In this Comparable Company Analysis Simulation, participants act as equity analysts or investment bankers, evaluating company’s assets.

Selection of peer group (industry classification, size, profitability)

Calculation of core multiples (EV/EBIT, EV/EBITDA, Price/Earnings, EV/Sales, EV/FCF)

Adjustment of financials (normalized earnings, extraordinary items, NOLs, tax rates)

Reconciliation of outliers and trimming of multiples

Growth and operational adjustments

Leverage and capital structure adjustment (unlevered vs levered multiples)

Converting multiples into implied valuation range

Sensitivity and scenario analysis (multiple ranges, growth, margins)

Communicating valuation assumptions and defending conclusions

Review the provided data including target company financials, peer company data, industry metrics, consensus estimates.

Define a criteria to include or exclude peer firms (size, region, business mix).

Compute multiples, adjust and normalize for non-recurring items, outliers, accounting differences, and unique attributes.

Prepare and present a short report or pitch defending the chosen peer group, multiples, assumptions, and valuation range.

Present to a mock “client team” or instructors and respond to skepticism or counterarguments.

Understand the process and methodology of comparable company valuation

Select and defend an appropriate peer group

Normalize and adjust financial metrics to make firms comparable

Compute and trim valuation multiples meaningfully

Apply discounts, premiums, or adjustments for idiosyncratic differences

Derive a defensible valuation range for the target company

Perform sensitivity analysis and stress tests on valuation assumptions

Communicate valuation rationale and defend assumptions to stakeholders

Recognize the limitations, risks, and caveats of relying solely on multiples

Integrate peer valuation with other valuation methods (DCF, precedent deals)

