Immerse yourself in the practical and critical task of calculating the Weighted Average Cost of Capital. Experience the challenges, assumptions, and strategic implications of determining the rate that dictates every major corporate investment decision.

Weighted Average Cost of Capital

Capital Asset Pricing Model

Beta (Levered and Unlevered)

Risk-Free Rate and Market Risk Premium

Cost of Debt and Credit Spreads

Capital Structure (Debt/Equity Ratio)

Tax Shield of Debt

Dividend Discount Model (DDM)

Market Efficiency and Data Sourcing

In the simulation, participants will:

Extract and analyze financial data from simulated company balance sheets and income statements.

Research current market data, including government bond yields and company credit spreads.

Calculate the cost of equity using both the CAPM and DDM approaches.

Estimate the company's beta and analyze its sensitivity to different time periods and peer groups.

Determine a realistic cost of debt based on simulated credit ratings.

Construct the firm's target capital structure and compute the final WACC.

Perform a sensitivity analysis to understand how changes in assumptions impact the WACC.

Compare their calculated WACC against a competitor's to assess relative investment attractiveness.

Explain the critical role of WACC as a hurdle rate in corporate finance and investment decisions.

Source relevant financial and market data necessary for cost of capital calculations.

Apply the CAPM and DDM models to calculate a company's cost of equity.

Differentiate between levered and unlevered beta and perform the relevering calculations.

Calculate the after-tax cost of debt, incorporating credit risk and tax shields.

Construct a WACC formula using a target capital structure.

Analyze the sensitivity of WACC to changes in key input variables (beta, risk-free rate, debt ratio).

Critique the assumptions and potential pitfalls inherent in any cost of capital estimation.

