The Cost-Volume-Profit (CVP) Analysis Simulation is an immersive, interactive learning experience designed to help participants understand how costs, volume (sales), and pricing decisions influence a company’s profitability in the short term.

Fixed Costs

Variable Costs

Contribution Margin

Contribution Margin Ratio

Break-Even Point

Target Profit Volume

Margin of Safety

”What-If” / Sensitivity Analysis

In the simulation, participants will:

Classify costs into fixed and variable components.

Determine selling price per unit for a product.

Estimate potential units to be sold under different market scenarios.

Compute contribution margin

Calculate the break-even point

Model target profit scenarios

Perform sensitivity testing

Analyze margin of safety and assess the risk and buffer before incurring losses.

Make managerial recommendations

Understand and articulate the basic components and assumptions of CVP analysis.

Compute break-even points and target profit volumes under various cost, price, and volume settings.

Use contribution margin and margin-of-safety metrics to assess business risk and profitability.

Conduct sensitivity (“what-if”) analysis to understand how changes in pricing, costs, or sales volume impact profit.

Make informed business decisions about pricing, cost management, product launch, production volume, and profitability planning.

Present financial insights and recommendations clearly — as would be required in managerial or board-level discussions.

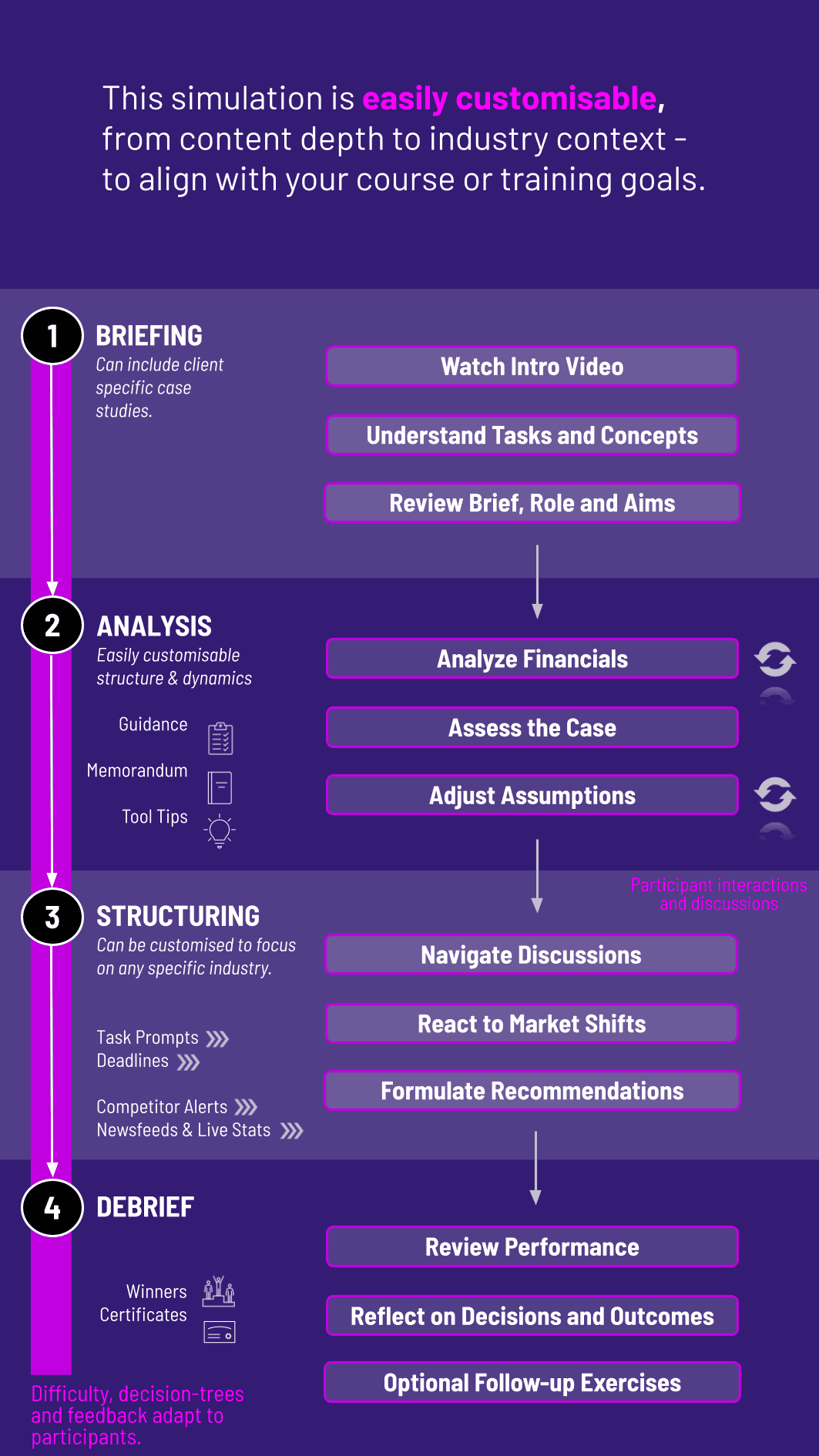

1. Scenario Setup Participants are presented with a business case. The case includes baseline data: fixed costs, variable cost per unit, expected demand, and suggested selling price.

2. Interactive Input Using a simulation dashboard, participants enter or modify inputs — such as unit price, variable cost, fixed costs, and expected volume.

3. Visual Outputs Charts and graphs visualize how costs, revenue, and profit change with volume.

4. What-If Analysis Rounds Participants run several rounds, adjusting assumptions and immediately see the impact on profitability.

5. Decision and Recommendation Finally, participants evaluate results and formulate strategic recommendations: whether to proceed with production, adjust pricing, reduce costs, or alter sales targets.

Why run a simulation rather than a simple CVP calculation? A simulation allows you to test multiple scenarios (cost increases, price changes, or sales variability) in a risk-free, dynamic environment. It offers more realistic decision-making practice, where you can instantly see the effects of different strategies before implementing them in real life.

What are the main components of CVP analysis? The main components are fixed costs, variable costs, sales volume, selling price per unit, contribution margin, and break-even point. In some versions, you may also consider product mix when multiple products are involved.

When is CVP analysis most useful? CVP is most useful for short-term business planning. It is particularly valuable when costs and prices are relatively stable, and sales volume is uncertain.

How does the simulation help with “what-if” and sensitivity analysis? The simulation lets you adjust inputs and instantly see the impact on break-even point, profit, and margin of safety. This helps you understand which variables are most sensitive — and how changes affect business viability under different scenarios.

Who should participate in a CVP Analysis Simulation? The simulation is ideal for business students (BBA, MBA), accounting or finance trainees, entrepreneurs, product managers, and anyone involved in pricing, budgeting, or profitability planning. It’s also useful for executives who need to understand cost structure and volume decisions.

Quality of the CVP analysis and supporting data used to justify each round’s key decisions (pricing, production, investment).

Effectiveness in responding to market volatility and recalculating break-even points.

A concise executive summary or presentation explaining the team’s strategy, how CVP guided decisions, key lessons learned, and what they would do differently.

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.