The Credit Analyst Simulation immerses you in the role of a junior credit analyst, where you will learn to assess the creditworthiness of companies, structure secure loan deals, and defend your recommendations to a loan committee.

The 5 Cs of Credit (Character, Capacity, Capital, Collateral, and Conditions)

Financial Statement Analysis

Ratio Analysis

Cash Flow Analysis

Credit Risk Modeling

Loan Structuring

Credit Memo Writing

Loan Committee Presentation

In the simulation, participants will:

Analyze historical financial statements for a case company.

Calculate and interpret key financial ratios and peer benchmarks.

Build an integrated financial model to project future performance and debt service capability.

Assess qualitative factors, including industry position and management strength.

Identify potential risks and mitigating factors for the loan.

Structure a proposed loan, including pricing and protective covenants.

Draft a professional Credit Approval Memo.

Present and defend your credit recommendation in a simulated Loan Committee meeting.

Perform a holistic credit analysis of a corporate borrower using quantitative and qualitative factors.

Interpret financial statements and ratios to identify trends, strengths, and red flags.

Construct a financial forecast to evaluate a company's future debt service capacity.

Structure a bank loan with appropriate terms, conditions, and covenants to protect the lender.

Compose a clear and concise credit memo that justifies a lending decision.

Defend a credit recommendation effectively under scrutiny, enhancing communication and critical thinking skills.

