In today's complex and volatile financial markets, technical skills are a given, but the true differentiator is critical thinking. This simulation challenges participants to analyze ambiguous data and question assumptions under pressure.

Cognitive Biases in Finance

Information Asymmetry and Analysis

Scenario Planning and Stress Testing

Behavioral Finance

Strategic Decision-Making

Quantitative vs. Qualitative Synthesis

Risk Management Under Uncertainty

Thesis Formulation and Pitching

In the simulation, participants will:

Analyze a starting portfolio of equities, bonds, and derivatives with incomplete initial data.

Research and request specific data on company financials, industry trends, and macroeconomic indicators.

Execute Trades based on their evolving investment thesis, reacting to real-time market updates.

Evaluate a potential M&A deal or capital raising opportunity, assessing strategic fit and valuation.

Manage Risk by adjusting asset allocation and using derivatives to hedge against potential downsides.

Compete against other teams, whose collective actions influence market prices and volatility.

Present their final strategy and performance to a "board of directors," justifying their critical thinking process.

Identify common cognitive biases in financial decision-making and develop strategies to counteract them.

Source and synthesize disparate pieces of financial and qualitative information to form a holistic view.

Construct a logical and defensible investment or corporate finance thesis under time constraints.

Evaluate the potential impact of unforeseen market events and adjust strategy accordingly.

Demonstrate improved judgment in capital allocation and risk-taking.

Articulate a complex financial strategy clearly and confidently, emphasizing the thought process over just the outcome.

