely online with no need for external platforms or installations.

Is coding involved? No programming is required - participants use an intuitive interface to price, trade, and analyze.

Does the derivatives training use real market data? It blends historical and simulated data to reflect realistic price movements and volatility.

Can participants work in teams? Yes, the derivatives training supports both individual and collaborative formats.

What types of derivatives are included? Options, futures, forwards, and swaps across multiple asset classes.

How are participants assessed? Evaluation is based on strategy development, risk management, trade execution, and communication.

What careers does this training support? The derivatives training prepares participants for careers in trading, risk management, investment banking, corporate treasury, and financial engineering.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the derivatives training.

or

Book a 15-minute Zoom demo with one of our experts to explore how the derivatives training can benefit you.