Students take on the role of derivatives professionals, pricing instruments, managing risk, and executing trades to optimize financial outcomes under real-world pressures with our derivatives simulator.

The Derivatives Simulation gives students the opportunity to work hands-on with the instruments that define modern financial risk management and speculative strategy. Acting as derivatives traders and risk managers, students use options, futures, swaps, and other structured products to build hedging strategies, enhance portfolio performance, and respond to shifting market dynamics in real time.

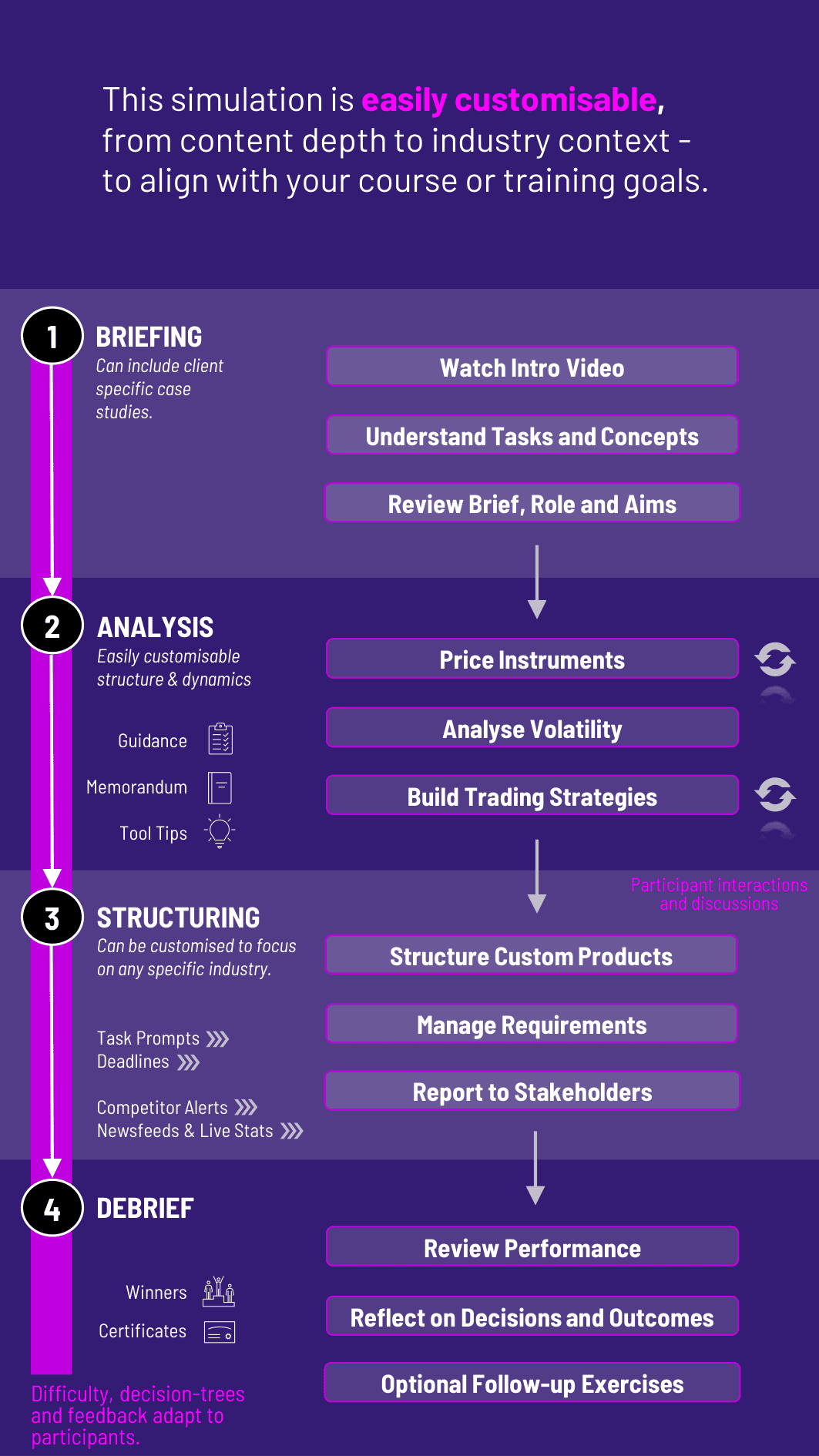

This immersive experience brings together theoretical knowledge and applied decision-making. From pricing and strategy design to trade execution and post-trade analysis, the derivatives simulation covers the full lifecycle of derivatives usage in institutional and corporate finance. Whether for hedging commodity risk, managing currency exposure, or structuring payoffs, students gain fluency in using derivatives for real-world financial outcomes.

This derivatives simulation is especially valuable for developing both technical proficiency and strategic thinking. It empowers students to not only understand the instruments, but also to use them with confidence in diverse financial contexts - from trading floors to corporate treasury departments. By immersing learners in realistic, time-sensitive challenges, it prepares them for the analytical demands of today’s financial careers.

Who should take this simulation? It’s ideal for finance, economics, or business students preparing for roles in trading, risk, or corporate finance.

Do I need prior knowledge of derivatives? A basic understanding of financial instruments helps, but the simulation includes guidance for all levels.

How long does the simulation take? Typically 4-6 hours, but it can be adapted into shorter sessions or multi-day formats.

What software is required? The simulation runs entirely online with no need for external platforms or installations.

Is coding involved? No programming is required - students use an intuitive interface to price, trade, and analyze.

Does the derivatives simulation use real market data? It blends historical and simulated data to reflect realistic price movements and volatility.

Can students work in teams? Yes, the derivatives simulation supports both individual and collaborative formats.

What types of derivatives are included? Options, futures, forwards, and swaps across multiple asset classes.

How are students assessed? Evaluation is based on strategy development, risk management, trade execution, and communication.

What careers does this simulation support? The derivatives simulation prepares students for careers in trading, risk management, investment banking, corporate treasury, and financial engineering.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the derivatives simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the derivatives simulation can benefit you.