Master the Art of Financial Strategy and Client Advisory. Navigate complex business challenges, analyze financial data, and deliver actionable recommendations to top-tier clients in the Consulting simulation.

Profit and Loss Analysis

Balance Sheet Restructuring

Discounted Cash Flow Valuation

M&A Screening and Synergy Analysis

Capital Structure Optimization

Credit Rating Analysis

Strategic Benchmarking

Client Management and Q&A

Data-Driven Storytelling

Executive Presentation Skills

In the simulation, participants will:

Dive deep into the financial statements and strategic positioning of multiple client companies.

Create and use models for valuation, M&A, and capital structure scenarios.

Formulate and test hypotheses to address client-specific pain points.

Choose between different strategic paths, each with quantifiable financial outcomes and risks.

Synthesize complex data into a clear, persuasive storyline.

Defend your recommendations and handle tough questions in a high-pressure boardroom setting.

Structure ambiguous business problems into a clear, analytical framework.

Analyze a company's financial health and competitive position to identify key value drivers and risks.

Apply advanced financial modeling and valuation techniques to justify strategic recommendations.

Evaluate strategic alternatives, including M&A, restructuring, and financing options, using quantitative and qualitative measures.

Synthesize complex data into executive-level insights and a persuasive presentation.

Defend strategic recommendations under cross-examination, honing executive presence and communication skills.