Adapt valuation judgments under market or news shocks

Enhance analytical rigor, narrative judgment, and presentation skills

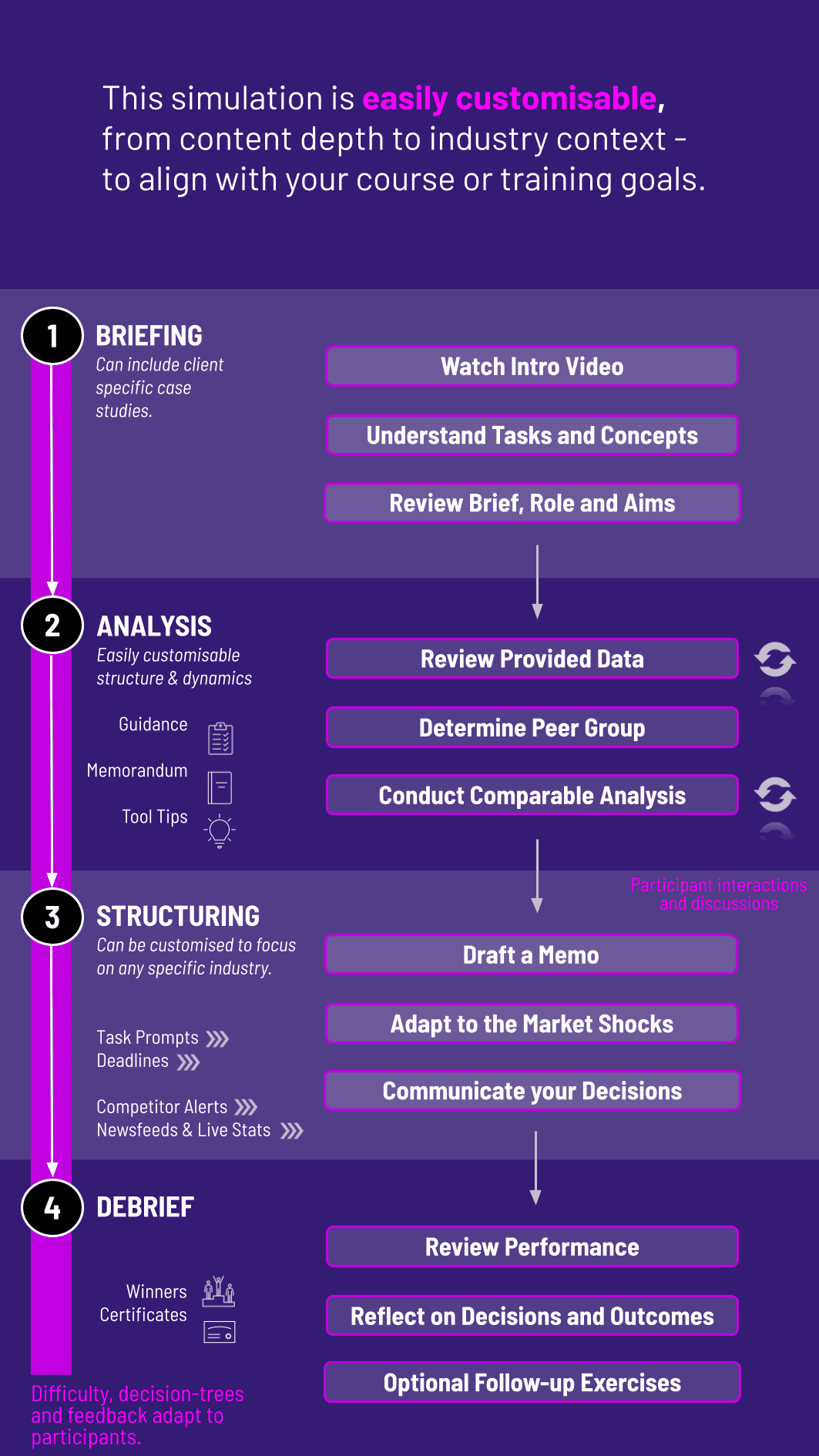

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

This simulation can be run individually or in teams in academic or corporate contexts. Each cycle represents a stage of preparing an analysis.

1. Receive a Scenario or Brief: Participants receive target company financials, peer company data, industry metrics, consensus estimates.

2. Analyse the Situation: They review the data to identify peer firms and then derive key ratios (EV/EBITDA, P/E, EV/Sales, etc.) for the target company.

3. Collaborate and Debate: In team formats, participants compare interpretations and challenge each other’s conclusions.

4. Draft a report: Participants revise their peer group, adjust multiples, re-run valuation models, and refine their report.

5. Communicate Findings: Participants present their valuation memo to a “client panel” (instructor or peers). They must defend their peer selection, multiple application, adjustments, and sensitivity cases.

6. Review and Reflect: Feedback highlights defensibility, consistency, risk assessment, and clarity of narrative.

Is it online-compatible? Yes. It works in digital, hybrid, and in-person formats.

Is this suitable for corporate training? Yes. It’s ideal for analysts, investment bankers, and finance professionals.

Is prior valuation experience needed? No. The simulation includes embedded instruction, tooltips, and guidance for users at various levels.

Can the scenarios be customized? Yes. They can reflect specific industries like IT, healthcare, or manufacturing.

How competitive is the simulation? Participants role-play in teams and may be pitied against each other.

How is success measured? Reports that are accurate and presented skillfully are evaluated higher than others.

How long does the Comparable Company Analysis Simulation last? Typically between 2 to 4 hours. It can be shortened or expanded to fit class schedules or training blocks.

Who is this simulation designed for? It is designed for students in corporate finance, investment banking, valuation classes, MBA or master’s in finance programs, executive education, and training programs for financial analysts or associates.

Accuracy in judgement of company’s assets and quality of assumptions and adjustments

Depth and logic of scenario analysis and sensitivity ranges

Clarity, coherence, and persuasiveness of the valuation memo and presentation

Ability to adapt and revise valuations in light of news shocks or changes

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Assessment can combine numeric scoring, qualitative feedback, peer review, and instructor debriefing. This flexibility allows the simulation to serve both graded university courses and corporate finance training environments.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.