Participants take on cost accounting roles, allocating costs, analyzing variances, and supporting decision-making in a dynamic business environment where cost control and strategic insight directly affect performance.

Cost Classification: Direct vs. indirect, fixed vs. variable

Cost Allocation Methods: Job costing, process costing, activity-based costing

Overhead Allocation and Absorption

Standard Costing and Variance Analysis

Contribution Margin and Break-even Analysis

Inventory Valuation (FIFO, LIFO, Weighted Average)

Cost-Volume-Profit (CVP) Relationships

Budgeting and Forecasting

Responsibility Accounting and Cost Centers

Relevant Costing for Decision-Making

Collect cost data from departments and projects

Select and apply appropriate costing methods for various scenarios

Allocate overheads and track direct materials and labor

Analyze actual vs. budgeted results and explain variances

Decide on pricing strategies based on cost behavior

Recommend make-or-buy, outsourcing, or product discontinuation options

Identify bottlenecks or inefficiencies in operations

Respond to changes in volume, pricing, or raw material costs

Present cost insights to managers for business decisions

Revise cost systems in response to evolving conditions

Understand the classification and behavior of different types of costs.

Apply appropriate cost allocation techniques in diverse business settings.

Use job, process, and activity-based costing systems to assign costs accurately.

Analyze variances between actual and standard costs to explain performance gaps.

Apply contribution margin and break-even analysis for decision support.

Evaluate pricing and product-line decisions using relevant cost data.

Interpret cost-volume-profit relationships to forecast profit outcomes.

Understand the impact of inventory costing methods on reported income.

Support budgeting processes by estimating and allocating future costs.

Communicate cost insights effectively to influence operational and strategic decisions.

