This simulation challenges participants to use futures, options, and swaps to hedge portfolio risk, speculate on market movements, and implement sophisticated trading strategies, transforming theoretical pricing models into actionable financial intuition.

Pricing and Valuation of Futures, Options, and Swaps

Delta, Gamma, Vega, and Theta for Risk Management

Hedging Strategies: Delta-Hedging, Portfolio Insurance

Speculative Strategies: Straddles, Strangles, Spreads

Interest Rate and Currency Swaps for Liability Management

Put-Call Parity and Arbitrage Opportunities

Margin Requirements and Counterparty Risk

Volatility Smiles and Market Sentiment

In the simulation, participants will:

Execute trades in options, futures, and swaps on various underlying assets.

Construct and manage a delta-neutral portfolio to hedge against market moves.

Implement option strategies to capitalize on views on volatility, direction, and time decay.

Structure interest rate swaps to transform the profile of corporate liabilities.

Respond to real-time market shocks, earnings announcements, and central bank decisions.

Monitor and meet margin requirements to avoid liquidation.

Analyze profit/loss drivers and risk exposure through dynamic dashboards.

Present a final strategy report justifying their risk-return positioning.

Apply theoretical pricing models to live, noisy market data.

Design effective hedging strategies to mitigate specific financial risks.

Evaluate the risk-return profile of complex derivative positions using the Greeks.

Synthesize market information to form actionable views and trade accordingly.

Manage the operational and financial risks (leverage, margin) inherent in derivative trading.

Articulate the economic rationale behind trading and hedging decisions.

