Navigate the complexities of modern corporate finance. The Corporate Budgeting Techniques Simulation immerses participants in the high-stakes process of creating, managing, and defending a comprehensive corporate budget.

Top-Down vs. Bottom-Up Budgeting

Zero-Based Budgeting

Incremental Budgeting

Activity-Based Budgeting

Capital Budgeting and Investment Appraisal

Cash Flow Forecasting

Variance Analysis

Rolling Forecasts and Re-budgeting

Stakeholder Management and Communication

In the simulation, participants will:

Analyze historical company performance and market forecasts.

Receive and negotiate funding requests from various departmental managers (Sales, Marketing, R&D, Operations).

Build a detailed, integrated P&L, cash flow, and capital expenditure budget.

Evaluate competing capital investment projects using financial metrics.

Present and defend their finalized budget proposal to the "Board".

Manage a simulated quarterly performance update, analyzing variances and making corrective adjustments.

Re-forecast the annual budget based on in-simulation "unexpected events".

Critically compare and apply different budgeting methodologies in appropriate contexts.

Construct a coherent, integrated master budget that aligns operational tactics with strategic objectives.

Apply capital budgeting techniques to make rational, value-adding investment decisions.

Identify key drivers of budget variances and propose actionable managerial responses.

Communicate the strategic rationale behind a budget effectively to senior stakeholders.

Develop the analytical and negotiation skills needed to navigate internal resource conflicts.