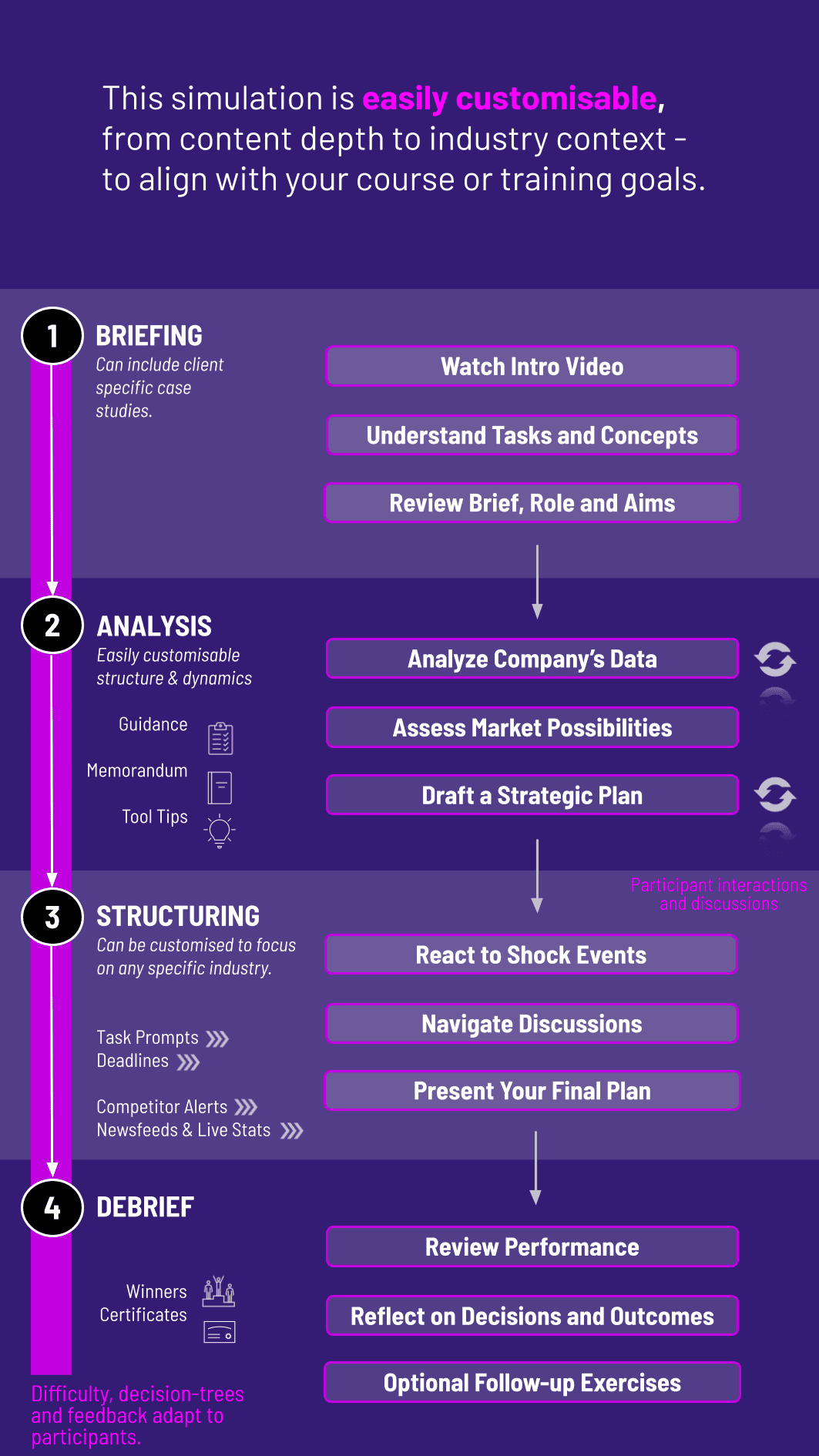

1. Team Formation and Briefing Participants are divided into consulting teams and receive a detailed briefing on their client's specific challenges.

2. Financial and Market Analysis Teams access the simulation platform to analyze the client's financials, run valuation models, and research the competitive landscape.

3. Strategic Decision-Making Teams make a series of interconnected decisions based on their analysis, inputting their chosen strategies into the platform.

4. Real-Time Results and Feedback The simulation processes the decisions, generating financial and market feedback, forcing teams to adapt their strategy.

5. Final Proposal Development Teams consolidate their findings into a final client proposal and presentation deck.

6. The Boardroom Presentation Teams present their strategic recommendations to a panel of "client executives" (instructors or judges), who challenge their assumptions and decide on the winning proposal.

What is the primary focus of this consulting simulation? This simulation focuses on the application of financial analysis and strategic thinking to solve real-world business problems, replicating the experience of working at a top-tier management consulting firm.

Do I need a finance background to succeed in this simulation? While a basic understanding of finance is helpful, the simulation is designed to be accessible. It provides learning materials and a structured environment that allows participants from diverse backgrounds (business, engineering) to quickly grasp the necessary financial concepts.

How is this different from a traditional case competition? Unlike a static case, our simulation is dynamic. Your decisions directly impact the client's financial results in real-time, creating a more immersive and iterative learning experience. You see the immediate consequences of your advice.

What kind of client scenarios can we expect? You will work with a variety of client types, such as a private equity-owned company needing operational improvement, a family-owned business planning for succession, or a public corporation considering a major acquisition.

Is this simulation suitable for MBA programs? Absolutely. This simulation is an ideal capstone experience for MBA students, integrating core coursework in finance, strategy, and leadership into a single, powerful practical exercise.

What software or tools are required? The simulation is entirely web-based and accessible through any modern browser. No additional software installation is required.

How long does the simulation typically last? The simulation can be configured to run from a single intensive one-day workshop to a multi-week module within a course, depending on the academic or corporate training objectives.

How does the simulation assess team performance? Performance is multi-faceted, assessed based on the quantitative financial improvement of your client, the quality and depth of your financial analysis, the strategic soundness of your recommendations, and the persuasiveness of your final presentation.

Accuracy of your financial models

Depth of your quantitative analysis

Logical soundness of your strategic assumptions.

The effectiveness of your in-simulation decisions, as measured by key performance indicators (KPIs) like client profitability, valuation, and market share.

Clarity, structure, and persuasiveness of your final presentation deck and your team's ability to defend its recommendations under pressure during the boardroom Q&A session.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.