Participants act as corporate finance leaders - designing tax strategies, managing global operations, and balancing compliance with efficiency - in our Corporate Tax Strategy Course.

Effective Tax Rate (ETR) Management: Balancing domestic and global obligations

Jurisdictional Planning: Understanding tax regimes, treaties, and transfer pricing

Deferred Taxes and Timing Differences

Intellectual Property (IP) Structuring: Tax-efficient holding companies

Transfer Pricing: Arm’s-length principles and cost-sharing arrangements

Tax Incentives and Credits: R&D credits, accelerated depreciation, green tax policies

GAAR and BEPS Compliance: Navigating anti-avoidance and OECD frameworks

Reputation and ESG: Aligning tax practices with stakeholder expectations

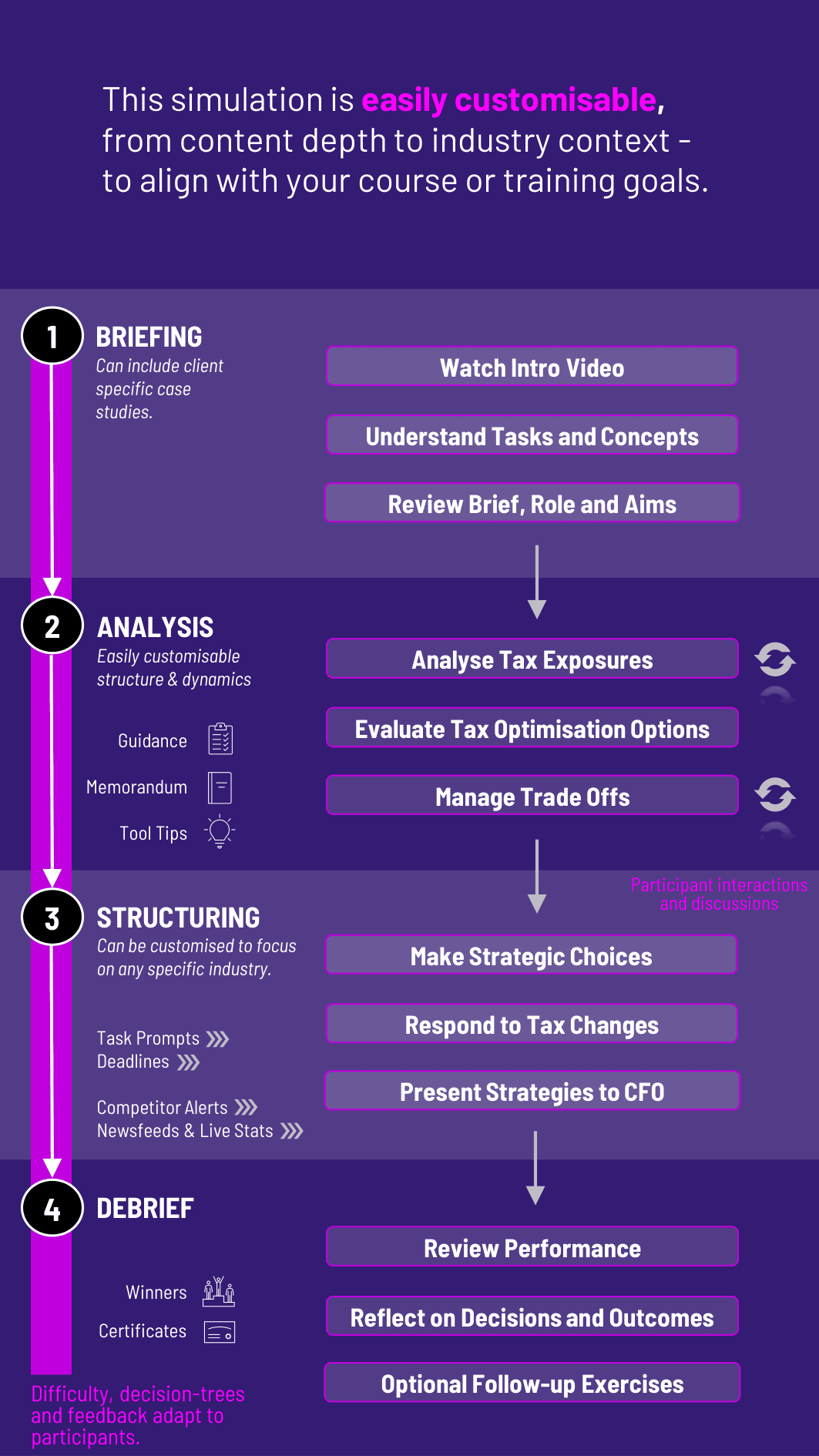

Analyze current tax exposure across global subsidiaries

Evaluate tax optimization options (e.g. intercompany loans, IP transfers, holding structures)

Make strategic choices on transfer pricing, repatriation, and entity location

Respond to simulated changes in legislation (e.g. global minimum tax, tax treaty revisions)

Present tax strategy recommendations to the CFO or board

Manage trade-offs between tax efficiency, compliance risk, and reputation

The course teaches participants to think of tax not just as a cost - but as a strategic function. They learn how to:

Design and evaluate tax planning strategies under real business constraints

Understand the impact of tax rules on global operations and financial statements

Communicate complex tax implications to business stakeholders

Identify red flags in aggressive tax strategies and recommend balanced approaches

Interpret legislative trends and regulatory risk

Weigh reputational, ESG, and stakeholder factors in tax decision-making

Do participants need a tax background? No. Basic finance or accounting knowledge is helpful, but the course includes onboarding to key tax concepts and strategy frameworks.

What regions are covered in the course? The course includes fictional jurisdictions modeled on real-world tax regimes (e.g., low-tax hubs, OECD-compliant, high-regulation environments).

Is transfer pricing included? Yes. Participants analyze intercompany transactions and adjust pricing strategies while adhering to OECD principles.

Are real laws and treaties used? The course uses simplified but realistic tax rules based on OECD and G20 principles. Optional modules include updates like Pillar Two (global minimum tax).

Can participants compare different tax structures? Yes. They model multiple structures and compare their impact on tax burden, regulatory risk, and public perception.

How is reputation or ESG risk factored in? Participants face stakeholder scenarios involving media leaks, activist investor pressure, and ESG reporting expectations.

Is it suitable for teams or individual play? Both formats are supported. Teams can assign roles (tax lead, finance, legal, ESG advisor) for broader decision-making experience.

How long does the course run? Typically 4 - 6 hours for a full decision cycle. Longer versions can simulate multi-year tax planning across growth stages or deals.

How is participant performance assessed? Assessment is based on tax efficiency, compliance quality, risk mitigation, and the clarity of strategic tax presentations.

Can instructors adjust complexity or jurisdiction mix? Yes. Course parameters are customizable for undergraduate, MBA, or executive levels with industry-specific tax considerations.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.