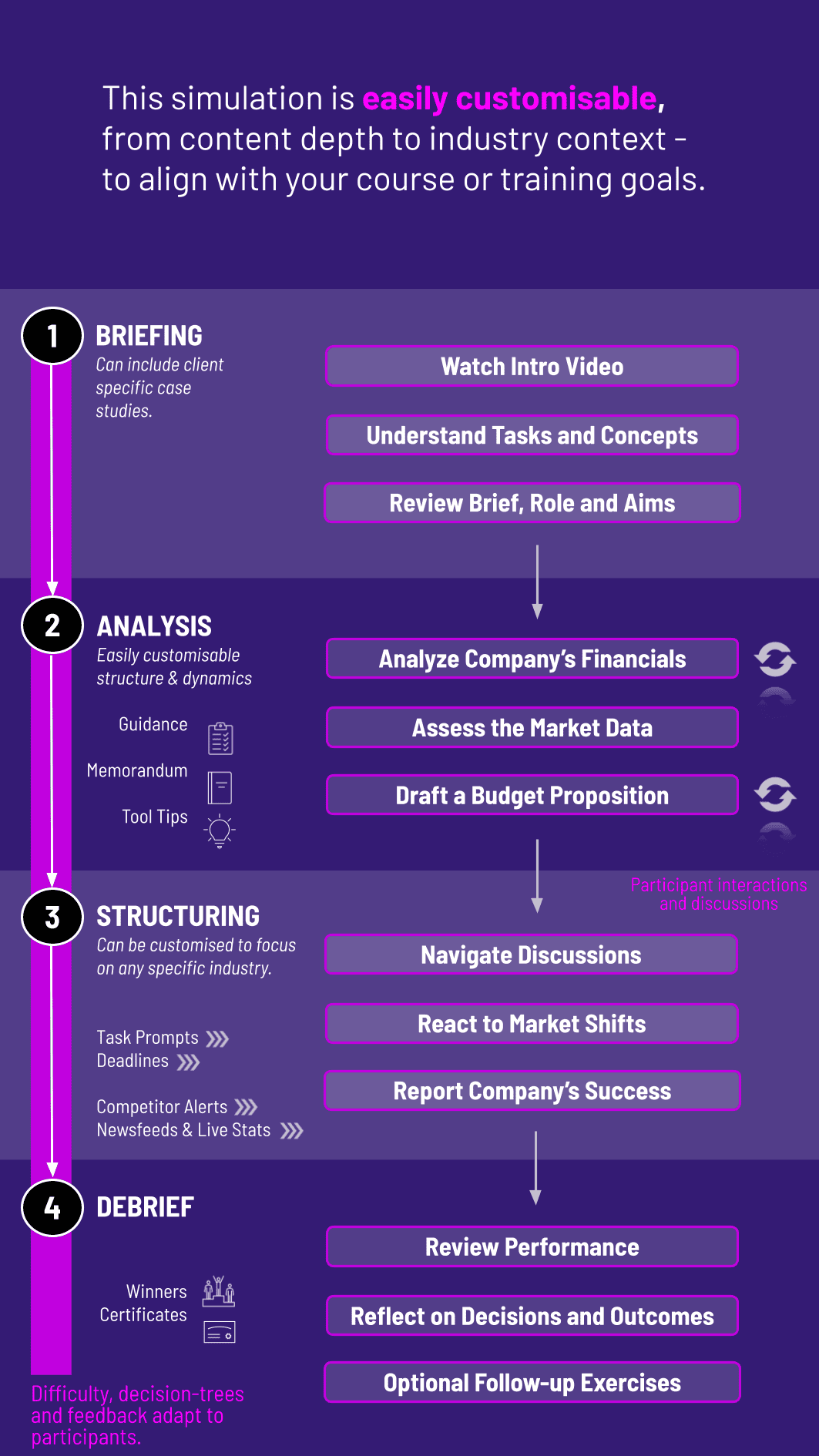

1. Introduction and Briefing Teams are formed and given the company background, strategic goals, and financial history.

2. The Planning Cycle Teams analyze data, meet with role-played department heads, and build their initial budget using the simulation's proprietary financial modeling platform.

3. The Board Review Teams present their budget to the Board, facing challenging questions on assumptions and priorities.

4. Execution and Variance Analysis The simulation engine generates Q1 results based on team budgets and hidden market variables. Teams analyze performance, identify variances, and prepare a management report.

5. Re-forecasting A "market disruption" event is introduced. Teams must adapt their budget for the remaining quarters and justify their changes.

6. Debrief and Awards Instructors lead a comprehensive debrief, linking simulation experiences to core concepts, and announce the top-performing team based on financial and strategic metrics.

Who is the target audience for this Corporate Budgeting Simulation? It is ideal for MBA students, early- to mid-career finance professionals (FP&A, controllers), managers from non-finance backgrounds who need budget responsibility, and corporate training programs.

What are the technical requirements to participate? Participants only need a standard web browser and a stable internet connection. Our simulation platform is cloud-based and requires no software installation.

How long does the simulation typically take to run? The core simulation can be run in an intensive 4-hour workshop, a full-day session, or extended over multiple weeks as part of a university course, depending on the depth of debrief and additional lectures.

Is this simulation focused on Excel, or do you provide a dedicated platform? We provide a dedicated, user-friendly platform that handles the complex modeling in the background. This allows teams to focus on strategic decisions, not spreadsheet mechanics.

Can the simulation be customized for our specific industry or company? Absolutely. We offer significant customization options, including industry-specific datasets, tailored strategic scenarios, and company-specific financial structures for corporate clients.

What makes this simulation different from a traditional budgeting case study? It is dynamic, interactive, and consequence-driven. Unlike a static case, your decisions produce immediate financial results, force trade-offs in real-time, and require you to adapt your plan—mirroring the true pressures of the corporate world.

Do participants need an advanced finance background? A basic understanding of financial statements is helpful. The simulation is designed to teach intermediate concepts, and comprehensive introductory materials are provided to bring all participants to a common starting level.

How does this simulation help with real-world career skills? Beyond technical budgeting skills, it directly develops high-demand soft skills: persuasive communication under pressure, cross-departmental negotiation, data-driven decision-making, and collaborative problem-solving within a finance team.

Teams are scored by the simulation engine on key metrics

Instructors assess the rationale behind budget allocations and strategic trade-offs during the board presentation

Depth and logic of scenario analysis

Ability to adapt and revise valuations in light of news shocks or changes

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.