In this high-stakes Crisis Management Simulation, participants lead decision-making during reputational, financial, and operational crises. They must assess risk, align stakeholders, and communicate clearly - all under intense time pressure.

Crisis Identification & Response Planning

Stakeholder Prioritisation: Internal teams, regulators, media, customers, shareholders

Communication Strategy: Tone, timing, transparency

Financial & Legal Risk: Containment and regulatory implications

Cross-Functional Alignment: Coordinating finance, ops, HR, and legal

Media and Reputation Management: Handling public fallout

Post-Crisis Review: Root cause analysis and long-term rebuilding

Scenario Planning & Resilience Building

Receive a breaking event and review real-time updates

Assess the facts, risks, and unknowns across business functions

Develop and execute response plans under time pressure

Communicate with stakeholders - customers, board, regulators, media

Manage cross-functional decision-making with limited information

Reassess strategies as new developments emerge

Reflect on what worked, what failed, and how future resilience can be built

Crises may include cybersecurity breaches, PR disasters, product recalls, leadership misconduct, financial distress, or activist interventions.

By the end of the simulation, participants will be more confident in:

Leading under uncertainty and pressure

Making fast, high-impact decisions with limited data

Communicating clearly and confidently in tense situations

Balancing competing interests and time-sensitive risks

Managing internal alignment and coordination in chaotic environments

Thinking strategically during short-term volatility

Applying structured thinking to unpredictable scenarios

Handling reputational risk and stakeholder trust

Learning from crisis to build long-term institutional resilience

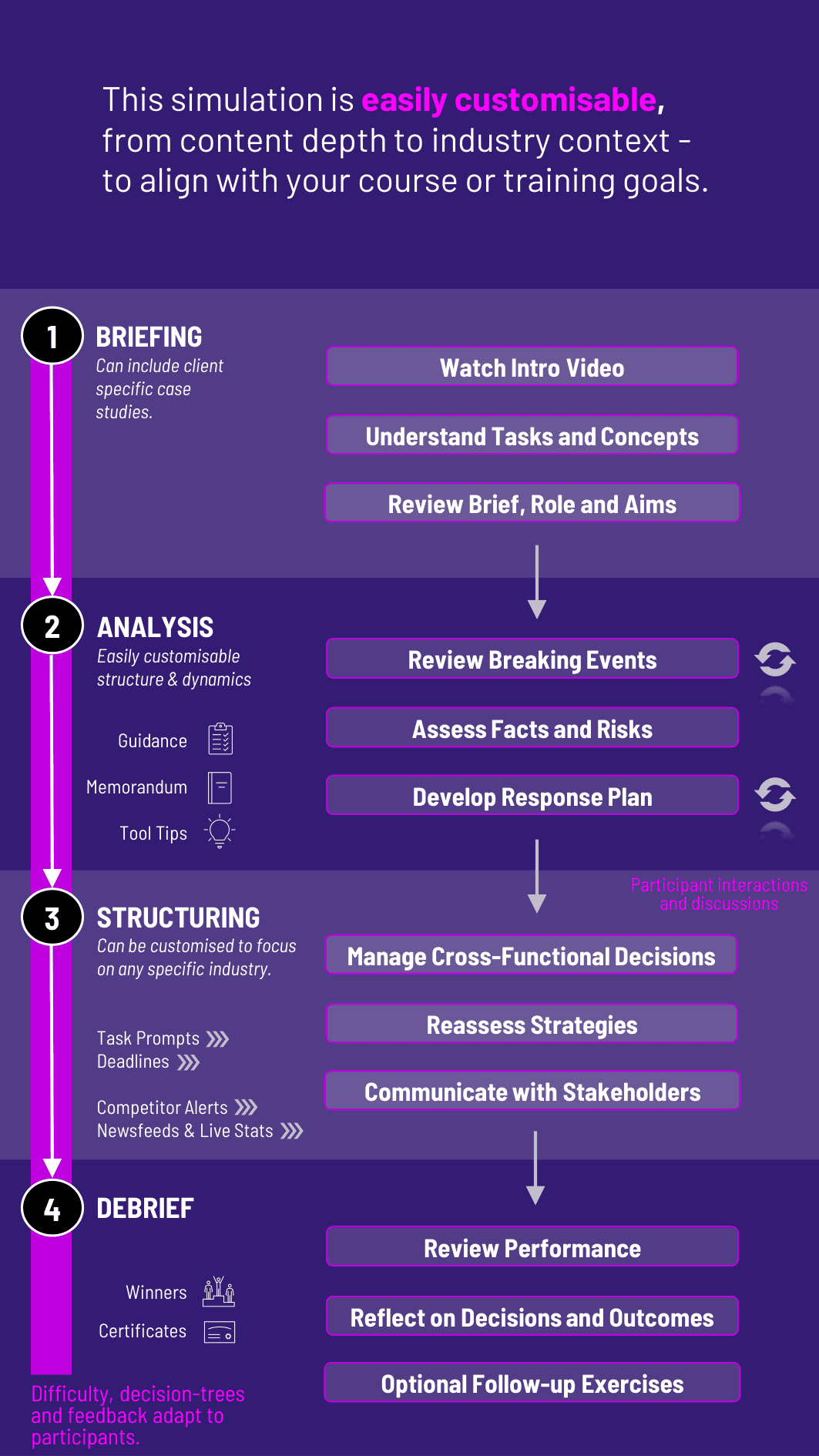

This is especially powerful for future managers, business leaders, and professionals in high-responsibility roles. The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program.

1. Receive a Crisis Scenario Participants receive a realistic crisis trigger (e.g. data breach, fraud report, viral complaint), plus key facts and context.

2. Assess and Prioritise They identify the critical stakeholders, immediate risks, legal considerations, and communication needs.

3. Make Time-Sensitive Decisions Participants must respond across communication, operations, finance, HR, and legal - often with incomplete information.

4. Monitor Response Impact Outcomes evolve based on decisions made - affecting public reaction, financial health, team morale, and compliance exposure.

5. Debrief and Reflect After each round, participants analyze outcomes, review blind spots, and adapt their response plans for the next round.

6. Iterate with New Challenges Multiple simulations can be run - ranging from internal failures to external shocks - to test agility, leadership, and resilience thinking.

Do participants need crisis experience? No. The simulation is suitable for learners with basic business knowledge and can be scaled in difficulty.

What types of crises are simulated? Cyberattacks, PR fallout, product failures, executive misconduct, market shocks, and more.

Is the simulation quantitative or qualitative? Primarily qualitative - focused on strategic decision-making, communication, and judgment under pressure.

Can we customise the crisis scenarios? Yes. Scenarios can be tailored by industry, region, or specific business functions.

Is it individual or team-based? It can be run as either. Team-based runs mirror real cross-functional crisis response groups.

How is performance measured? By decision quality, stakeholder impact, response timing, communication clarity, and overall resilience shown.

Can it be used in leadership or executive education? Yes. It is well-suited for both early-career professionals and senior leaders.

Are real-time updates included? Yes. The simulation includes dynamic developments and new inputs across each round to simulate uncertainty.

How long does the simulation run? From 2 hours (single crisis) to multi-session formats (series of escalating challenges).

Is debriefing included? Yes. Facilitator-led debriefs can focus on team dynamics, blind spots, and what would be done differently.

Decision speed and strategic judgment

Communication under stress

Stakeholder sensitivity and alignment

Ethical reasoning and regulatory awareness

Post-crisis reflection and learning

Team collaboration and leadership presence

Overall business resilience strategy

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated into by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.