In this hands-on Credit Risk Simulation, participants act as credit analysts and risk managers, evaluating borrower profiles, structuring loans, and managing defaults while balancing profitability, regulatory requirements, and portfolio stability.

Credit analysis and borrower profiling

Loan structuring and pricing

Probability of default and loss given default

Portfolio diversification and risk concentration

Credit ratings and external assessments

Regulatory frameworks and capital adequacy

Collateral, covenants, and risk mitigation tools

Stress testing and scenario analysis

Trade-offs between profitability and risk appetite

Stakeholder communication and reporting

Review borrower financials, industry data, and qualitative factors

Assign internal credit ratings and decide loan terms

Evaluate portfolio exposure and manage sector concentration

Respond to shocks such as defaults, downgrades, or policy changes

Balance growth goals with regulatory capital requirements

Communicate credit rationale to committees, boards, or regulators

By the end of the simulation, participants will be able to:

Conduct structured credit risk analysis using financial and qualitative data

Assess default probabilities and loss impacts across portfolios

Design loan structures aligned with risk-return goals

Apply stress testing and scenario planning

Navigate regulatory capital requirements and compliance

Manage portfolio concentration and diversification

Communicate risk assessments effectively to stakeholders

Balance profitability, ethics, and long-term stability

Adapt credit strategies to changing economic conditions

Strengthen collaboration across risk, business, and compliance teams

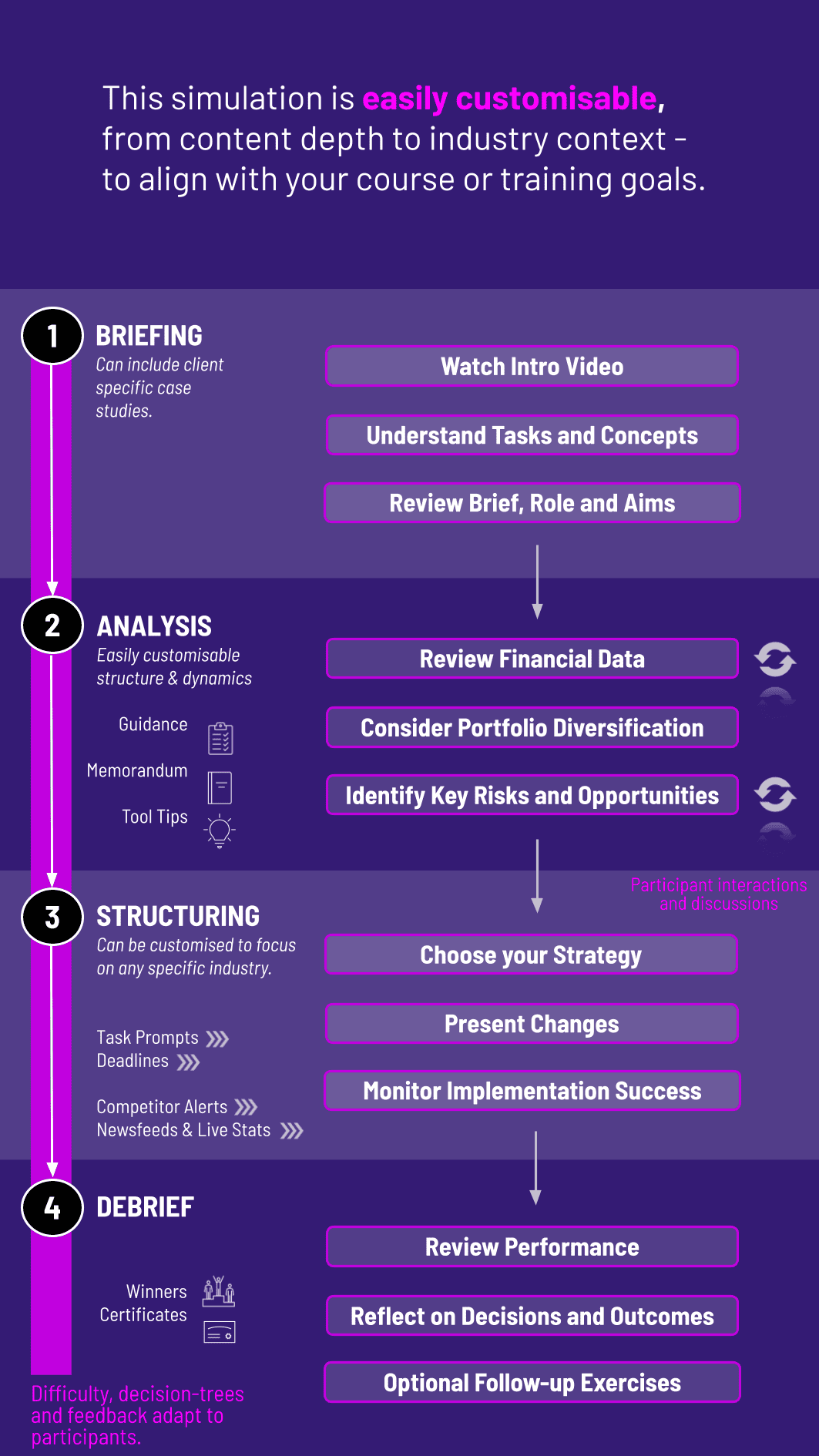

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

The simulation can run individually or in teams, in both academic and corporate contexts. Each cycle represents a lending decision or portfolio review.

1. Receive a Scenario or Brief: Participants are given a lending request, borrower profile, and macroeconomic conditions.

2. Analyse the Situation: They review financial statements, ratios, sector trends, and qualitative risks.

3. Make Credit Decisions: Participants set terms, decide on loan approval, and determine collateral or covenants.

4. Manage Portfolios: Over multiple rounds, participants adjust exposure, diversify, and manage defaults or downgrades.

5. Review Results and Reflect: They receive feedback on profitability, capital impact, and portfolio risk metrics.

6. Iterate with New Developments: Subsequent rounds introduce economic shifts, defaults, or regulatory changes requiring adaptation.

Do participants need a background in banking? Not necessarily. The simulation is accessible to learners at all levels, with guided explanations of key concepts.

Can it be adapted for corporate training? Yes. It’s widely used in banks and financial institutions for onboarding and upskilling credit teams.

Does it include regulatory frameworks? Yes. Capital adequacy, Basel requirements, and local regulations can be embedded.

Is this simulation based on real borrower data? Scenarios are inspired by real cases but anonymized for learning.

Can it be run in teams? Yes. Teams can represent credit committees, with debates and approvals built into the format.

What kinds of shocks are included? Defaults, sector downturns, interest rate changes, and regulatory shifts.

Does it include portfolio management? Yes. Beyond individual loans, participants manage overall portfolio exposure and diversification.

How long does it run? It can run as a short 2-hour module or across multi-day sessions.

Can universities integrate it into finance courses? Absolutely. It fits well into corporate finance, banking, and risk management curricula.

Is it available online? Yes. It can be delivered digitally, in-person, or in blended formats.

Quality and accuracy of credit analysis

Loan structuring and pricing decisions

Portfolio diversification and risk management

Responsiveness to shocks and stress scenarios

Communication clarity in committee or stakeholder settings

Peer/self-assessments to measure collaboration and reflection

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.