Step into the shoes of a credit analyst at a major commercial bank, where you will evaluate real-world company cases, assess their financial health, and make critical recommendations that balance risk and reward.

The Five Cs of Credit

Financial Statement Analysis

Ratio Analysis

Cash Flow Analysis

Debt Capacity Modeling

Loan Structuring

Covenants

Credit Memorandum

Risk Rating

In the simulation, participants will:

Analyze a detailed case study of a company requesting financing.

Perform a thorough fundamental analysis, including SWOT and industry review.

Build integrated financial models to forecast future performance and debt capacity.

Calculate and interpret key financial ratios and compare them to industry benchmarks.

Structure a proposed loan, including size, terms, and pricing (interest rate).

Draft a set of financial covenants to monitor the borrower's health.

Prepare a professional Credit Memorandum summarizing the analysis and recommendation.

Present and defend their lending decision in a simulated Credit Committee meeting.

Understand the end-to-end process of corporate credit analysis from a lender's perspective.

Analyze a company's financial health and its ability to generate sufficient cash flow to service debt.

Construct a financial model to project future performance and determine a company's debt capacity.

Structure a syndicated or bilateral loan, including appropriate terms, covenants, and pricing based on risk.

Synthesize quantitative and qualitative findings into a coherent Credit Memorandum.

Recommend a clear lending decision (Approve, Deny, or Approve with Conditions) and justify it effectively.

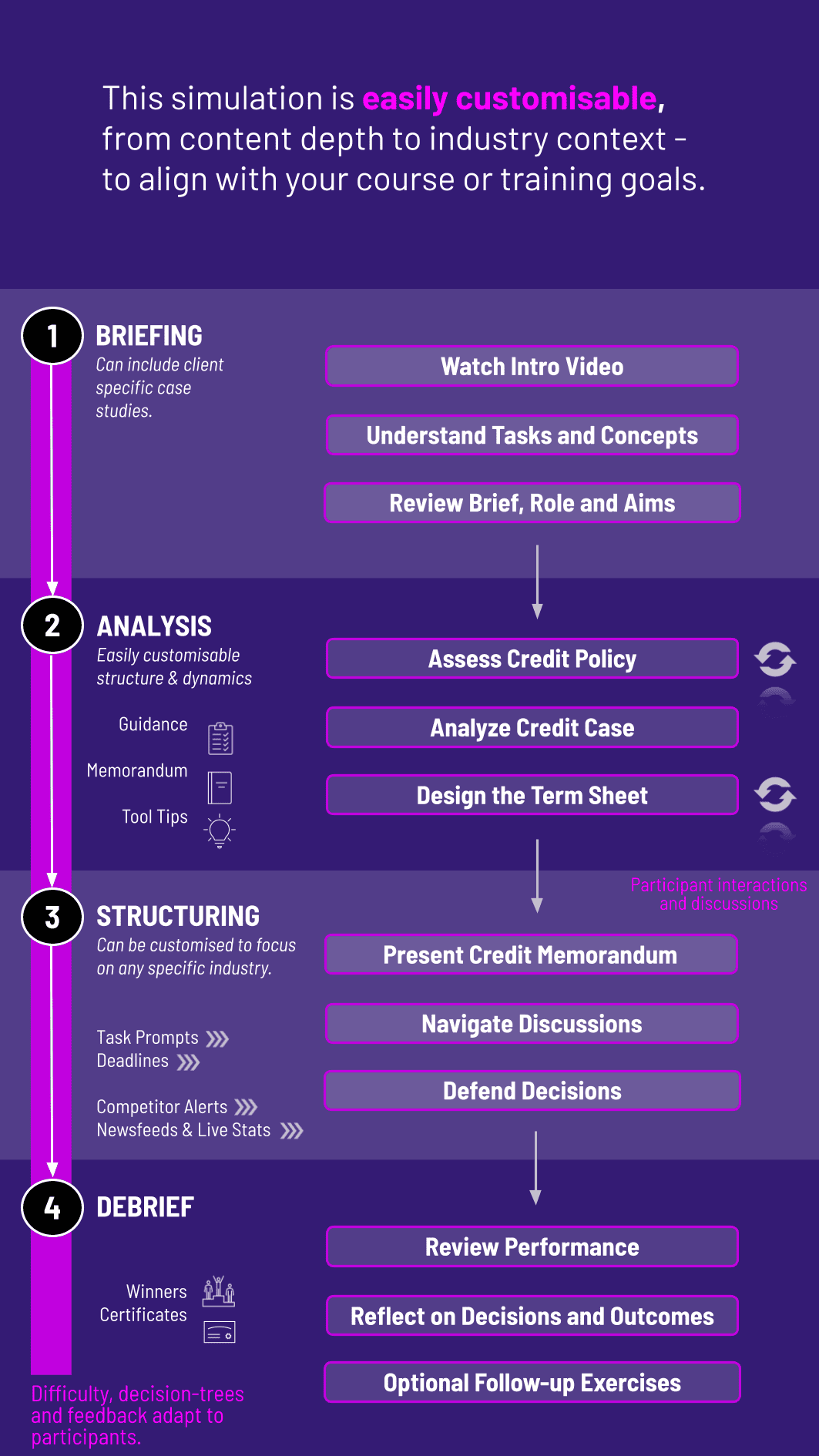

1. Introduction and Case Launch Participants are introduced to the bank's credit policy and receive the detailed case study of the corporate borrower.

2. Financial Analysis Phase Using provided financials and market data, participants analyze historical trends, build forecasts, and calculate key credit metrics.

3. Loan Structuring Phase Based on their analysis, participants design a term sheet, proposing the loan amount, interest rate, maturity, and covenants.

4. Credit Memo Submission Participants compile their analysis, recommendation, and term sheet into a formal Credit Memorandum.

5. Credit Committee Meeting Teams present their findings to a "Credit Committee" (composed of instructors or peers), answer challenging questions, and defend their final decision.

Who is the Credit Analysis Simulation designed for? It is ideal for MBA students, finance undergraduates, early-career bankers, and professionals in commercial lending, corporate banking, or private debt who want to solidify their credit skills.

What are the prerequisites for this simulation? A foundational understanding of accounting and corporate finance is recommended. However, pre-reading materials and refresher guides are provided to ensure all participants are on a level playing field.

Is this a debt financing simulation? Yes, this simulation focuses specifically on debt financing from the lender's perspective. It complements our other simulations like M&A and Investment Banking, which often view capital from the issuer/borrower's side.

What kind of companies do we analyze in the simulation? The cases feature realistic, proprietary scenarios of mid-market companies across various industries, often facing growth, acquisition, or restructuring financing needs.

Do we need prior experience with financial modeling? While helpful, it is not required. The simulation provides Excel-based templates and step-by-step guidance to build a robust credit model, making it accessible for beginners while still challenging for those with experience.

How long does the simulation typically take to complete? The core simulation can be run as an intensive 1-2 day workshop or extended over several weeks as part of a university course, depending on the depth of analysis required.

Can this credit risk simulation be customized for our institution? Absolutely. We can tailor the case studies, industries, and loan types to match your specific curriculum or training objectives.

What makes this simulation different from a standard case study? Unlike passive case studies, this is an active simulation. Participants make real-time decisions, face consequences, and must defend their reasoning in a dynamic Credit Committee setting, mirroring the pressures and collaborative nature of a real banking environment.

Depth of financial analysis

Accuracy of calculations

Logical structuring of the loan.

Accuracy, structure, and the validity of the assumptions used in the debt capacity forecast.

Professionalism of the presentation

The strength of the recommendation

The ability to handle challenging questions from the committee.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.