The Corporate Financial Strategy Simulation is a dynamic, hands-on learning platform that thrusts participants into the high-stakes role of a corporate finance team.

Capital Structure Optimization

Corporate Valuation

Mergers and Acquisitions

Dividend Policy and Share Buybacks

Credit Markets and Debt Issuance

Financial Forecasting and Modeling

Risk Management

Market Signaling

In the simulation, participants will:

Take the helm of a publicly-traded firm over multiple simulated fiscal years.

Raise capital in dynamic debt and equity markets, managing maturity profiles and costs.

Identify, value, and negotiate the acquisition of target companies to drive growth.

Decide on dividend levels and share repurchase programs.

Benchmark your financial strategy against rival teams in the simulation.

Respond to market events, analyst questions, and rating agency reviews.

Make integrated decisions to maximize your firm's share price and economic value added.

Evaluate the impact of capital structure decisions on firm value, risk, and cost of capital.

Conduct valuations for organic projects and potential M&A targets using standard methodologies.

Construct a coherent corporate financial strategy that aligns investment, financing, and dividend policies.

Analyze the trade-offs between leveraging for growth and maintaining financial flexibility.

Interpret market signals and manage stakeholder expectations in a competitive environment.

Synthesize complex financial data into a strategic action plan under time constraints.

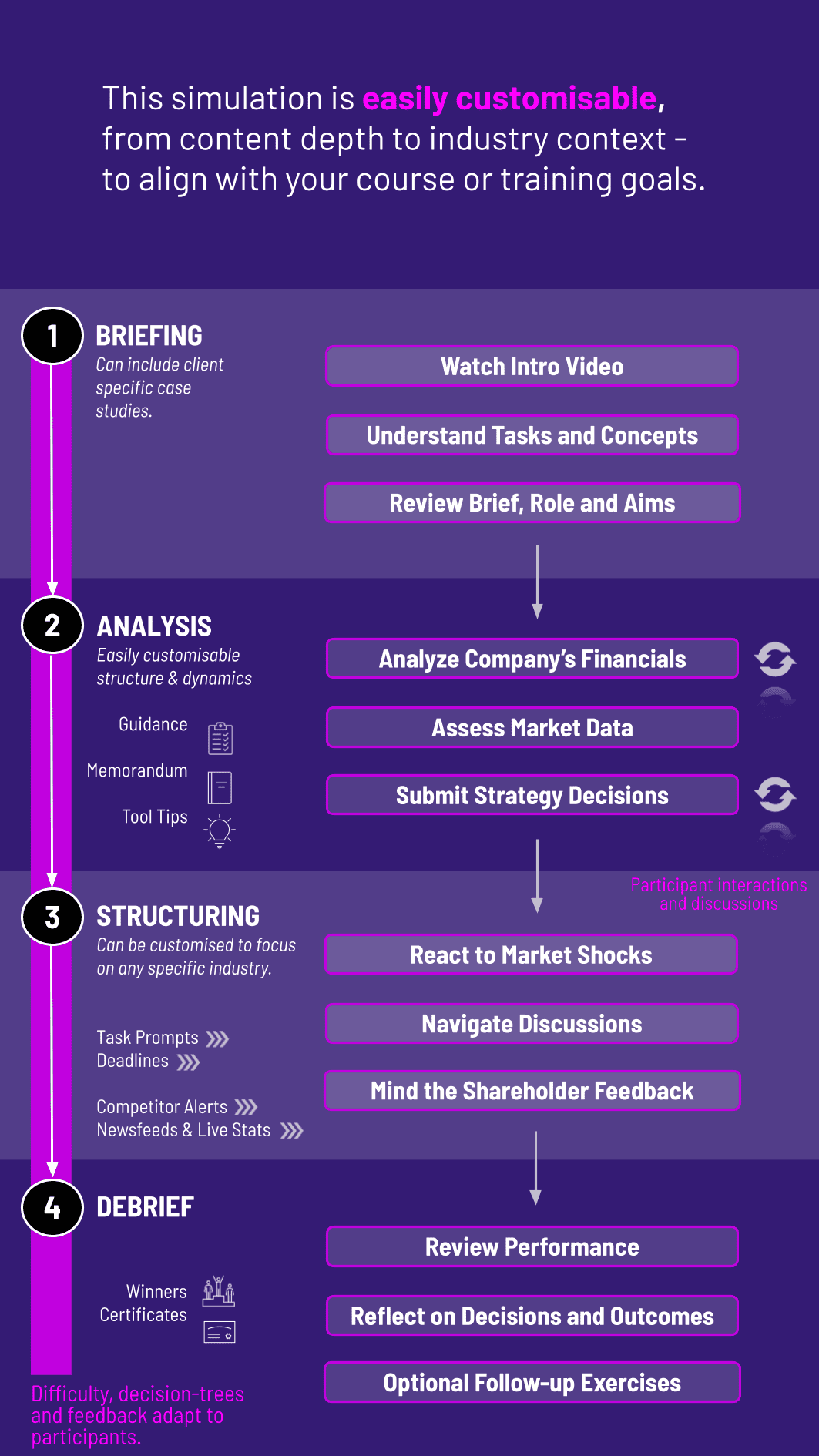

1. Initial Analysis Teams receive detailed company financials, industry data, and market conditions.

2. Decision Rounds Each round represents a fiscal quarter or year. Teams submit a comprehensive set of financial strategy decisions.

3. Market Simulation The platform's algorithm processes all team decisions, simulating competitive interactions, economic shifts, and market reactions.

4. Results and Analysis Teams receive detailed financial reports, updated stock prices, credit ratings, and analyst commentary.

5. Debrief and Strategy Refinement Instructors lead discussions on outcomes, and teams adjust their strategy for the next round, incorporating lessons learned.

6. Final Assessment Performance is evaluated based on a balanced scorecard of metrics, including shareholder return, credit strength, and strategic execution.

Who is the Corporate Financial Strategy Simulation designed for? It is ideal for MBA students, finance executives in development programs, and professionals in corporate development, treasury, or strategic planning roles seeking a holistic view of corporate finance.

What are the technical requirements to participate? Participants only need a standard web browser and an internet connection. No specialized software or installation is required.

Do I need advanced Excel or modeling skills? While helpful, advanced skills are not mandatory. The simulation focuses on strategic decision-making. Basic financial analysis proficiency is sufficient, and the simulation provides necessary data outputs.

How long does a typical simulation program last? Programs can be tailored from intensive one-day workshops to multi-week courses, typically involving 4-8 decision rounds.

Is the simulation focused on M&A like a "M&A Simulation"? While M&A is a key component, this simulation is broader. It integrates M&A decisions into the full financial strategy, forcing you to consider how to finance the deal and its impact on your overall capital structure.

Can the simulation be customized for our specific industry or company? Absolutely. We offer custom scenario development to mirror specific industries (e.g., Tech, Energy, Industrials) or incorporate particular strategic challenges relevant to your organization.

How is team performance evaluated in the simulation? Performance is multi-faceted, measured by a combination of share price appreciation, return on invested capital (ROIC), credit rating stability, and the strategic coherence of your decisions as presented in a final boardroom presentation.

Total Shareholder Return, Credit Rating, Market Share Gain, and EBITDA Growth.

Evaluation of the team's final strategic plan and boardroom presentation, defending their financial choices.

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.