Participants take on the role of credit analysts, evaluating borrowers, interpreting financial ratios, and making real-time lending decisions in our Credit Risk Analysis Training.

Participants are introduced to foundational and advanced credit risk topics, including:

Financial Ratio Analysis: Liquidity, solvency, profitability, and coverage ratios

The 5 Cs of Credit: Character, Capacity, Capital, Conditions, and Collateral

Credit Scoring and Internal Ratings: Quantifying risk using scorecards and rating models

Covenant Structuring: Designing financial and operational covenants

Risk-Based Pricing: Aligning interest rates and loan structures with risk

Credit Approval Process: Navigating committees and risk reviews

Portfolio Risk Exposure: Balancing individual credit decisions with broader institutional exposure

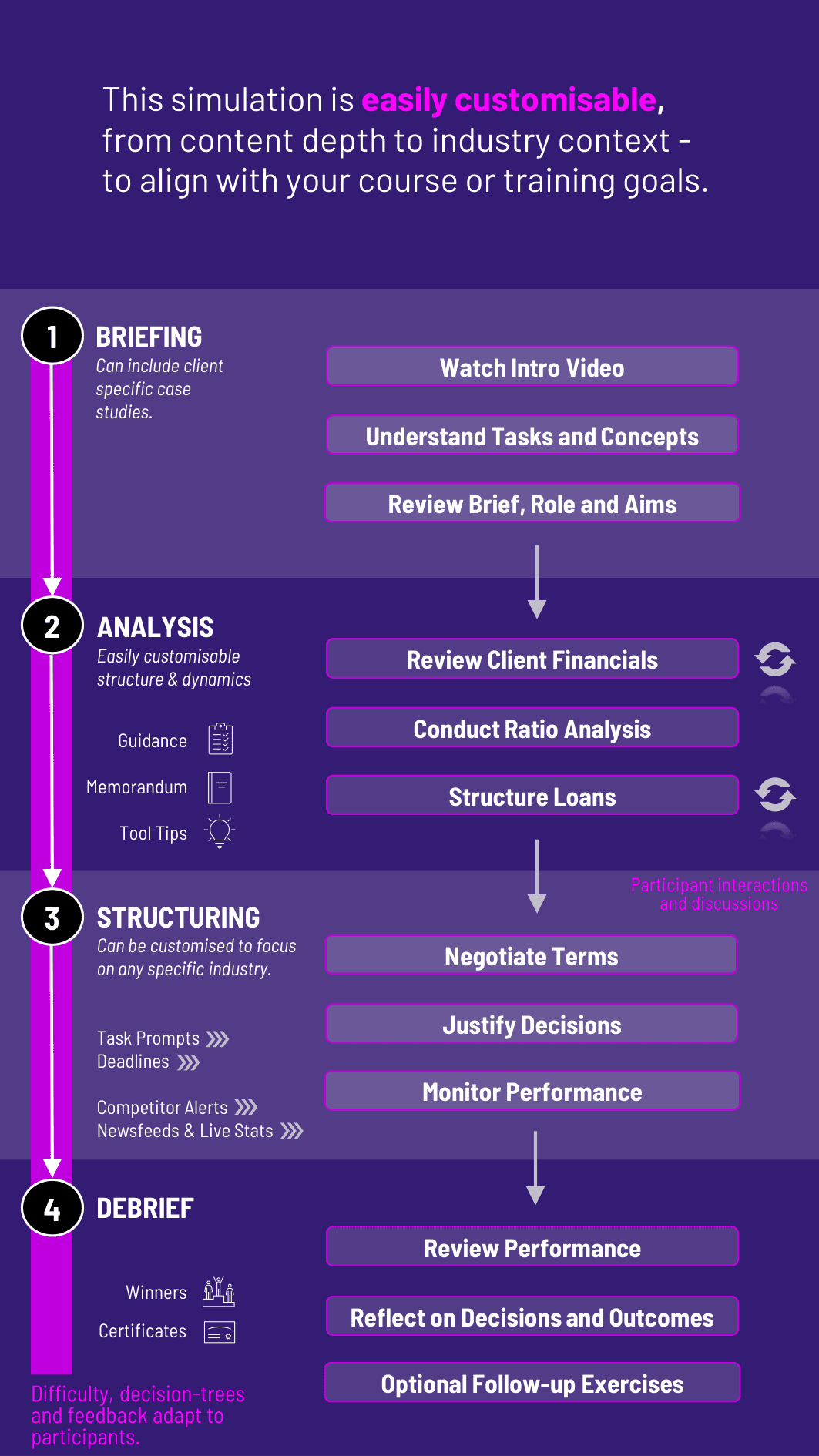

In this single or multiplayer course, participants act as credit analysts at a commercial bank. Their responsibilities include:

Reviewing client financials, credit histories, and business models

Conducting ratio analysis to assess risk

Asking probing questions to clarify ambiguities in the borrower’s narrative

Deciding whether to approve, reject, or conditionally structure a loan

Setting repayment terms, covenants, and collateral requirements

Justifying decisions to senior credit officers or investment committees

Monitoring post-lending performance and identifying early warning signals

This course trains participants to think like credit professionals under time pressure and imperfect information. Participants learn how to:

Apply credit analysis frameworks to real business cases

Identify red flags in borrower data and qualitative disclosures

Align lending decisions with institutional policy and risk appetite

Structure loans to mitigate identified risks

Communicate credit rationales clearly and confidently

Evaluate evolving borrower performance and trigger responses when needed

What background knowledge is required? Basic understanding of financial statements and ratios is recommended. No prior experience in credit or lending is necessary.

Is this best for undergraduates or postgraduates? Both. The course can be calibrated in complexity - from introductory ratio analysis to advanced structuring and portfolio risk themes.

How long does the course run? The course can be completed in 4 - 5 hours for a single round or extended over multiple sessions for deeper analysis and committee-style reviews.

Can participants work individually or in teams? It supports both formats. In team play, participants role-play analysts, relationship managers, and risk officers.

How are participants assessed? Scoring is based on risk-adjusted return, default avoidance, covenant discipline, and clarity of justification presented to the committee.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.