In this hands-on Debt Capital Markets Course, participants act as capital markets advisors helping companies raise debt. They structure bond issuances, price credit risk, and navigate volatile markets to meet client and investor needs.

Bond Types & Instruments: Investment-grade, high-yield, green bonds, convertibles

Market Timing: Issuer readiness vs. investor sentiment and macro indicators

Credit Ratings: Understanding how ratings drive pricing and investor appetite

Term Sheet Design: Tenor, coupon type, call features, covenants

Pricing Strategy: Benchmarking yield curves, setting new issue premiums

Syndication: Allocation, book-building, and investor targeting

Client Advisory: Communicating issuance strategy, risk, and timing to issuers

Macroeconomic Drivers: Rates, inflation, monetary policy, and risk sentiment

Analyze a client’s funding needs and credit profile

Assess the market environment - yields, spreads, sentiment, comparable deals

Structure the bond - type, size, tenor, and terms

Decide on timing and investor communication strategy

Simulate a deal launch, price guidance, and investor response

Adjust strategy based on market volatility or new information

Present recommendations and results to clients or internal teams

By the end of the course, participants will be more confident in:

Structuring debt instruments for different corporate needs

Interpreting credit risk and aligning with market pricing

Navigating market timing and investor sentiment

Explaining DCM strategy clearly to clients and internal stakeholders

Making high-pressure pricing and syndication decisions

Understanding how bonds are marketed, sold, and distributed

Integrating macro and micro data into deal execution

Managing the complex coordination of stakeholders in capital markets

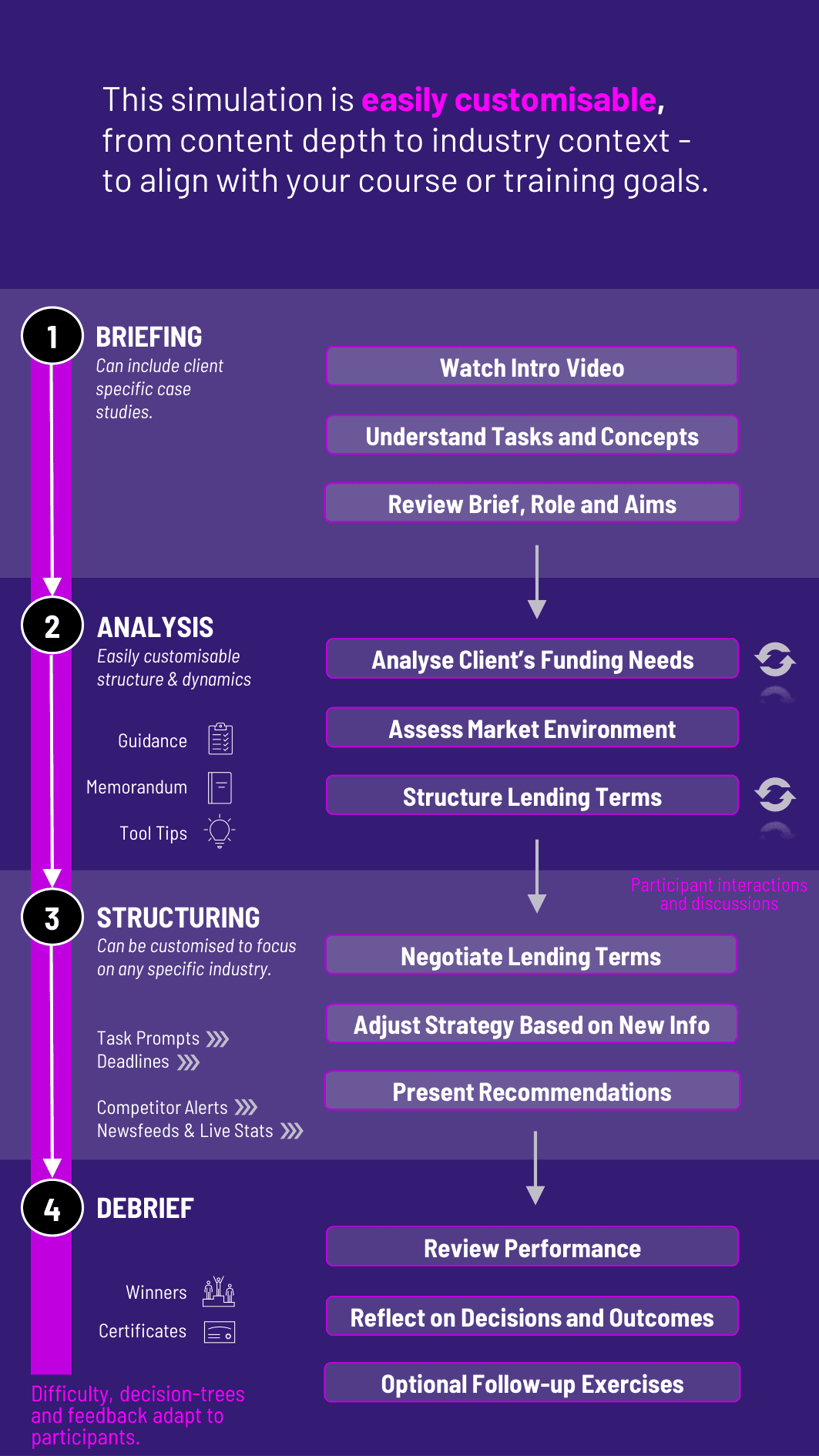

The course’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program in higher education.

1. Client Mandate Participants receive a corporate client's brief: funding needs, timing constraints, credit profile, and strategic objectives.

2. Market Analysis They assess market indicators (rates, spreads, recent deals) and sector appetite to determine feasibility and timing.

3. Deal Structuring Participants choose bond type, size, maturity, and terms, considering the credit profile and market comparables.

4. Investor Strategy and Pricing Based on investor demand scenarios, they price the deal and simulate pre-marketing efforts, book-building, or changes to pricing.

