In this simulation, participants act as investors, regulators, and entrepreneurs navigating digital currency markets - balancing volatility, innovation & strategy while responding to shocks, speculation, and evolving blockchain-driven ecosystems.

Cryptocurrency market dynamics and volatility

Blockchain fundamentals and digital asset design

Initial Coin Offerings (ICOs) and token launches

Regulation, compliance, and global policy differences

Speculative bubbles and investor psychology

Cybersecurity and fraud in crypto markets

Stablecoins, DeFi, and evolving financial innovations

Market liquidity and trading strategies

ESG considerations in crypto mining and sustainability

Long-term adoption vs short-term speculation

Build and manage cryptocurrency portfolios under volatile conditions

Evaluate ICOs and blockchain projects for credibility and value

React to news, regulations, and speculative shifts in markets

Negotiate with regulators, investors, or exchanges

Decide between speculation, hedging, and long-term adoption strategies

Reflect on lessons from successes, failures, and missed opportunities

By the end of the simulation, participants will be able to:

Understand cryptocurrency market mechanics and drivers

Balance risk, speculation, and long-term adoption strategies

Evaluate blockchain projects and token economics

Navigate regulatory uncertainty and compliance requirements

Recognize investor psychology in speculative markets

Respond effectively to external shocks and crises

Communicate investment reasoning and risk management approaches

Explore the role of crypto in global finance and innovation

Identify vulnerabilities like fraud, scams, and cyberattacks

Build confidence in applying crypto knowledge to real-world contexts

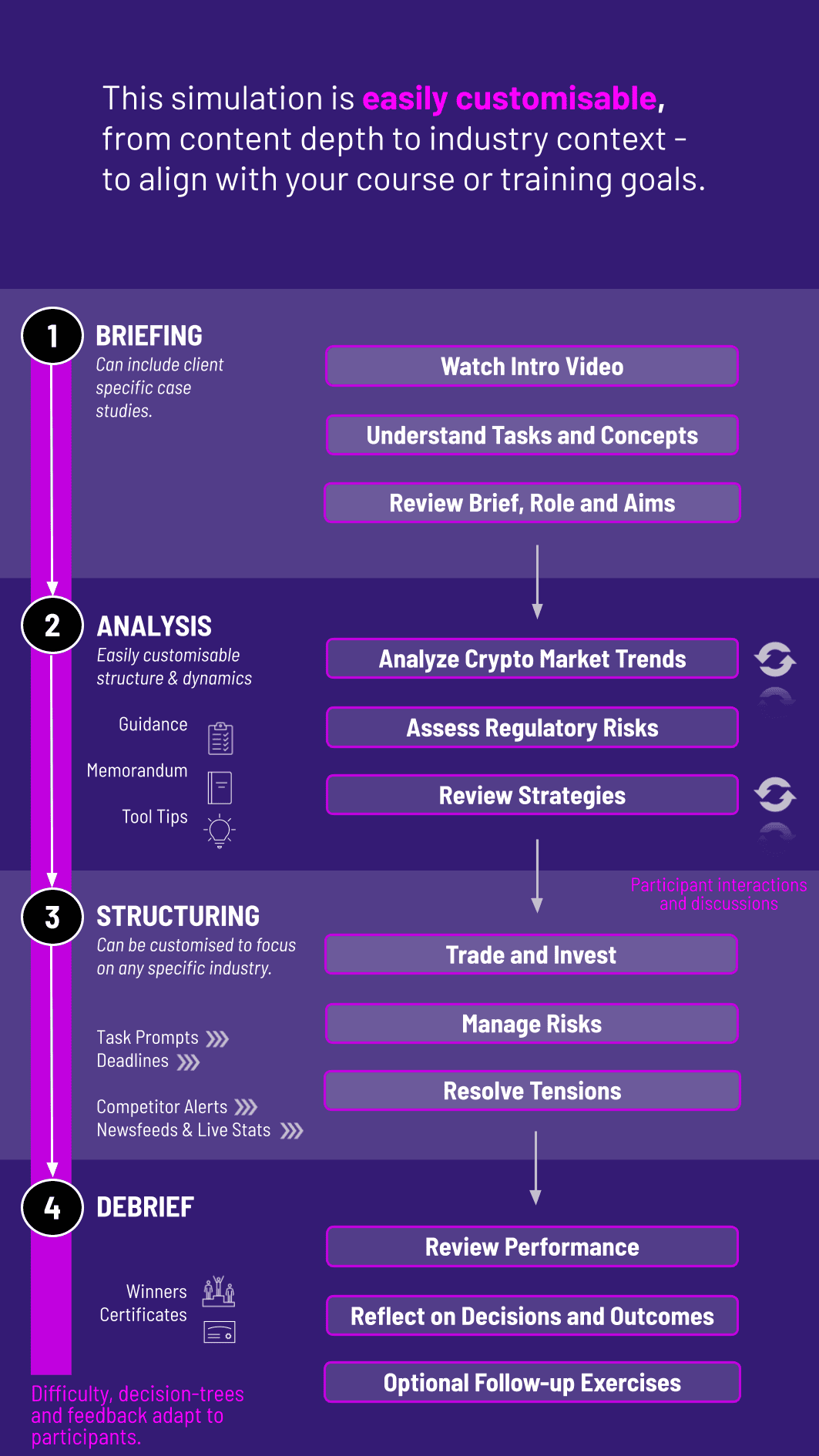

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

The simulation can be run individually or in teams in classrooms or corporate workshops. Each cycle represents a decision-making round in crypto markets.

1. Receive a Scenario or Brief: Participants are given a crypto market update with context, objectives, and challenges.

2. Analyse the Situation: They review project fundamentals, market sentiment, and regulatory risks.

3. Make Strategic Decisions: Participants decide on trading, investing, or regulatory responses under time pressure.

4. Collaborate Across Roles: Teams may act as regulators, investors, or entrepreneurs negotiating in the ecosystem.

5. Communicate Outcomes: Participants present investment memos, regulatory updates, or project pitches.

6. Review and Reflect: Feedback highlights portfolio results, project viability, and stakeholder trust. Participants adapt strategies in subsequent rounds.

Do participants need blockchain expertise? No. The simulation introduces key blockchain and crypto concepts in an accessible way.

What roles are included? Investors, regulators, entrepreneurs, and exchanges.

Can scenarios be customized? Yes. They can reflect global markets, regulations, or specific use cases.

Is this simulation focused only on trading? No. It also covers regulation, governance, and long-term adoption.

How long does it run? It can be run as a short 4-hour session or extended into multi-day sessions.

Can it be run online? Yes. The simulation is fully compatible with digital and hybrid learning.

Does it cover fraud and security? Yes. Scenarios include hacks, scams, and investor protection issues.

Is this suitable for executives? Yes. It is widely used in corporate training and executive programs.

How is success measured? By portfolio performance, project evaluation, and stakeholder credibility.

Does it cover DeFi and stablecoins? Yes. Advanced scenarios include DeFi platforms, token design, and stablecoin risks.

Effectiveness in portfolio and project decisions

Judgment in balancing risk, speculation, and adoption

Responsiveness to regulation and market volatility

Clarity in communicating investment strategies

Collaboration and negotiation across roles

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.