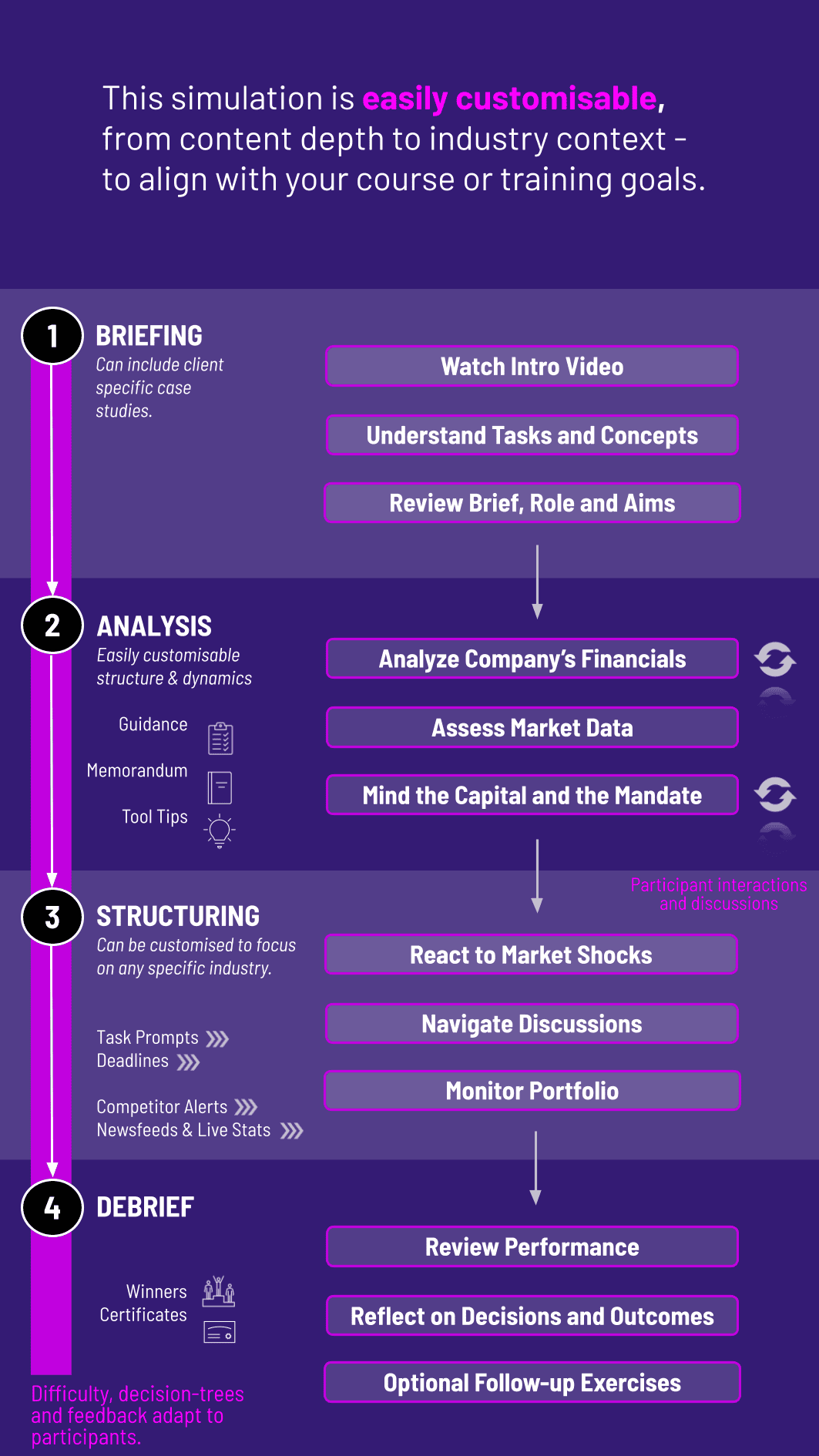

1. Team Formation Participants are divided into competing trading desks or fund teams.

2. Market Introduction Teams receive initial capital, a mandate, and access to the trading platform.

3. Live Trading Rounds The simulation progresses through multiple periods. Each round features new market data, volatility updates, and potential "news events".

4. Strategy Execution Teams analyze data, price derivatives, place orders, and manage their existing book of positions.

5. Performance Feedback After each round, teams see their P&L, risk metrics, and ranking on a leaderboard.

6. Final Review The simulation culminates in a debrief where teams explain their strategy, results, and lessons learned from their trades and risk management choices.

Is this simulation suitable for undergraduate students? Absolutely. It is highly effective for final-year undergraduates in finance, economics, or business, providing crucial practical context for their theoretical studies.

What is the typical duration of the simulation? The core experience can be run intensively over 1-2 days or extended across 4-6 weekly sessions within a semester-long course, depending on the depth of integration.

Can the simulation be customized for an executive education audience? Yes. For executives, we can focus on corporate finance applications, such as using derivatives for treasury risk management (hedging FX or commodity exposure) and structuring swaps for corporate financing.

What kind of market data and assets are included? The platform simulates diverse assets including equity indices, major currency pairs, commodities (oil, gold), and interest rate products, with data reflecting realistic volatility and correlations.

How are teams assessed within the simulation? Assessment is multi-faceted, based on risk-adjusted returns, consistency in applying hedging strategies, quality of trade rationale, and final portfolio analysis.

Do you provide instructor support and teaching materials? Yes. We provide a comprehensive instructor manual, slide decks for briefing and debriefing, technical guides, and dedicated setup support to ensure a seamless educational experience.

Is this simulation related to your Hedge Fund Simulation? While complementary, they are distinct. The Hedge Fund Simulation focuses on overall portfolio management and asset allocation. The Derivative Securities Simulation drills deep into the specific tools (options, futures, swaps) used within such a fund for hedging, speculation, and alpha generation.

Risk-adjusted returns, accuracy of derivative pricing, effectiveness of hedges (reduction in portfolio volatility/drawdown).

Quality of trade justifications, consistency with stated market views, and adaptation to new information.

Proactive management of the Greeks, adherence to margin rules, and overall book risk control.

Clarity and insight in the concluding report, demonstrating mastery of the link between theory, strategy, and outcome.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.