Marketing success is no longer about gut feelings; it's about data. This simulation tasks participants with maximizing Return on Investment by strategically allocating a limited budget across a dynamic digital and traditional marketing mix.

Marketing Mix Modeling (MMM)

Return on Investment (ROI) and Return on Ad Spend (ROAS)

Customer Acquisition Cost (CAC) & Customer Lifetime Value (LTV)

Multi-Touch Attribution Modeling

Budget Constraint Optimization

Brand Equity & Awareness Metrics

A/B Testing and Experimentation

Market Saturation and Diminishing Returns

Competitive Analysis and Market Share

Data Visualization and KPI Dashboarding

In the simulation, participants will:

Analyze a dashboard of past performance data for various marketing channels.

Allocate a finite quarterly budget across 8-10 different marketing channels.

Set specific campaign goals and target KPIs for each allocation.

React to unexpected market events, competitor moves, and changes in channel effectiveness.

Interpret the results of their decisions through a detailed performance report after each simulated quarter.

Adjust their strategy based on data-driven insights to improve outcomes in subsequent rounds.

Present a final marketing plan and budget justification to the "board" (instructors or peers), defending their strategic choices.

Articulate the relationship between marketing spend, channel performance, and overall business profitability.

Analyze complex data sets to identify the most and least effective marketing channels.

Optimize a multi-channel marketing budget under constraints to maximize key metrics like ROI, ROAS, and lead volume.

Evaluate the impact of external factors and competitive actions on marketing strategy.

Synthesize performance data into a coherent narrative to justify past actions and future budget requests.

Build a scalable framework for making ongoing, data-driven marketing decisions.

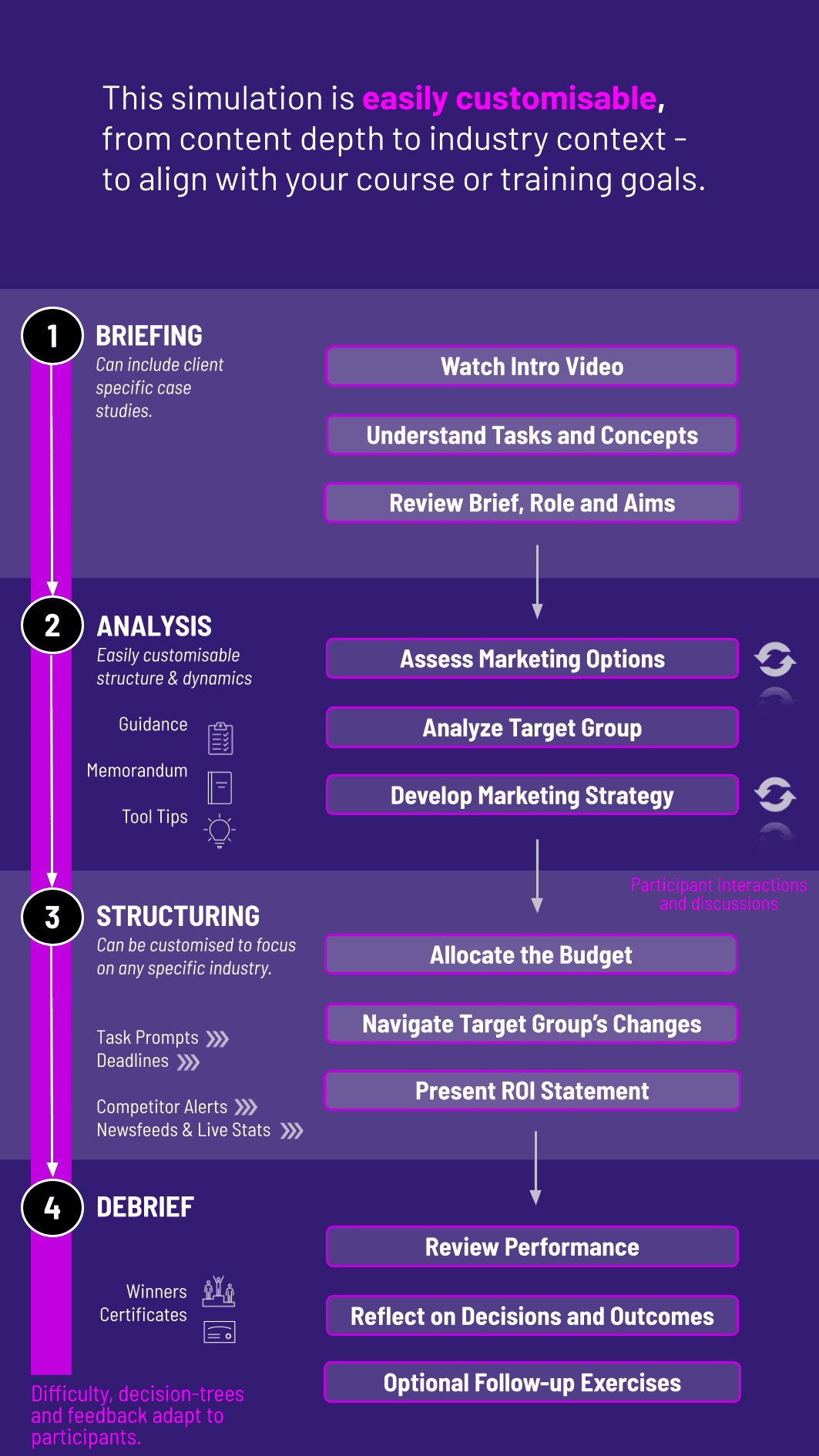

1. Receive and Analyze the Brief Participants are briefed on the company, its products, the competitive landscape, and the simulation interface

2. Plan and Strategize Using historical data and financial models, teams make their initial budget allocations and set their strategic goals.

3. Manage Finances and Team Dynamics The simulation engine processes the decisions, incorporating elements like market randomness and competitor team’s decisions. Teams receive a detailed quarterly report showing their performance against KPIs.

4. Adapt and Change Up the Strategy Armed with results from the previous round—and often facing new market scenarios—teams re-allocate their remaining budget to correct mistakes and capitalize on opportunities.

5. Debrief and Present The session concludes with a guided debrief where teams present their final strategy, results, and key learnings.

Accuracy in judgement of company’s assets and quality of assumptions and adjustments

Depth and logic of scenario analysis and sensitivity ranges

Clarity, coherence, and persuasiveness of the valuation memo and presentation

Ability to adapt and revise valuations in light of news shocks or changes

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.