This simulation challenges participants to act as credit analysts and loan committee members, evaluating corporate loan applications, assessing risks, structuring deals, and making pivotal lending decisions that balance profitability with prudence.

The 5 Cs of Credit

Financial Statement Analysis for Lending

Cash Flow Analysis and Debt Service Coverage

Loan Structuring: Tenor, Amortization, and Pricing

Financial Covenant Design and Monitoring

Credit Risk Grading and Probability of Default

Qualitative Risk Assessment and Management Evaluation

Credit Memorandum Writing and Committee Presentation

In the simulation, participants will:

Analyze full-scale corporate financial statements (Income Statement, Balance Sheet, Cash Flow).

Build a dynamic loan model to forecast future cash flows and debt service capacity.

Calculate and interpret key credit ratios and compare them to industry benchmarks.

Structure specific loan terms, including size, interest rate, maturity, and amortization schedule.

Draft and negotiate financial and performance covenants to mitigate risk.

Prepare a professional Credit Approval Memo summarizing analysis and recommendations.

Present and defend their lending proposal in a simulated Loan Credit Committee.

Make a final approve/decline decision and monitor the outcome of their portfolio.

Develop Proficiency in analyzing corporate borrowers from a lender’s perspective.

Apply Financial Analysis to assess a company’s ability to service and repay debt.

Design and Structure a corporate loan, aligning terms with identified risks and opportunities.

Understand the Role of covenants in protecting the lender and signaling early distress.

Enhance Decision-Making and judgment skills under uncertainty and risk-return trade-offs.

Improve Communication skills by articulating credit rationale clearly and concisely in written and oral formats.

