Conflict is not a matter of if, but when. Deals strain under pressure, teams disagree on strategy, and negotiations hit impasses. Transform conflict from a disruptive force into a strategic tool for achieving superior financial and relational outcomes.

Sources of Financial Conflict

Conflict Styles

Negotiation Dynamics

Emotional Intelligence

Value Creation vs. Value Claiming

Communication and Active Listening

Mediation and Third-Party Intervention

Ethical Decision-Making

In the simulation, participants will:

Assume roles such as Hedge Fund Manager, Investment Banker, Venture Capitalist, or Company CEO.

Tackle scenarios like a contentious term sheet negotiation, a post-merger integration dispute, or a distressed debt restructuring.

Formulate a conflict resolution plan before entering each negotiation.

Engage in difficult dialogues, receive real-time feedback, and adapt their approach.

Assess the financial, operational, and relational results of their conflict management choices.

Evaluate and provide constructive feedback on their colleagues' negotiation and mediation techniques.

Diagnose the underlying causes and dynamics of conflict in financial settings.

Apply a structured framework to prepare for and manage difficult financial negotiations.

Utilize advanced communication and active listening skills to de-escalate tension and build rapport.

Differentiate between positions and interests to create value in deadlocked situations.

Develop strategies for mediating conflicts between other parties to protect deal value.

Enhance their emotional intelligence and ability to perform under stress.

Articulate the impact of effective conflict resolution on financial returns and long-term business relationships.

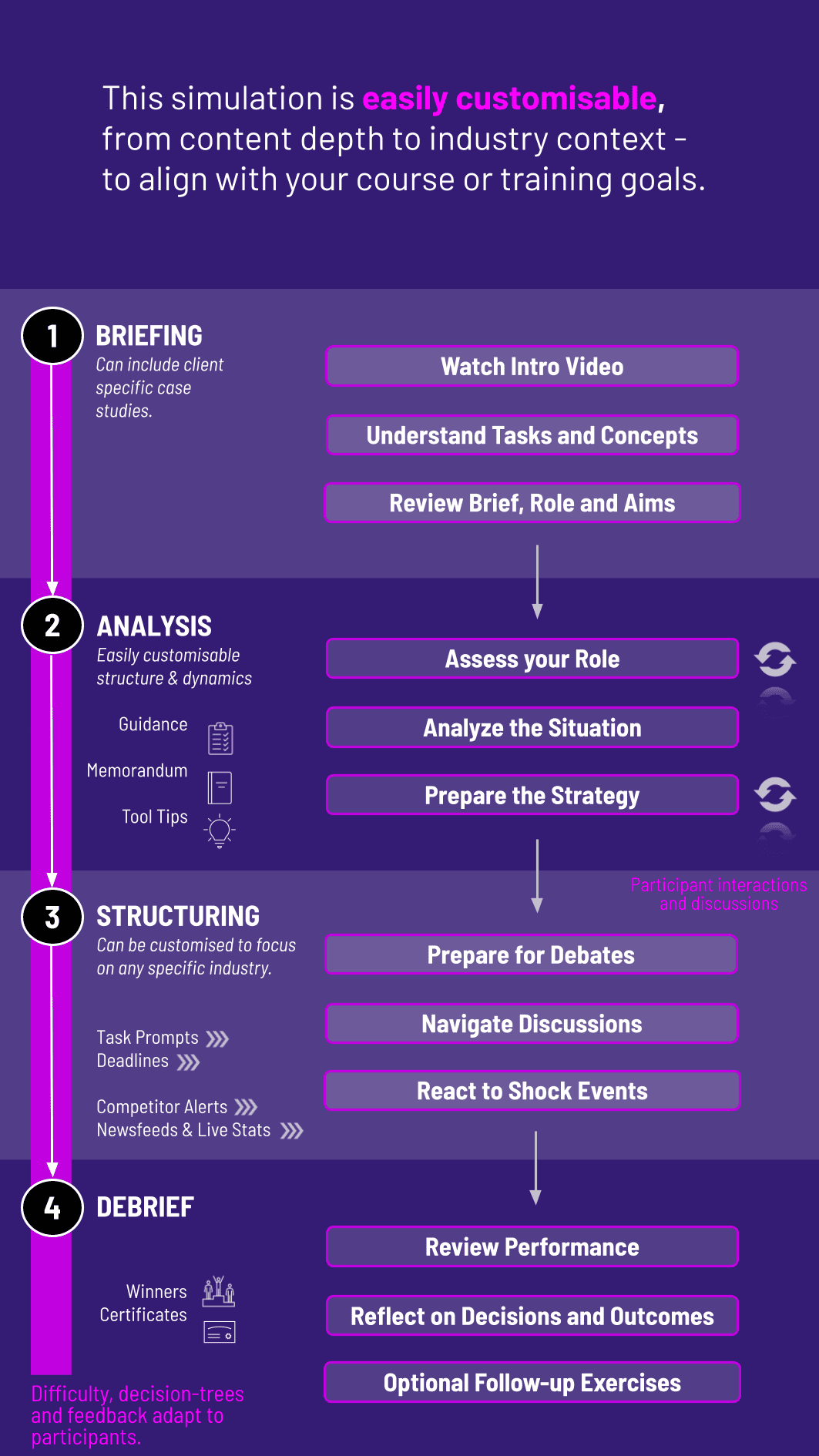

1. Preparation Participants receive their role profiles, confidential information, and simulation background. They complete pre-reading on core conflict resolution frameworks.

2. Scenario Briefing A new financial conflict scenario is introduced ("Portfolio Company Turnaround Dispute").

3. Strategy Development In their teams, participants analyze the situation, identify stakeholder interests, and plan their negotiation/mediation strategy.

4. Live Simulation Rounds Participants engage in timed, multi-party negotiations. They must navigate unexpected twists and new information injected by the facilitator.

5. Debrief and Feedback After each round, facilitators lead a structured debrief. Participants review what worked, what didn't, and the quantitative and qualitative outcomes of their decisions.

Who is this Conflict Resolution in Finance Simulation for? This simulation is designed for finance professionals at all levels, including investment bankers, private equity and hedge fund analysts, asset managers, corporate financiers, and MBA students aiming to excel in these fields.

I'm great with numbers but find "soft skills" challenging. Is this for me? Absolutely. This simulation is specifically designed for analytically-minded individuals. We provide concrete frameworks and models for managing conflict, turning a "soft skill" into a strategic, learnable competency.

What makes this different from a generic negotiation workshop? Our simulation is built on authentic financial case studies (M&A, fundraising, etc.). The conflicts, stakes, and terminology are specific to the finance industry, ensuring immediate relevance and application.

Do I need prior finance experience? A basic understanding of financial concepts is helpful but not always mandatory. The simulation can be tailored to the audience's experience level, from undergraduates to seasoned executives.

How long does the simulation typically last? We offer flexible formats, from intensive 3-hour sessions to comprehensive multi-day programs, depending on the depth of coverage required.

Is this simulation conducted online or in-person? We offer robust versions for both in-person and virtual delivery, using breakout rooms and digital collaboration tools to ensure an equally engaging experience remotely.

What is the ideal group size? We recommend groups of 12 to 36 participants to ensure everyone has ample opportunity for active participation and personalized feedback.

How is success measured in the simulation? Success is measured holistically, not just by the final deal price. We assess the quality of the relationship preserved, the value created through creative solutions, and the participant's ability to apply the taught frameworks effectively.

Pre- and Post-Simulation Knowledge Check

Facilitator Observation and Scoring

Peer Feedback

Final Reflective Assignment

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.