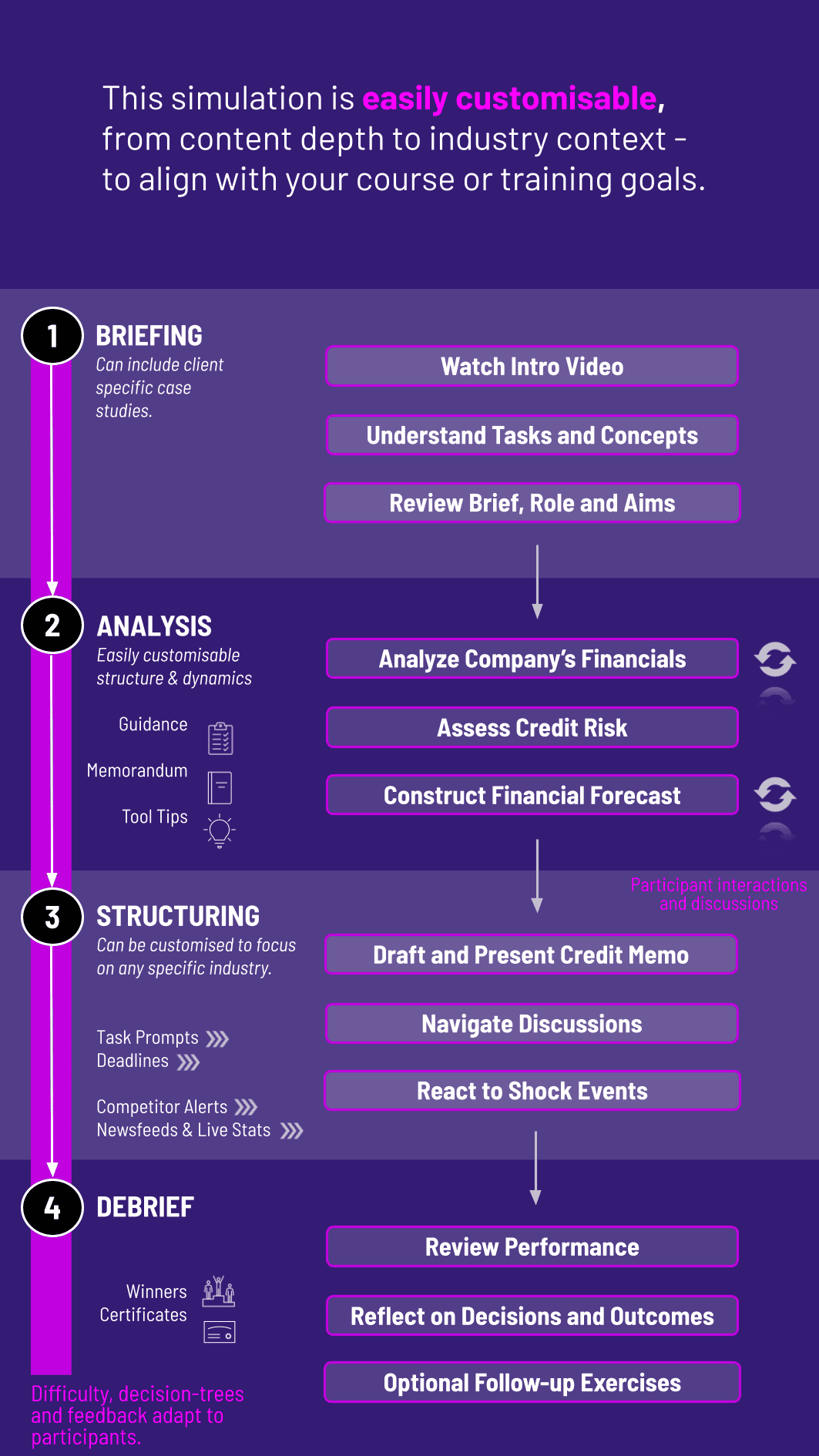

1. Introduction and Case Launch You receive the company's background, financials, industry data, and the loan request details.

2. Financial Analysis Phase You dive into the financials, calculate ratios, and benchmark the company against its peers.

3. Modeling and Forecasting Phase You build a projection model to forecast the company's financials and its ability to repay the loan under different scenarios.

4. Loan Structuring Phase Based on your risk assessment, you propose the final loan structure (amount, rate, term, covenants).

5. Credit Memo Submission You synthesize all your analysis into a formal Credit Approval Memo.

6. Loan Committee Presentation You present your findings and recommendation to an instructor or a panel acting as the Loan Committee, answering challenging questions in real-time.

Who is the Credit Analyst Simulation designed for? It is ideal for undergraduate and graduate business students, MBA candidates, career-changers, and junior finance professionals in commercial banking, corporate banking, credit risk, and private debt who want to build or sharpen their practical credit skills.

What are the prerequisites for this simulation? A foundational understanding of accounting and corporate finance is recommended. However, the simulation includes guides and resources to help refresh key concepts, making it accessible to motivated participants.

What software is required? The Simulation is entirely web-based and can be run using any modern browser (Chrome, Firefox, Safari) with a stable internet connection.

How long does the simulation take to complete? The simulation is designed to be flexible. It can be run as an intensive 1-2 day workshop or extended over a 4-6 week academic module, depending on the depth of analysis required.

Is this simulation relevant for investment banking or equity research roles? Absolutely. The deep financial analysis, modeling, and critical thinking skills developed are highly transferable and valued in investment banking, equity research, and corporate finance roles.

Do participants work individually or in teams? The simulation can be configured for both. Individual participation fosters deep personal mastery, while team-based work mirrors the collaborative environment of a real bank credit department.

How is the simulation graded or assessed? Assessment is based on the accuracy of financial analysis, the logic of the loan structuring, the quality of the written credit memo, and the persuasiveness of the loan committee defense. A detailed rubric is provided.

Can this simulation be customized for our specific program? Yes, we offer customization options, including tailoring the case company to a specific industry or focusing on particular learning outcomes for your curriculum.

Accuracy in financial ratio calculation, cash flow analysis, and the construction of a logical financial forecast model.

Ability to identify key risks, both financial and operational, and to structure a loan with appropriate covenants to mitigate those risks.

Clarity, structure, and professionalism of the written Credit Approval Memo.

Effectiveness in presenting the recommendation and responding to challenging questions from the Loan Committee, demonstrating understanding and critical thinking under pressure.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.