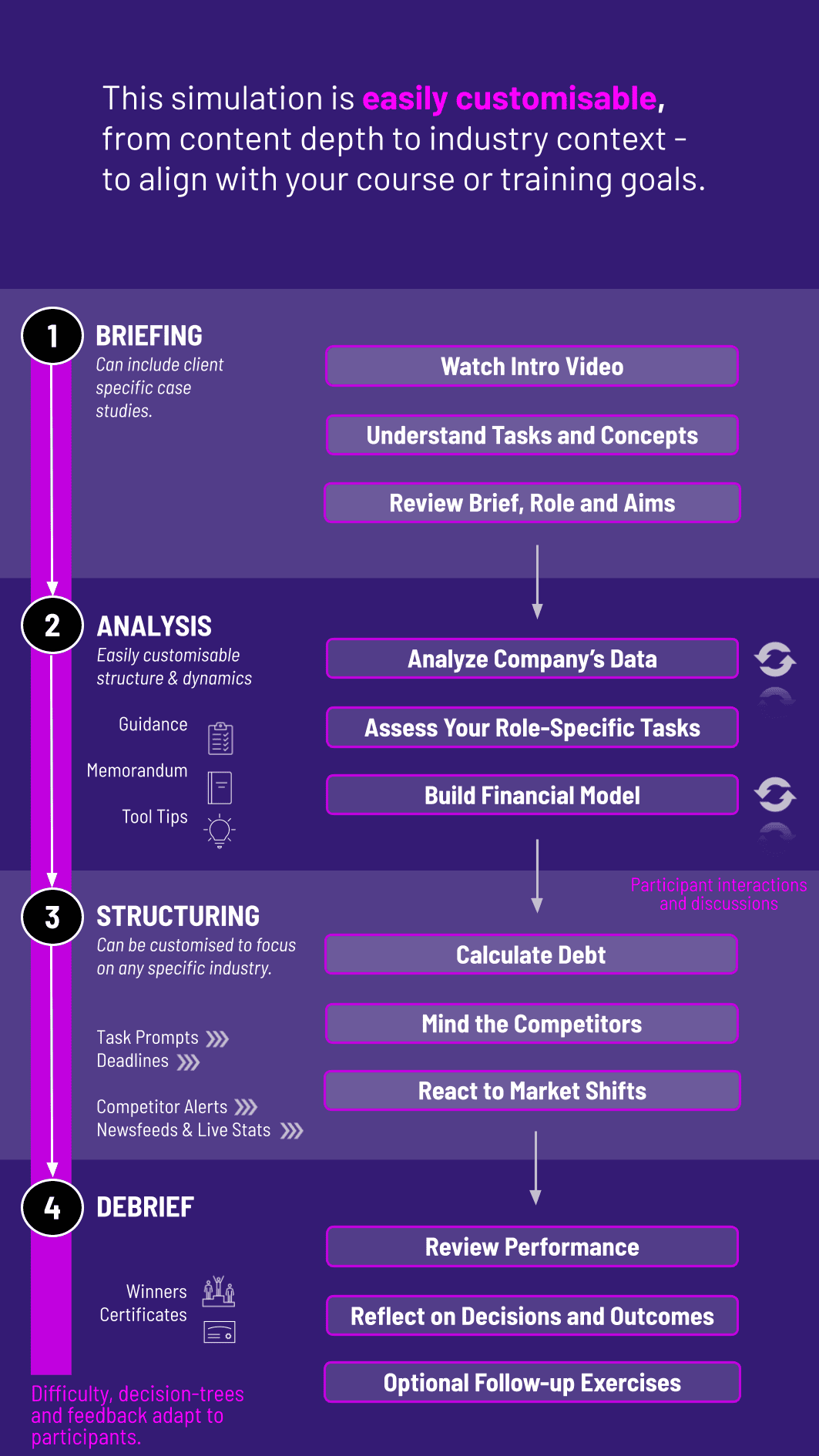

1. Introduction and Briefing Participants receive a briefing on their company and the overall goal: to determine an accurate WACC for capital budgeting purposes.

2. Data Collection Phase They access a simulated financial terminal to gather data (company 10-Ks and quarterly reports, historical stock prices and dividend data, current government bond yields, corporate bond yields and credit rating information)

3. Calculation Phase Using provided spreadsheet tools integrated into the platform, participants perform their calculations. The system allows them to input their assumptions for beta estimation, risk premium.

4. Sensitivity Analysis Participants use sliders to adjust key inputs and instantly see the impact on the final WACC, fostering a deeper understanding of driver relationships.

5. Reporting and Debrief Participants submit their final WACC report. The session concludes with an instructor-led debrief comparing results, discussing the range of valid answers, and highlighting the qualitative judgment involved in quantitative finance.

What is the target audience for this simulation? This simulation is ideal for MBA students, undergraduate finance majors, and professionals in corporate finance, investment banking, and equity research roles who need a practical understanding of valuation fundamentals.

Do participants need advanced Excel skills? Basic Excel proficiency is helpful, as the simulation involves spreadsheet-based calculations. However, the platform provides templated worksheets and formulas to guide all necessary computations, making it accessible.

How long does it take to complete the simulation? The core simulation can be completed in a 2-3 hour session. This can be extended with deeper analysis, team presentations, and a comprehensive debrief.

Is this simulation focused on a single company or multiple industries? The core module typically features one primary company for in-depth analysis. However, many of our simulations include a comparable company analysis, and we offer different industry-specific scenarios (e.g., Tech, Utilities, Manufacturing) to vary the learning experience.

How does the simulation handle different capital structure theories (like Modigliani-Miller)? While the core task is to calculate the current WACC, the debrief and advanced analysis sections explore how WACC changes with leverage, introducing concepts from Modigliani-Miller and the trade-off theory of capital structure.

Can this simulation be integrated into a larger corporate finance course? Absolutely. It serves as a perfect practical application module following theoretical lessons on time value of money, capital budgeting, and cost of capital. It directly sets the stage for more advanced topics like DCF valuation and M&A.

How current is the market data in the simulation? The simulation uses a controlled, realistic market environment that is periodically updated to reflect modern financial conditions. This ensures consistency and fairness for all participants, regardless of when they run the simulation.

What makes this simulation better than a traditional case study? Unlike a static case study, our simulation is interactive and dynamic. Participants actively source data, make their own assumptions, and instantly see the outcomes of their decisions. This learn-by-doing approach leads to higher knowledge retention and a more realistic appreciation of the challenges involved.

The technical correctness of the final WACC calculation, including the proper derivation of its components (Cost of Equity, Cost of Debt, Weights).

The quality of the written rationale for key assumptions (chosen Market Risk Premium, Beta estimation method, target capital structure). This emphasizes that the "why" is as important as the "what."

The depth of insight demonstrated in the sensitivity analysis, showing an understanding of which variables have the most significant impact on the WACC and why.

The ability to contextualize their calculated WACC against a peer company and industry averages, demonstrating strategic thinking.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.