In today's complex regulatory environment and heightened public scrutiny, a strong foundation in corporate governance and financial ethics is not just a compliance issue, but a critical competitive advantage.

Fiduciary Duties

Board Structure and Committees

Stakeholder vs. Shareholder Theory

Ethical Decision-Making Frameworks

Conflict of Interest Identification and Management

Executive Compensation and Say-on-Pay

Whistleblower Policies and Protections

Financial Reporting Integrity and Fraud Prevention

ESG Integration

Crisis Management Reputational Risk

Regulatory Compliance

Insider Trading and Confidentiality

In the simulation, participants will:

Assume specific roles on the Board of Directors or executive team.

Review detailed dossiers on issues like questionable accounting practices, executive misconduct, hostile takeover bids, and ESG concerns.

Engage in structured boardroom debates to build consensus.

Make critical decisions on corporate policy, executive hires, and crisis response.

Respond to unfolding events like whistleblower allegations or negative media reports.

See the direct impact of their decisions on the company's stock price, credit rating, public reputation, and employee morale.

Identify and analyze potential conflicts of interest and ethical dilemmas in a corporate setting.

Apply ethical frameworks to guide complex business decisions.

Evaluate the effectiveness of different corporate governance structures.

Understand the legal and regulatory responsibilities of directors and officers.

Articulate the business case for strong corporate governance and ethical culture.

Develop strategies for implementing and monitoring compliance and ethics programs.

Respond effectively to a corporate crisis from a governance perspective.

