The Commodity Analyst Simulation plunges participants into the high-stakes world of raw materials trading. Learn to navigate the volatile and complex global commodity markets, where economic data drives prices.

Fundamental Analysis

Geopolitical and Event Risk

Term Structure and Futures Curves

Macroeconomic Indicators

Technical Analysis

Risk Management and Position Sizing

The Role of the USD

Correlations and Spreading

In the simulation, participants will:

Analyze real-time news feeds and economic calendars for market-moving events.

Conduct in-depth research on assigned commodities, building a fundamental view.

Execute buy and sell orders for futures contracts and options across the energy, metals, and agriculture complexes.

Monitor and manage a live portfolio, adjusting positions based on market developments.

Write and present concise trade recommendations and market commentary, justifying their thesis.

Compete against peers in a live leaderboard, simulating the performance pressure of a real trading floor.

Articulate the primary drivers of value for major global commodities.

Analyze the impact of geopolitical and macroeconomic events on commodity prices.

Develop and execute a disciplined trading strategy based on fundamental and technical analysis.

Construct and manage a diversified commodity portfolio while actively managing risk.

Interpret the term structure of futures markets and understand its implications.

Communicate complex market views and trade rationales effectively and persuasively.

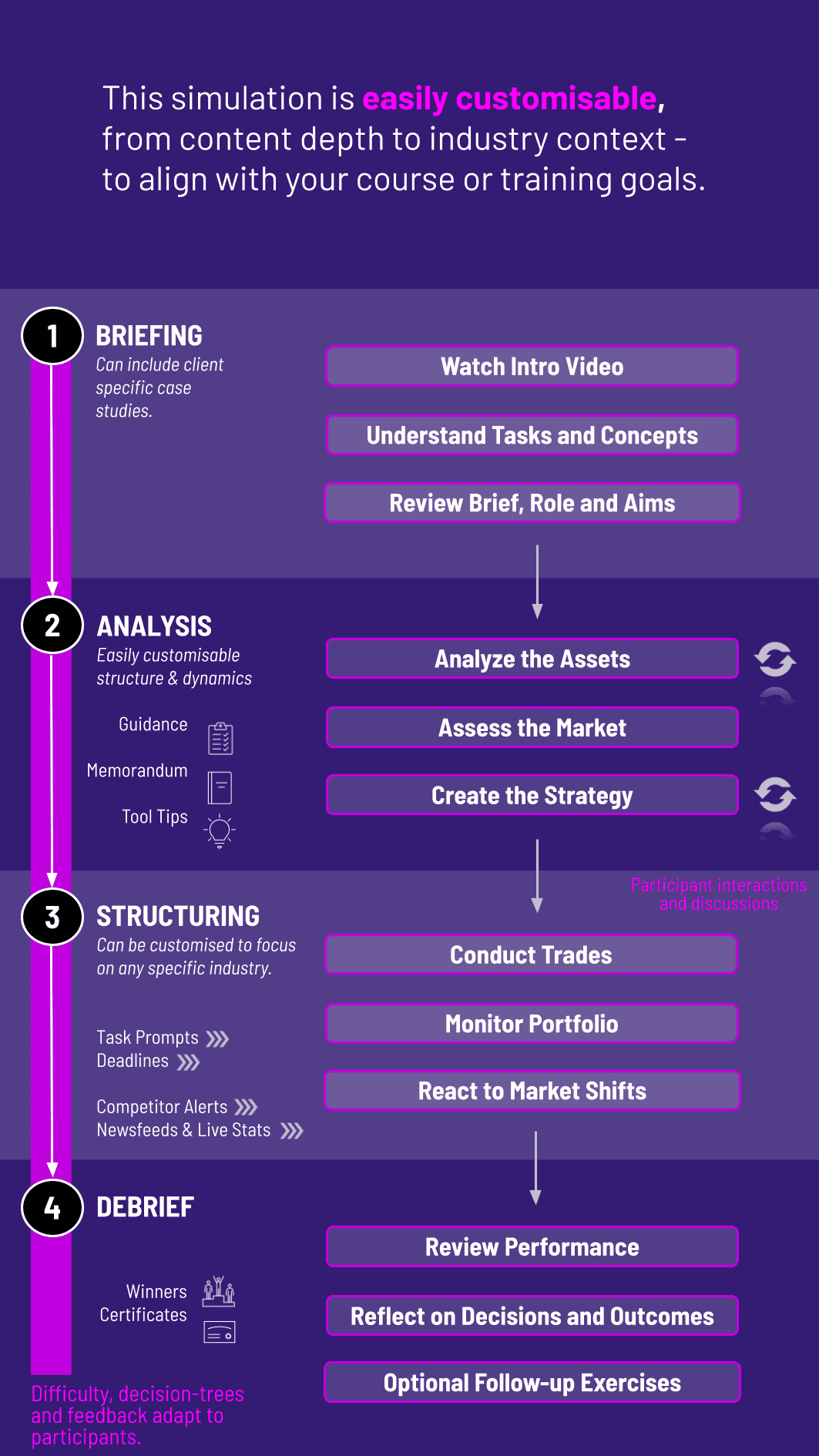

1. Introduction and Training Participants are introduced to the trading platform and the core concepts of commodity markets through guided tutorials.

2. Market Analysis Each round begins with a news cycle and new economic data. Participants analyze this information to form a market view.

3. Trade Execution Based on their analysis, participants execute trades, choosing the commodity, contract month, and position size.

4. Portfolio Management As the simulation progresses, new events unfold. Participants must monitor their positions, manage risk, and decide whether to hold, add to, or exit trades.

5. Reporting and Debrief Participants may be required to submit a brief report outlining their strategy and performance. The session concludes with an instructor-led debrief analyzing market outcomes and key learning moments.

Who is the Commodity Analyst Simulation designed for? It is ideal for students and professionals in finance, economics, and business, as well as anyone seeking a career in trading, asset management, or corporate finance within commodity-intensive industries.

What are the technical requirements to participate? You only need a standard web browser and a stable internet connection. No specialized software or downloads are required.

Do I need prior trading experience? No prior experience is necessary. The simulation includes introductory training modules to get all participants up to speed, regardless of their background.

Is this a "game" or a realistic simulation? This is a professional-grade simulation used by top business schools and financial institutions. It uses real-world data, realistic news scenarios, and a trading engine that mimics live market conditions, including liquidity and slippage.

How long does a typical simulation last? Programs can be tailored, but a standard simulation runs over a one-day intensive workshop or across several weeks as part of a university course.

Can the simulation be customized for corporate training? Absolutely. We can tailor scenarios to focus on specific commodities (e.g., only energy markets) or to include corporate hedging challenges relevant to your company.

What commodities can we trade in the simulation? The platform includes a wide range of commodities, including WTI Crude Oil, Brent Crude, Gold, Silver, Copper, Corn, Wheat, Soybeans, and Natural Gas.

How is performance measured and graded? Performance is primarily measured by risk-adjusted returns, not just absolute profit. Instructors can also grade based on the quality of trade rationales and final reports.

Trading Performance is based on the Sharpe Ratio or a similar metric to reward consistent, smart risk-taking over reckless gambling.

Evaluation of the participant's ability to articulate their overall strategy, analyze their trades, and explain their successes and failures.

Active engagement in debriefs and maintaining a log of trades with rationales.

Feedback from teammates on collaboration and contribution (if a team-based simulation).

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.