In this hands-on Cost of Capital Simulation, participants are corporate finance professionals tasked with calculating and applying the WACC to guide investment and financing decisions under real-world constraints.

Cost of Equity: Using CAPM, beta estimation, and equity risk premiums

Cost of Debt: Considering credit spreads, default risk, and tax shields

Weighted Average Cost of Capital (WACC): Understanding capital mix, weights, and firm value impact

Capital Structure Optimization: Debt vs. equity trade-offs

Project Valuation: Applying WACC to investment appraisal, NPV, and IRR

Macroeconomic Impact: Interest rate shifts, inflation, and credit cycle influences

Investor Communication: Justifying assumptions and capital allocation decisions

Strategic Financing Choices: Debt issuance, buybacks, equity raises, and hybrid instruments

Analyze current capital structure and financial strategy

Estimate cost of equity using market data, risk-free rate, and beta

Calculate cost of debt based on ratings, covenants, and debt maturity

Determine WACC using appropriate weighting and tax considerations

Evaluate potential projects, acquisitions, or funding approaches

Defend cost of capital assumptions to boards or investors

Adjust assumptions in response to changing economic data

Monitor how WACC changes with business or capital structure shifts

Each decision round builds on previous outcomes, encouraging continuous iteration and improvement.

By the end of the simulation, participants will be confident in:

Accurately calculating the cost of equity, debt, and WACC

Understanding how capital structure affects firm valuation

Making investment decisions using discount rates tied to real-world data

Communicating finance concepts clearly to non-technical stakeholders

Applying WACC to NPV, DCF, and capital budgeting decisions

Evaluating the effects of risk, interest rates, and taxes on financing

Using cost of capital insights in M&A, fundraising, and corporate strategy

Justifying assumptions and navigating ambiguity in decision-making

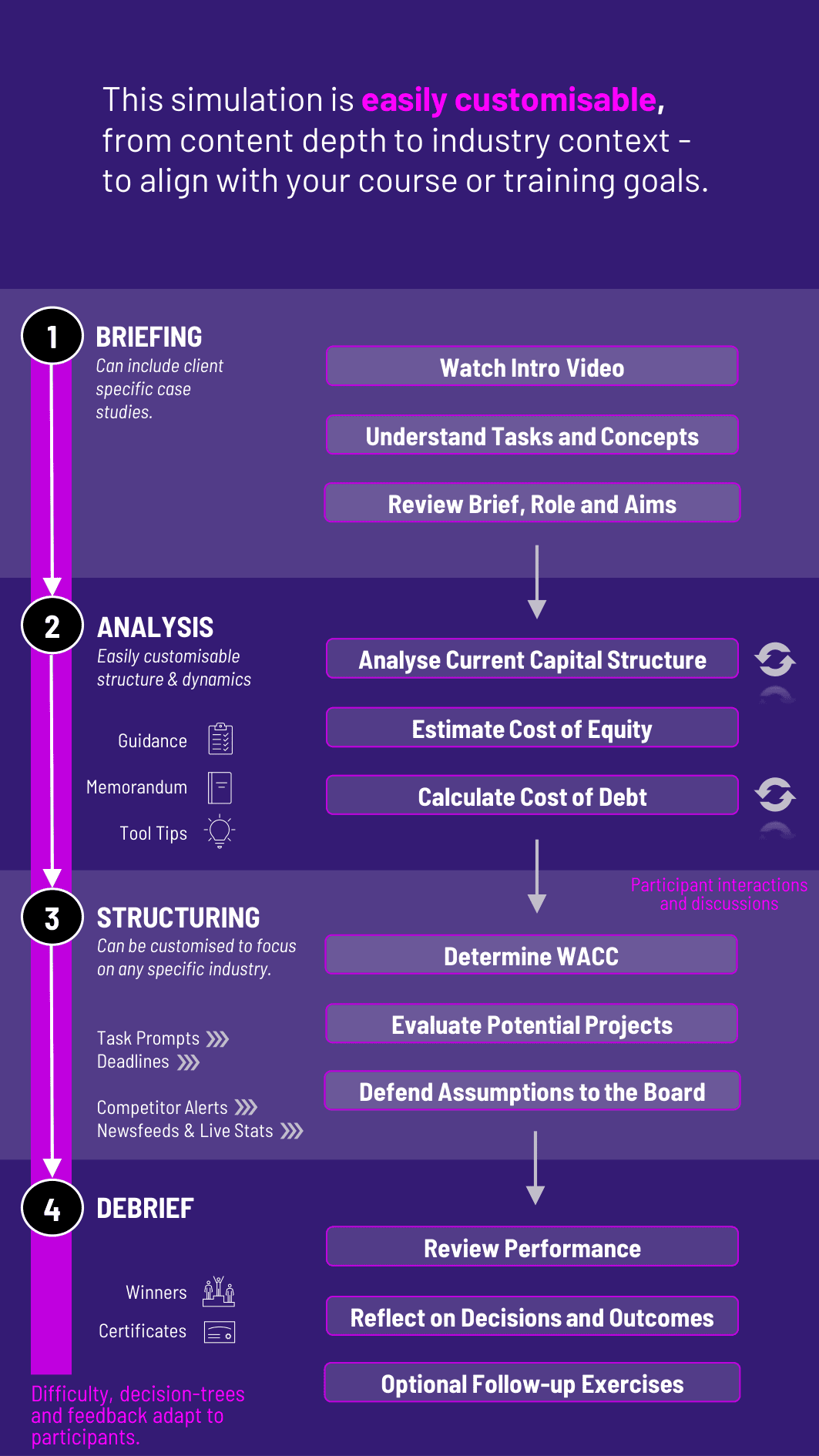

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

1. Receive a Case Brief Participants begin with a business context: a company considering a capital project, funding plan, or acquisition.

2. Analyze Financial Structure They assess the current capital structure, recent financing decisions, and market conditions.

3. Estimate Cost of Capital Using guided steps or provided data, they estimate the cost of equity and debt and calculate WACC.

4. Make Capital Allocation Decisions They apply WACC to project evaluations and determine whether to proceed with investments or change funding strategy.

5. Defend and Communicate Participants justify their assumptions and decisions to stakeholders - simulated boards, investors, or finance committees.

6. Adapt and Iterate As the market or internal strategy shifts, participants adjust their calculations and recommendations in future rounds.

Do participants need prior finance experience? A basic understanding of financial statements helps, but the simulation is guided and can be adjusted for beginner to advanced levels.

Does the simulation teach CAPM and beta? Yes. Participants estimate beta, equity risk premiums, and risk-free rates to calculate the cost of equity.

Can this be used in valuation courses? Absolutely. WACC plays a key role in DCF modeling, investment appraisal, and M&A.

Is it suitable for corporate training? Yes. It’s ideal for upskilling finance teams, analysts, and strategy professionals.

How long is the simulation? It can run in 3 - 4 hours or be stretched across multiple sessions with deeper analysis and reflection.

Can the scenarios be customized by industry? Yes. Case briefs can reflect sectors like tech, manufacturing, retail, or financial services.

Are group decisions part of the simulation? Yes. Teams can collaborate on assumptions, debate discount rates, and present as a finance committee.

How is feedback delivered? Participants receive performance metrics, variance from optimal WACC, and stakeholder response feedback.

Does it simulate capital structure changes? Yes. Participants can model different mixes of debt and equity to see how WACC shifts.

Is this a prerequisite for other simulations? It pairs well with M&A, valuation, or corporate strategy simulations - but stands alone effectively too.

Accuracy and defensibility of WACC calculations

Strategic thinking in capital allocation decisions

Communication clarity in presenting assumptions

Responsiveness to new data or interest rate shifts

Understanding of risk-return trade-offs

Team collaboration and stakeholder engagement

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.