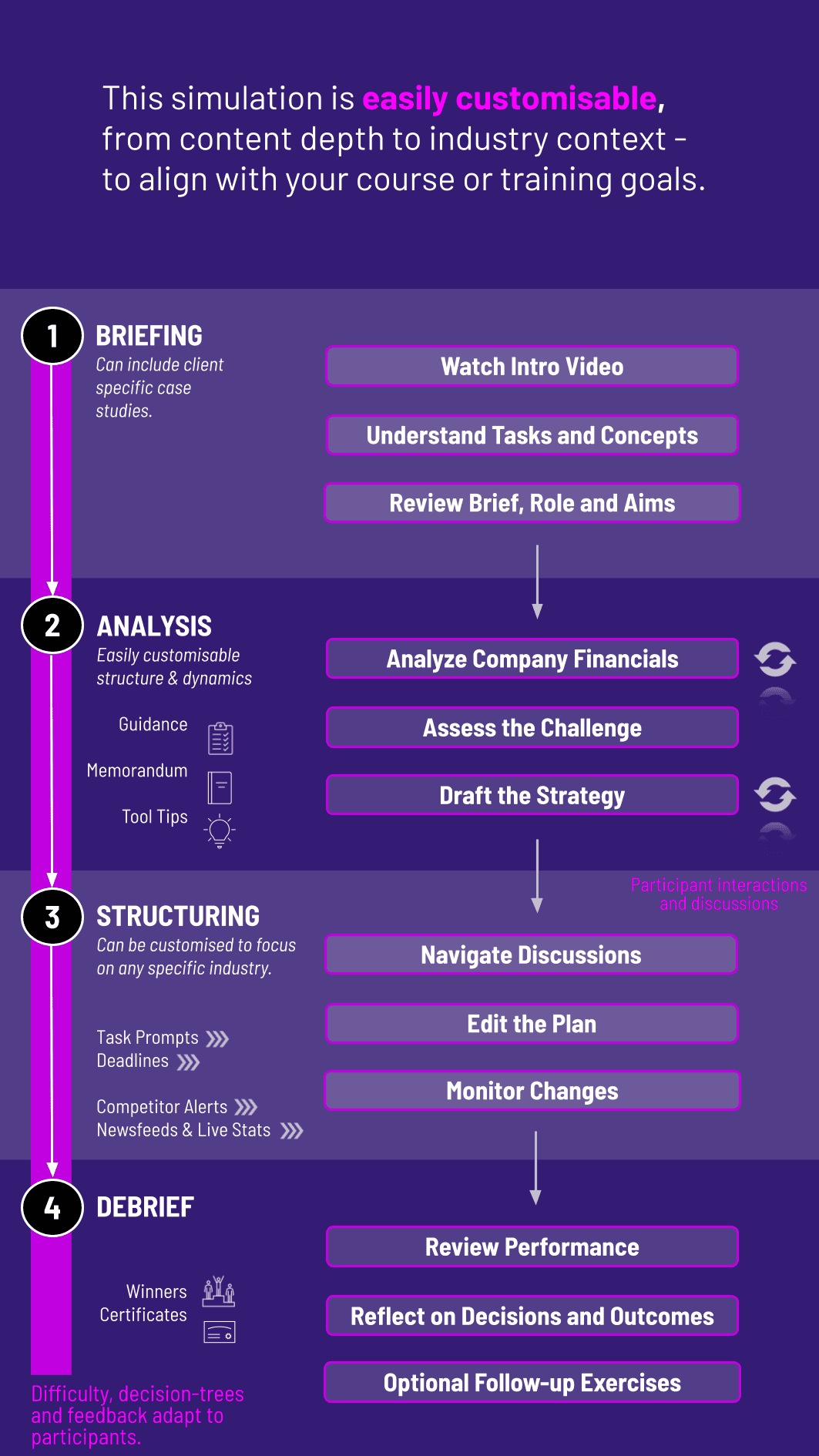

1. Setup and Role Assignment Participants are divided into teams, each representing the board of a different company. Roles are assigned.

2. Scenario Release A new governance or ethical challenge is released each round.

3. Team Deliberation Teams review confidential information, debate the issues, and must reach a collective decision or formulate a response plan.

4. Decision Input Teams submit their official decisions, policy changes, or public statements through the simulation platform.

5. Real-Time Feedback and Consequences The simulation engine processes the decisions, generating immediate consequences on a dynamic "Company Dashboard" showing stock price, reputation score, regulatory scrutiny level, and analyst opinions.

6. Instructor-Led Debrief A facilitated debrief session analyzes the teams' choices, explores alternative approaches, and reinforces key learning points, connecting the simulation experience to theoretical concepts.

Who is the target audience for this simulation? This simulation is ideal for MBA students, executive education programs, corporate training for senior managers and board members, and professionals in compliance, legal, and finance roles.

What are the technical requirements to run the simulation? The simulation is a cloud-based platform accessible via any modern web browser (Chrome, Safari, Firefox) on a desktop, laptop, or tablet. No special software installation is required.

How long does a typical simulation session last? The simulation is highly flexible. A comprehensive run can span multiple sessions over 2-3 days, but condensed versions for a single 3-4 hour workshop are also available.

Is this simulation relevant for non-financial companies? Absolutely. While financial metrics are used, the core principles of governance, ethics, risk management, and stakeholder relations are universal across all industries, from tech and manufacturing to non-profits.

Do participants need prior governance experience? No prior experience is necessary. The simulation includes preparatory materials that cover fundamental concepts, making it accessible to those new to the topic while still challenging for experienced professionals.

How does this simulation improve a company's ethical culture? By providing a shared, practical experience, it creates a common language and framework for discussing ethics. It builds empathy for different roles and makes abstract concepts tangible, empowering employees to make better decisions in their real jobs.

Can the simulation be customized to our industry? Yes, we offer customization options for the scenarios, company profiles, and key metrics to reflect the specific governance challenges and regulatory landscape of your industry.

How is success measured in the simulation? Success is not measured by "winning" in a traditional sense. Performance is evaluated based on a balanced scorecard that includes long-term shareholder value, stakeholder trust, reputation score, and regulatory compliance, encouraging a sustainable and ethical approach to leadership.

Accuracy of data analysis, calculations, and the financial justification for the decisions.

Quality and relevancy of the change propositions.

Professionalism, structure, persuasiveness, and effective use of visual aids during the presentation.

Ability to think on foot, handle objections, and defend strategic choices under pressure from the "client".

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.