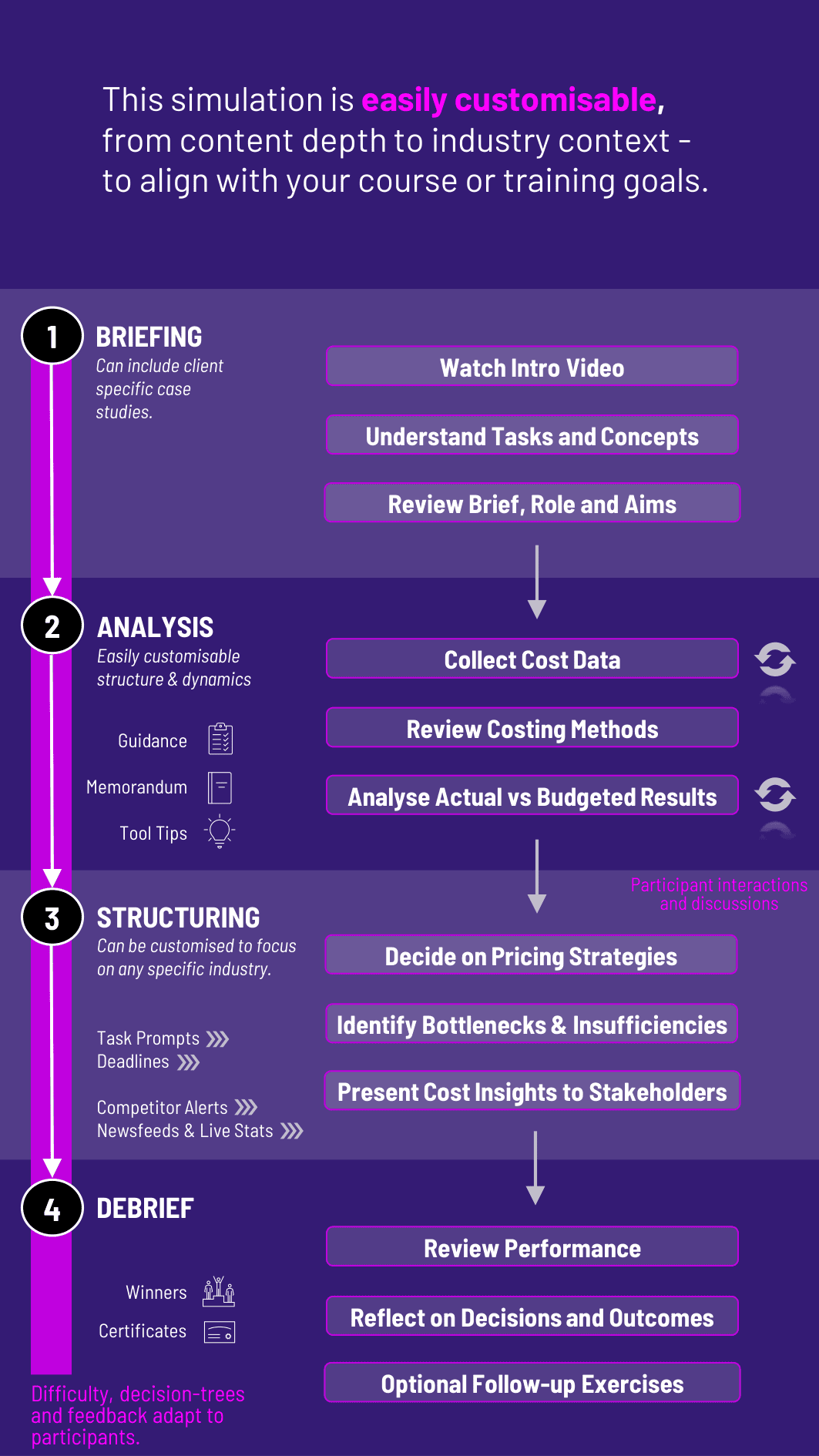

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

1. Scenario Setup Participants receive a business scenario that includes product lines, cost structures, and performance targets. They review internal reports, production data, and financial goals to frame their approach.

2. Cost Data Collection and Classification They identify fixed, variable, direct, and indirect costs from operations. Participants must determine how best to organize and interpret the data.

3. Cost Allocation and Method Selection Using guided tools, participants apply costing systems (e.g., ABC or job costing) to assign costs to products, services, or departments.

4. Decision-Making Based on Cost Analysis With full cost data available, participants make decisions about pricing, outsourcing, product mix, or operational improvements.

5. Variance and Performance Analysis After implementing decisions, participants receive results showing performance, cost control, and efficiency metrics - including variance reports.

6. New Round Challenges Each new round introduces fresh cost pressures or strategic decisions (e.g., a supplier cost spike or a drop in demand), prompting recalibration and revised analysis.

Is this simulation suitable for students without accounting backgrounds? Yes, it includes structured guidance and builds foundational knowledge step-by-step.

Can I use this in both accounting and operations courses? Absolutely - it bridges both fields and is ideal for interdisciplinary learning.

Does it cover both manufacturing and service scenarios? Yes. The simulation can be tailored for either or both contexts.

How long does the simulation run? It can be delivered in 3 - 4 hours or as a multi-session course module.

Do students work individually or in teams? It supports both individual and team play formats.

Are standard costing and variance analysis included? Yes, these are core parts of the decision-making and feedback process.

Can learners choose between different costing methods? Yes. Participants experiment with job costing, ABC, or process costing.

Are pricing decisions included? Yes. Cost data informs key pricing and profitability trade-offs.

Does it integrate budgeting elements? Yes. Participants make cost forecasts as part of their planning process.

Is performance tracked over multiple rounds? Yes. Each round builds on the last with cumulative feedback and learning.

Accuracy of cost allocation and classification

Effectiveness of costing method selection

Depth of variance analysis and response

Soundness of pricing or operational decisions

Communication of cost findings and strategic recommendations

Improvement across simulation rounds

Strategic use of relevant costing

Team collaboration (where applicable)

Engagement with financial and non-financial drivers

Final performance summary and optional reflection memo

Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.