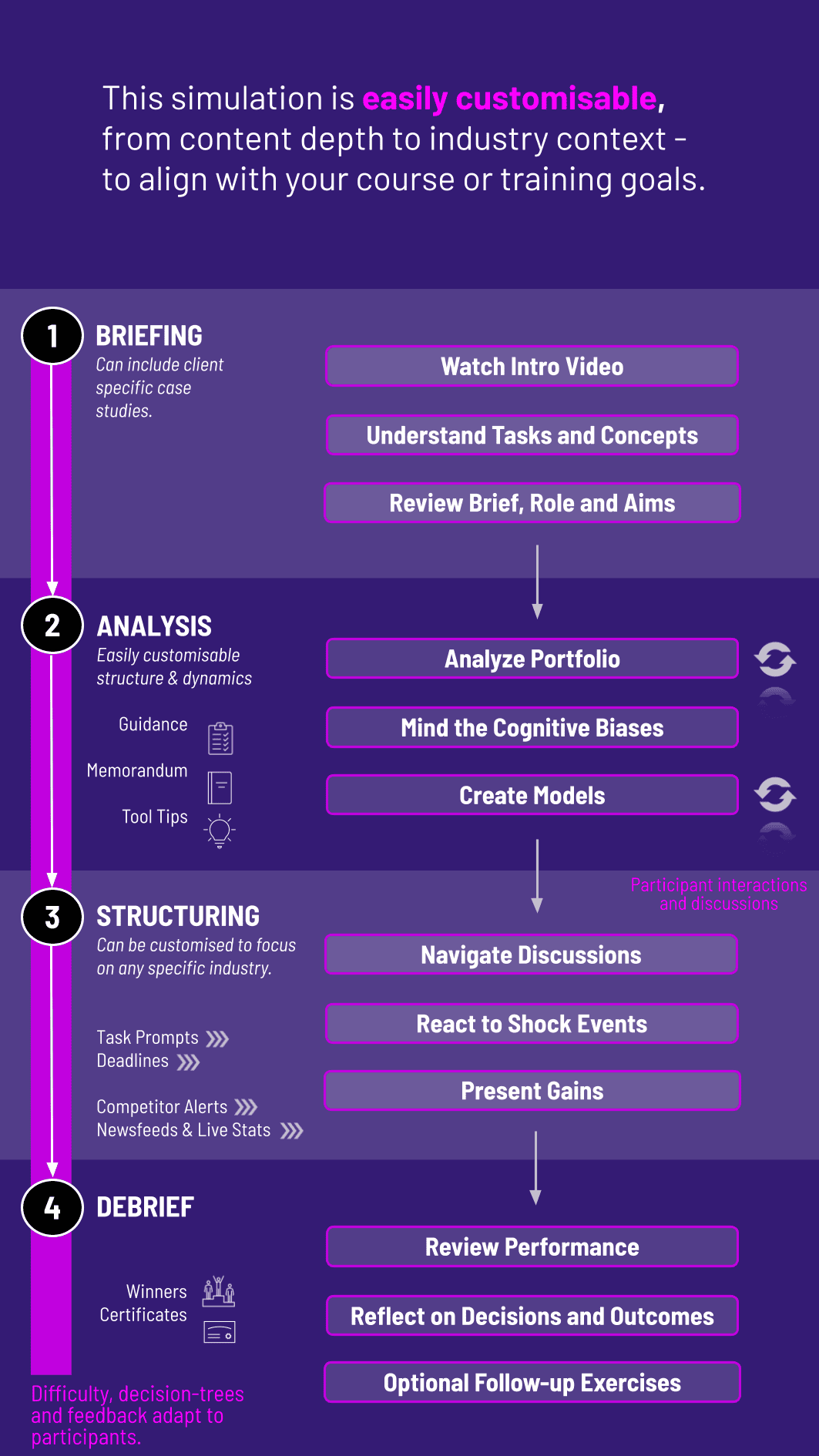

1. Team Formation and Briefing Participants are divided into competing funds or advisory teams. They receive the initial case materials and access to the simulation platform.

2. Initial Analysis Phase Teams conduct their first analysis, identifying knowledge gaps and requesting specific data packs from the simulation moderator.

3. Market News and Data Drops New information is released, including earnings reports, economic data, and geopolitical events.

4. Decision Period Teams analyze the new data, adjust their models, and execute trades or deals.

5. Results and Feedback Teams see their performance metrics (Sharpe ratio, alpha, ROE) and receive qualitative feedback on their strategy.

6. The Shock Event A mid-simulation unexpected event tests teams' risk management and adaptability.

7. Final Review and Presentation The simulation concludes with teams preparing a final report and presentation, justifying their decisions and the critical thinking framework they employed throughout the exercise.

What makes this different from a typical stock market game? While stock games focus on returns, our simulation emphasizes the process of decision-making. You are judged not just on profitability, but on the quality of your analysis, risk management, and ability to defend your strategy in the face of ambiguity and bias.

What is the ideal team size and participant background? We recommend 3-5 participants per team. The simulation is designed for advanced undergraduates, MBA students, and finance professionals who have a foundational understanding of financial concepts.

What technical skills are required? A basic understanding of financial statements, valuation, and Excel is helpful. The primary focus, however, is on strategic thinking and analysis, not complex modeling.

How long does the simulation last? The core simulation can be run as an intensive 1-day workshop or extended over multiple sessions (e.g., 3-4 hours per week for 3 weeks) to allow for deeper analysis.

Is this simulation relevant for careers outside of portfolio management? Absolutely. The critical thinking skills honed are directly applicable to investment banking, equity research, corporate M&A, and strategic consulting—any role requiring sound judgment under uncertainty.

What kind of support is provided during the simulation? A dedicated simulation moderator acts as a central bank, data provider, and news source. They are available to answer procedural questions and provide requested data packs.

Can the simulation be customized for our specific program? Yes. We can tailor case companies, asset classes, and the specific market events to align with your course's learning objectives, be it for a Hedge Fund, Investment Banking, or General Corporate Finance focus.

How is performance assessed? Performance is multi-faceted. It includes quantitative metrics (risk-adjusted returns) and, more importantly, qualitative assessment of your team's decision-making process, final presentation, and ability to answer challenging questions. See the Assessment section below for details.

Risk-Adjusted Returns (Sharpe Ratio, Sortino Ratio)

Maximum Drawdown and Volatility Management

Consistency of Performance vs. Benchmark

Quality of the Initial Investment Thesis

Rationale for Strategic Pivots and Trade Decisions

Demonstrated Understanding of Biases and Risk Factors

Coherence and Depth of the Final Strategic Report

Clarity, Structure, and Persuasion of the Final Presentation

Ability to Field Challenging Questions and Defend Decisions Under Scrutiny

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.