Understand how different depreciation methods directly influence profitability, tax liability, cash flow, and key performance metrics in a dynamic, competitive business environment.

Depreciation methods and models (straight-line, accelerated, fiscal value considerations)

Fixed asset capitalizations and management

Forecasting depreciation for current and planned assets

Impact of depreciation on financial statements

Asset residual and fiscal values considerations

Simulation versus actual transaction confirmation

Risk and financial planning involving asset depreciation

In the simulation, participants will:

Receive asset scenarios or briefs detailing asset values and expected depreciation timelines

Analyze financial data including asset purchase values, fiscal data, and prior depreciation

Simulate various depreciation outcomes and view effects on financial reports

Make decisions on which depreciation model to apply and how to manage asset values

Convert simulated depreciation results into actual accounting transactions after review

Collaborate with team members acting as accountants, finance managers, or auditors

Communicate and justify depreciation choices and their financial implications

Reflect on simulation outcomes and adjust strategies in iterative rounds

Understand how depreciation influences corporate financial reporting and asset management

Apply different depreciation methods appropriately to varied asset types

Forecast depreciation impact on financial statements using simulation tools

Manage fixed assets through their lifecycle with attention to fiscal and residual values

Evaluate and confirm depreciation transactions to comply with accounting standards

Improve decision-making skills under financial uncertainty related to asset management

Appreciate the role of depreciation in broader financial planning and risk management

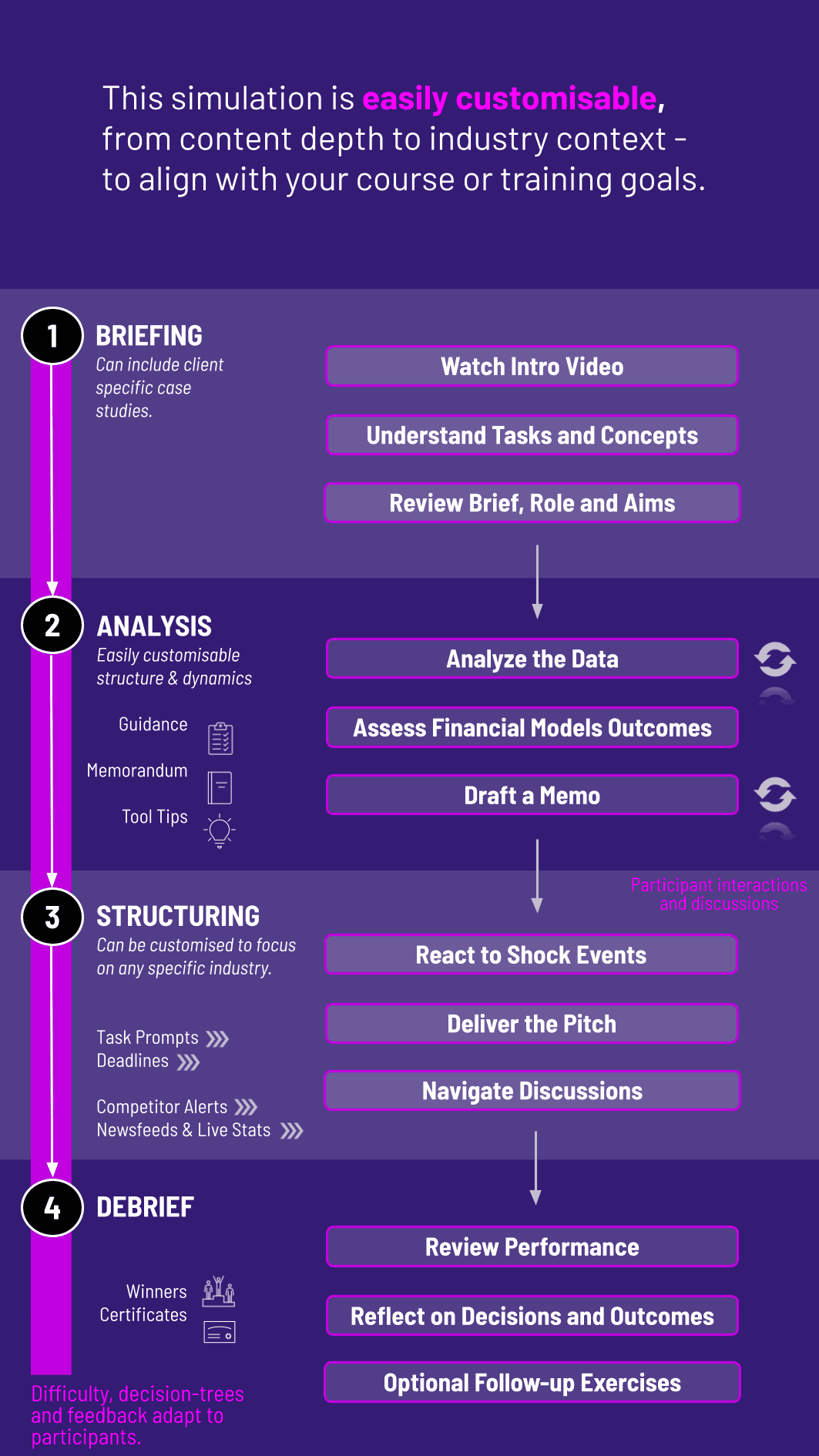

1. Team Formation and Introduction Participants are divided into management teams running competing companies. They receive initial capital and company objectives.

2. Decision Rounds Analyze the market and decide on capital investments, choose a depreciation method for each new asset, review automatically generated financial statements, manage operational decisions based on their financial results.

3. Competition After each round, a consolidated ranking is published based on key metrics like Net Income, ROA, and Cash Flow. This competitive element forces teams to adapt their strategies.

4. Instructor-Led Debrief After the final round, a comprehensive debriefing session led by the instructor connects the simulation experiences to core accounting and finance theories, solidifying the learning.

What is a Depreciation Simulation? It is an interactive tool to forecast, calculate, and manage asset depreciation effects on financial reporting without immediate accounting impact.

Who can benefit from this simulation? Finance students, accountants, asset managers, and corporate finance teams seeking to understand depreciation impacts and accounting practices.

Is prior accounting knowledge required? Basic accounting and fixed asset knowledge helps, but the simulation provides guidance for all skill levels.

What depreciation methods are supported? Common models like straight-line, accelerating depreciation, and fiscal value-based methods are included.

** Can planned capital investments be simulated?** Yes, the system allows including planned asset purchases and their depreciation forecasts.

How long does the simulation typically run? Depending on depth, it can be completed in a few hours or spread over multiple sessions.

Is the simulation suitable for individual or group learning? Both settings are supported, encouraging collaboration or solo decision-making.

Individual contribution and collaboration within the team, provided by fellow team members.

Ranking based on key financial health indicators achieved by the end of the simulation

Assessment of individual contribution and collaboration within the team

Depth and logic of scenario analysis

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.