Become a Corporate Banking officer responsible for managing key client relationships. Your goal is to analyze corporate clients, structure winning financing deals, and manage risk, while maximizing your bank's profitability in a competitive market.

Financial Statement Analysis

Credit Analysis and Risk Assessment

Loan Structuring

Debt Capital Markets Basics

Pricing and Spread Determination

Covenant Setting and Monitoring

Relationship Management

Capital Allocation and Portfolio Management

Profitability Analysis

Syndicated Lending

In the simulation, participants will:

Analyze the creditworthiness of corporate clients using real-world financial data.

Structure and price various debt instruments, including term loans and revolving credit facilities.

Negotiate key terms such as interest margins, fees, and financial covenants with clients.

Compete in a live deal pipeline to win lucrative financing mandates.

Manage a portfolio of loans, monitoring covenant compliance and client performance.

Respond to dynamic economic events that impact your clients and your bank's balance sheet.

Present your financing proposals to an "approval committee".

Balance the trade-offs between risk, return, and capital constraints.

Analyze a company's financial health and identify key credit risks.

Structure appropriate debt financing solutions tailored to specific client needs.

Price loans and facilities to achieve target risk-adjusted returns.

Evaluate the impact of different economic scenarios on a corporate loan portfolio.

Articulate the rationale behind a credit decision in a clear and professional manner.

Understand the end-to-end process of corporate lending, from pitch book to portfolio management.

1. Team Formation Participants are divided into teams, each representing a competing corporate bank.

2. Deal Pipeline Each round, a new deal pipeline is released. Teams receive detailed information on companies seeking financing.

3. Analysis and Structuring Teams analyze the clients, build a credit view, and structure a proposed financing package (loan type, amount, tenor, interest margin, fees, covenants).

4. Bidding and Award Teams submit their final bids. The simulation engine, or the instructor, awards the deal to the bank with the most competitive and profitable offer.

5. Portfolio Management Won deals are added to the team's portfolio. Teams must monitor their clients' ongoing performance and covenant compliance.

6. Economic Updates Each round is accompanied by economic news that may affect specific industries or the entire market, forcing teams to adapt their strategy.

What is the main goal of the Corporate Banking Simulation? The primary goal is to provide a hands-on, practical understanding of how a corporate bank operates. You learn by doing—making credit decisions, negotiating terms, and managing a portfolio—ultimately seeing the direct link between your actions and your bank's financial performance.

Do I need prior banking experience to participate? No prior professional experience is required. A basic understanding of accounting and finance is helpful, but the simulation is designed as a learning tool with guidance and reference materials to support participants at various levels.

What kind of financing deals will we be working on? You will encounter a range of standard corporate banking products, including acquisition financing, capital expenditure funding, working capital revolvers, and refinancing of existing debt for companies of different sizes and credit ratings.

Is this a team-based or individual activity? The simulation is primarily designed as a team-based activity to foster collaboration, debate, and strategic decision-making, mirroring the real-world team environment of a corporate bank.

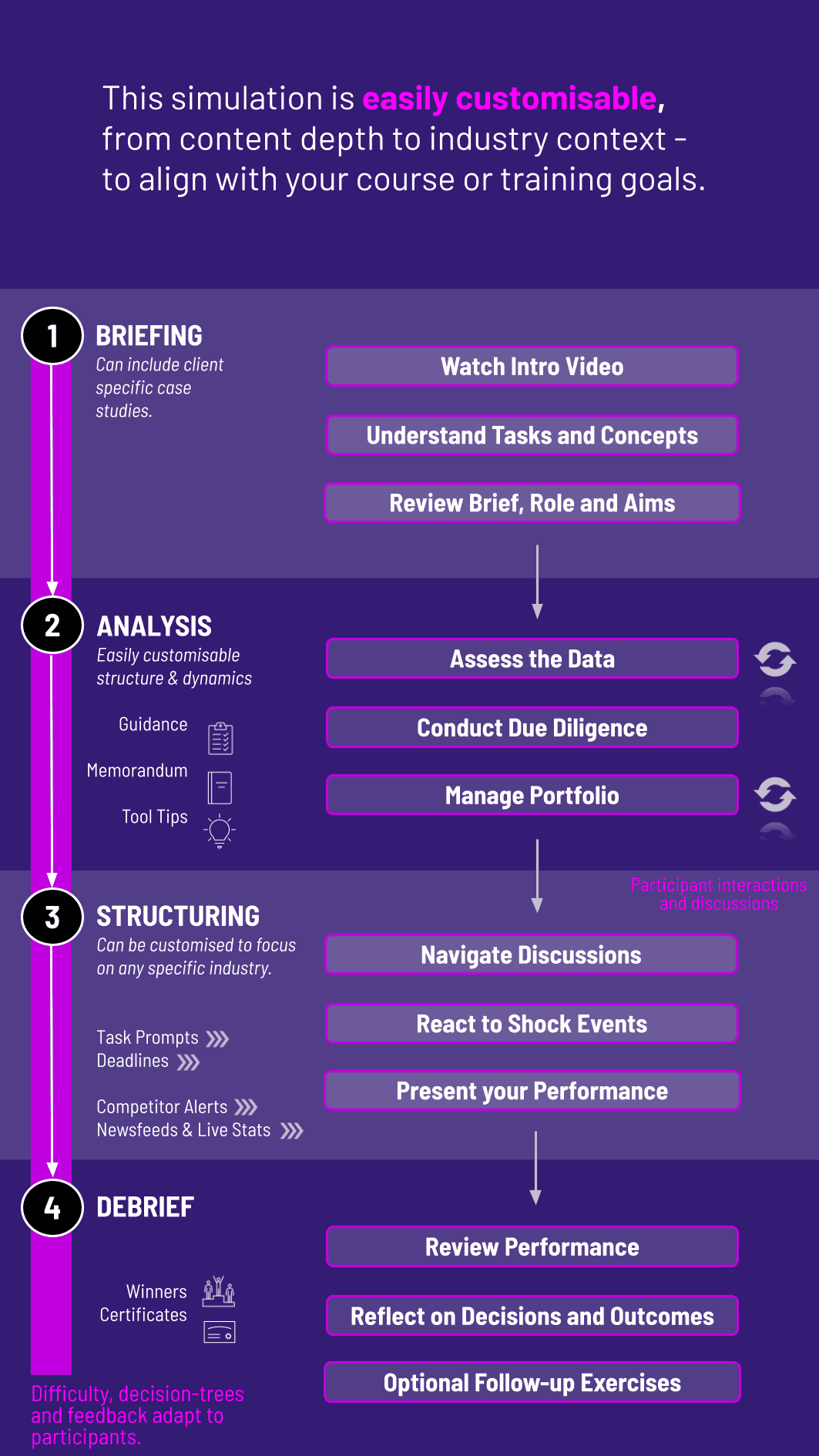

Can the simulation be customized for our specific program? Yes, we can often customize certain elements, such as the client industries, deal types, or economic scenarios, to better align with your curriculum or training objectives. Please contact us to discuss possibilities.

What technical requirements are needed to run the simulation? The simulation is browser-based and runs on any modern web browser. A stable internet connection is required. No special software installation is needed.

Final Bank Profitability

Portfolio Quality and Risk Management

Deal-Winning Ratio

Credit Committee Proposals

Final Strategic Presentation

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.