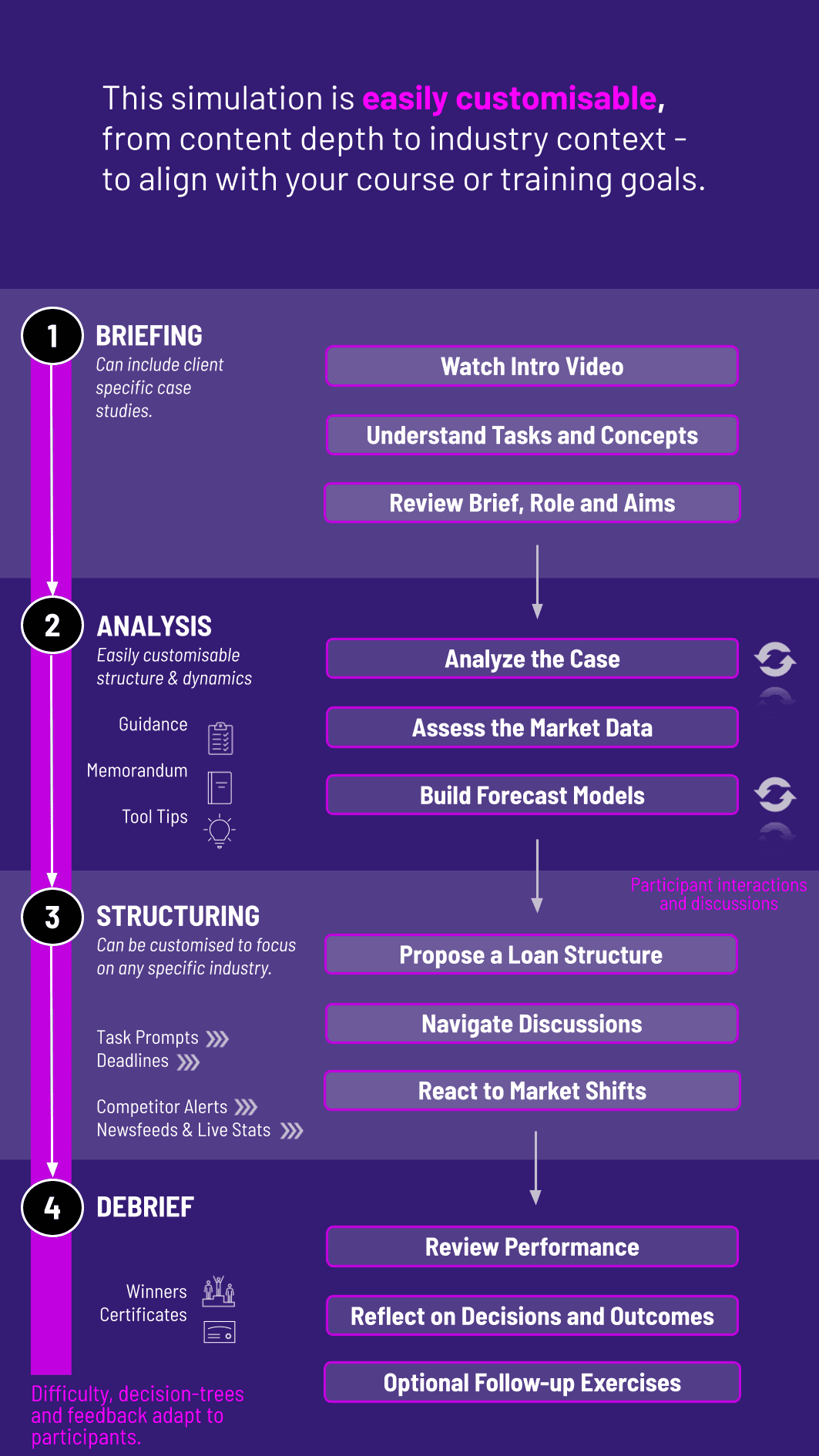

1. Introduction and Role Assignment Participants are briefed on their role as Credit Analysts and introduced to the simulation platform and the bank’s risk appetite.

2. Deal Pipeline Review Teams receive a pipeline of 3-4 distinct corporate loan cases, each with a business summary and historical financials.

3. Deep Dive Analysis For each case, participants conduct quantitative modeling and qualitative research, using provided tools and data.

4. Structuring and Proposal Based on their analysis, participants structure a proposed loan and draft a formal Credit Approval Memo.

5. Credit Committee Teams present their top loan proposal to a simulated credit committee (instructors or peers), facing challenging questions.

6. Decision and Feedback Final decisions are locked in. The simulation provides dynamic feedback on the performance of the loan portfolio over time, showing the consequences of each decision.

7. Debrief A comprehensive review links simulation experiences to core credit principles and real-world banking practices.

Who is this Corporate Lending Simulation designed for? This simulation is ideal for business school students, early-career bankers in commercial or corporate banking, finance professionals transitioning to lending roles, and any corporate finance practitioners seeking to understand the lender’s perspective.

What prior finance knowledge is required? A foundational understanding of financial statements (income statement, balance sheet, cash flow) and basic financial ratios is recommended. The simulation includes guidance to help participants apply this knowledge to credit-specific contexts.

How long does the Credit Analysis Simulation take to complete? The simulation is modular and flexible. A typical workshop runs 4-8 hours. It can be condensed for a focused session or extended over multiple days for deeper analysis and presentation sessions.

Is this simulation focused on large corporate or middle-market lending? The simulation covers principles universal to all corporate lending. The case studies are designed to reflect a mix of middle-market and smaller corporate borrowers, where comprehensive analysis of both financial and business risks is most critical.

Can participants use Excel during the simulation? Yes. The simulation encourages, and often requires, the use of Excel (or similar) for building financial projection and debt service models. It reinforces the technical skills required for a career in credit.

How is the simulation delivered for university or corporate training? We provide a complete package: a facilitator’s guide, participant logins to our web-based platform, all case materials, Excel templates, and debrief slides. It can be run in-person or virtually with equal effectiveness.

What makes this simulation different from a standard case study? Unlike static case studies, this simulation is dynamic and decision-driven. Participants see the consequences of their structuring choices, covenants are tested by simulated events, and the portfolio outcome changes based on the quality of their collective analysis and judgment.

Evaluation of the correctness of financial models, ratio calculations, and cash flow projections.

Assessment of the appropriateness of proposed loan terms (pricing, covenants, structure) relative to the identified risks.

Scoring based on the clarity, completeness, and persuasiveness of the written recommendation and committee defense.

The risk-adjusted return of the participant’s approved loan portfolio within the simulation.

Qualitative feedback during the credit committee and final debrief sessions on analytical rigor and critical thinking.

This multi-faceted approach ensures participants are assessed not just on numerical skills, but on the holistic judgment required of a proficient credit professional.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.