5. Syndication and Outcome Review Participants receive feedback on investor response, pricing success, and issuer satisfaction. Adjustments may be made, and deals can succeed or fail.

6. Iteration with New Deals or Challenges Subsequent rounds introduce different types of issuers, markets (emerging, volatile, or ESG-linked), or macroeconomic shocks.

This iterative format allows for reflection, strategy refinement, and development of real-world capital markets intuition.

Do participants need prior capital markets experience? No. Key concepts are introduced in onboarding. Basic finance or fixed income knowledge is helpful but not required.

Are real-world bond types included? Yes. The course features investment-grade, high-yield, green bonds, and other formats relevant to today’s market.

How is pricing determined? Participants analyze yield curves, recent deals, and market conditions to simulate pricing outcomes.

Is this course suitable for teams? Yes. Teams can split roles (client lead, pricing analyst, syndication) to reflect a real DCM desk structure.

Does it simulate investor feedback? Yes. The course includes investor reaction based on deal structure, timing, and external market conditions.

How long does it take to run? Sessions can range from 2 hours (one deal cycle) to multi-round courses run over multiple days or weeks.

Can ESG bonds or emerging markets be simulated? Yes. The course can include custom issuer profiles, ESG-linked deals, or macro-specific contexts.

What data is provided? Participants receive issuer financials, market data, rating summaries, and comparable deal benchmarks.

Is communication skill assessed? Yes. Participants present deal strategies and rationales to clients or internal stakeholders in written or verbal format.

Can instructors adjust complexity? Absolutely. The course is customizable for undergrad, MBA, or executive levels - adjusting inputs, deal types, and stakeholder interactions.

Participants can be assessed on:

Quality of deal structure and pricing logic

Strategic alignment with issuer objectives

Responsiveness to market conditions

Clarity and confidence in internal or client presentations

Team collaboration and stakeholder management

Adaptability across changing rounds or scenarios

Optional memos, pitch decks, and peer/self-assessments

This course integrates well into capital markets, investment banking, and finance strategy courses. You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.